Preparing Quarterly MCTMT Reports (New York)

This topic provides an overview of quarterly MCTMT (Metropolitan Commuter Transportation Mobility Tax) reports and discusses how to create these reports for New York.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

RUNCTL_TAX820NY |

Generate electronic files and print quarterly New York Metropolitan Commuter Transportation Mobility Tax (MCTMT) reports. |

Employers that are subject to the Metropolitan Commuter Transportation Mobility Tax (MCTMT) are required to file quarterly MCTMT returns.

For employers engaging in business within the Metropolitan Commuter Transportation District (MCTD), they are liable for the MCTMT if their payroll expense for all covered employees in the MCTD exceeds $312,500 in any calendar quarter.

For purposes of the MCTMT, the MCTD is divided into two zones:

Zone 1 includes the counties of:

New York (Manhattan)

Bronx

Kings (Brooklyn)

Queens

Richmond (Staten Island)

Zone 2 includes the counties of:

Rockland

Nassau

Suffolk

Orange

Putnam

Dutchess

Westchester

The rate that applies is based on the amount of payroll expense in either zone for the quarter. This table lists the payroll expense ranges and applicable MCTMT rates for zones 1 and 2.

Both listed amounts and rates are subject to change in future years.

|

Payroll Expense Attributable to Zone 1 |

MCTMT Rate |

|---|---|

|

Over $0, but not over $375,000 |

0.11% (.0011) |

|

Over $375,000, but not over $437,500 |

0.23% (.0023) |

|

Over $437,500 |

0.60% (.0060) |

|

Payroll Expense Attributable to Zone 2 |

MCTMT Rate |

|---|---|

|

Over $0, but not over $375,000 |

0.11% (.0011) |

|

Over $375,000, but not over $437,500 |

0.23% (.0023) |

|

Over $437,500 |

0.34% (.0034) |

For example, an employer has payroll expense of $600,000. $400,000 of that payroll expense is attributable to Zone 1 and $200,000 of that payroll expense is attributable to Zone 2. The calculation of the employer’s MCTMT is:

$400,000 x 0.23% (for zone 1) + $200,000 x 0.11% (for zone 2) = $1,140

Employers must file quarterly MCTMT returns if they are required to withhold New York State income tax from wages paid to employees, and their payroll expense for all covered employees in the MCTD exceeds $312,500 in any calendar quarter.

Employers who are liable for MCTMT for one quarter and not liable for the next quarter are not required to file a return showing no tax due. However, if the employer is subject to the MCTMT for a subsequent quarter, the employer must file a quarterly return and pay the tax due.

Employers who have made any MCTMT payments during the quarter or have an MCTMT overpayment that is carried over from a previous quarter must file a quarterly return to request a refund (or request a credit to the next quarter if you anticipate owing MCTMT for that quarter).

In order to be included in the quarterly report, an employee must be subject to the MCTMT for Zone 1 or Zone 2 using the specific local tax code defined exclusively for the MCTMT, P0023 (MCTMT Zone 1 Payroll Tax) and P0047 (MCTMT Zone 2 Payroll Tax). This specific local tax code must be mapped to the employee Local Tax Data record. The system will recognize all wages paid to a covered employee as wages subject to the tax.

Run the TAX820NY program on the Create Qtrly MCTMT File NY Page to create quarterly reports with data required to comply with New York MCTMT quarterly reporting requirements.

For more details about this quarterly report, refer to the New York Metropolitan Commuter Transportation Mobility Tax Quarterly Reporting document that is available on the Payroll for North America Tax Update Documentation page (My Oracle Support Doc ID 2820620.2), under the Tax Update 25-A/Update Image 9.2.51 section.

