Setting Up Alabama Overtime Tax Exemption Reports

Payroll for North America delivers a reporting program (TAX010AL.SQR) to create monthly and quarterly reports with data needed to comply with the 2024 Alabama overtime reporting requirements.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PY_ST_ERN_MAPPING |

List the overtime earnings codes to be used exclusively to pay overtime wages that qualify for Alabama tax exemption. |

|

|

RUNCTL_TAX010AL |

Set up parameters for monthly and quarterly reporting related to the exemption of overtime pay from Alabama withholding tax. |

Alabama HB217, which became law on June 6, 2023, excludes overtime wages paid to full-time hourly employees from Alabama taxable income, and exempts such overtime payments from income tax withholding, beginning with wage payments made on or after January 1, 2024.

To meet the reporting requirements for Alabama’s exemption of overtime pay from Alabama withholding tax, employers can run the monthly as well as quarterly Alabama Exempt Overtime Report (TAX010AL) reports, which include the following data in their Alabama Form A-6 (monthly) and Form A-1 (quarterly) withholding tax returns respectively:

The total dollar amount of overtime paid during the period which was exempt from Alabama taxation; and

The total number of full-time hourly employees who received such overtime pay.

For more details about Alamaba overtime tax exemption reporting, refer to the Report Alabama Tax-Exempt Overtime Pay document that is available on the Payroll for North America Tax Update Documentation page (My Oracle Support Doc ID 2820620.2), under the Tax Update 24-A/Update Image 9.2.048 section.

To exempt eligible overtime payments from Alabama taxation, you need to create one or more specific Earnings Codes that will be used exclusively to pay overtime wages that qualify for the Alabama tax exemption.

These Earnings Codes will be tagged with a unique Taxable Gross Component ID that will exclude the payments from Alabama taxable income and exempt the payments from Alabama withholding tax. At a high level, you need to:

Update the entry for Alabama on the Taxable Gross Definition Table Page to create a new Taxable Gross Component ID to tag (identify) the Earnings Code(s) that will be used to pay Alabama tax-exempt overtime wages.

Create one or more specific Earnings Codes to be used to pay overtime wages that qualify for the Alabama tax exemption, and tag these Earnings Codes with the new Taxable Gross Component ID.

See Also Establishing Earnings Codes.

Add the Earnings Code(s) to the Earnings Program Table(s) which are used for paying full-time Alabama hourly-paid employees on the Earnings Program Table Page.

To create the Alabama exempt overtime report:

List the overtime earnings codes that are to be used exclusively to pay overtime wages that qualify for Alabama tax exemption on the Earnings Mapping Page.

Run the TAX010AL report on the Alabama Tax-Exempt Overtime Page.

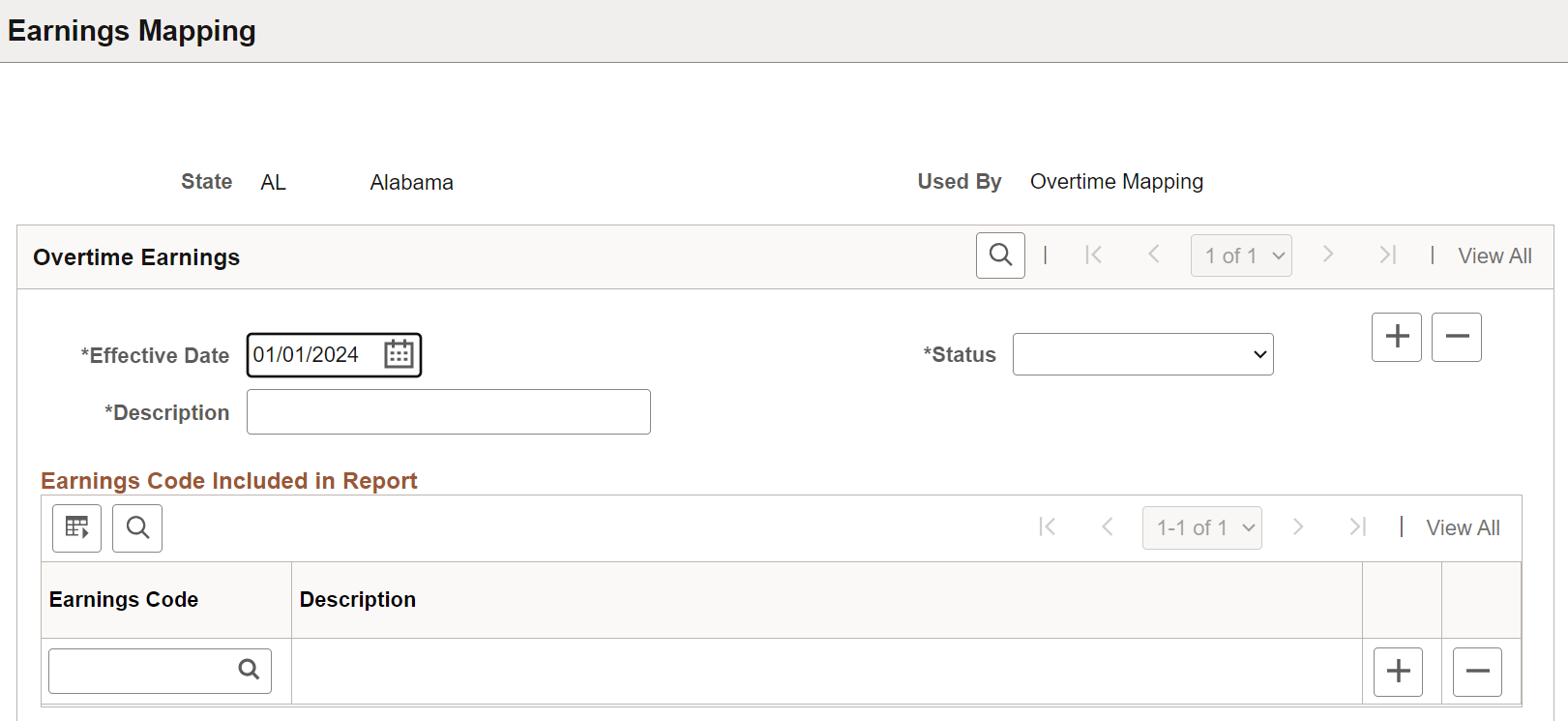

Use the Earnings Mapping page (PY_ST_ERN_MAPPING) to list the overtime earnings codes to be used exclusively to pay overtime wages that qualify for Alabama tax exemption.

Navigation:

This example illustrates the fields and controls on the Earnings Mapping page.

Employers must update the Earnings Mapping Table(s) with the applicable Overtime Earnings Code(s) before the monthly/quarterly report can be generated.

The system determines whether the overtime earnings code qualify for the Alabama Tax exemption by looking at the Earnings Mapping table. If an employee has overtime wages paid using the earnings code added to the Earnings Mapping table, the employee and the corresponding overtime wages will be included in the report.

Note: When calculating and paying overtime, some employers use two different Earnings Codes to split and separately pay overtime straight-time and overtime premium amounts. If you pay overtime using this method, be sure to add both of the Earnings Codes on this page for the report to pull the overtime pay.

|

Field or Control |

Description |

|---|---|

|

Used By |

Displays Overtime Mapping, the only option currently available. |

|

Earnings