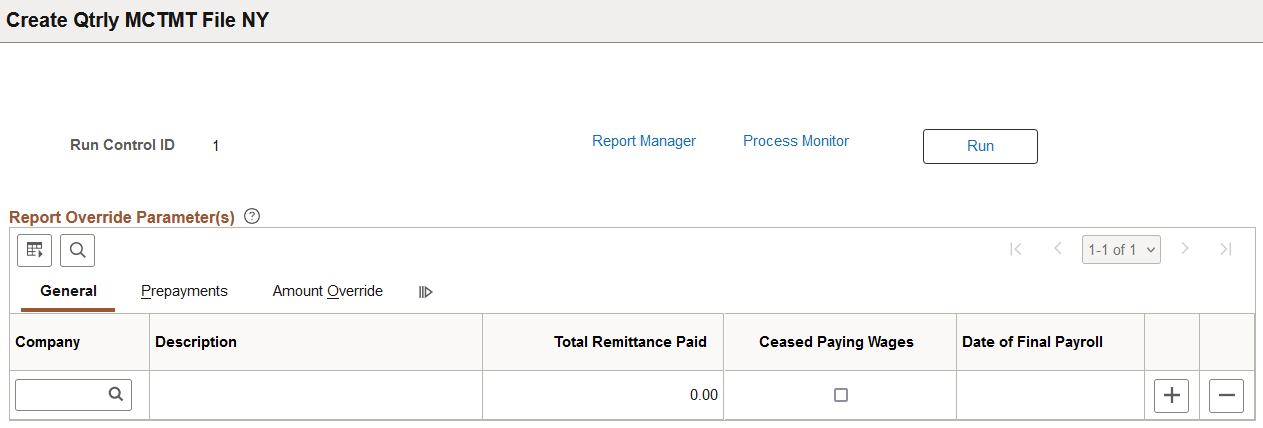

Use the Create Qtrly MCTMT File NY page (RUNCTL_TAX820NY) to generate electronic files and print quarterly New York Metropolitan Commuter Transportation Mobility Tax (MCTMT) reports.

Navigation:

This example illustrates the fields and controls on the Create Qtrly MCTMT File NY page.

Important! To create quarterly MCTMT reports, you need to launch the TAX820NY program twice.

First, run the program without any specified parameters. The purpose of this run is to prepare values to be displayed in the Total Remittance Paid field for Zone 1 and Zone 2 on the General tab.

After running the program for the first time, you can specify companies in the Report Override Parameter(s) section and make updates as needed. When a company is selected, the system displays the total amount that it is remitting with this filing in the Total Remittance Paid field. Run the program again to generate quarterly MCTMT reports.

General

|

Field or Control |

Description |

|---|---|

|

Company |

Enter the reporting company. |

|

Total Remittance Paid |

Displays the total amount taxpayer is remitting with this filing after the program has been run for the first time in the quarter. |

|

Ceased Paying Wages |

Select if the company is no longer doing business in the MTA region. |

|

Date of Final Payroll |

Enter the date of final payroll, which must be within the quarter and year of this filing. This field becomes editable when the Ceased Paying Wages field is selected. |

Prepayments

|

Field or Control |

Description |

|---|---|

|

Previous Credit |

Enter any overpayment of tax or credit from a previous quarter of the same current year, if applicable. |

|

Total Overpaid |

Displays the overpaid amount by subtracting any MCTMT tax due amount from the value in the Previous Credit field. The value must be greater than or equal to zero. |

|

Refund or Credit Indicator |

Specify what you want to do with the amount shown in the Total Overpaid field. This field becomes editable if the total overpaid amount balance is greater than zero. Select Refund to request a refund, or Credit to credit the amount to the next quarter if you anticipate owing MCTMT for that quarter. |

Amount Override

|

Field or Control |

Description |

|---|---|

|

Due for Zone 1 |

Displays the amount due for MCTMT Zone 1 from the system balances. |

|

Override Zone 1 |

Enter an override amount for MCTMT Zone 1. |

|

Due for Zone 2 |

Displays the amount due for MCTMT Zone 2 from the system balances. |

|

Override Zone 2 |

Enter an override amount for MCTMT Zone 2. |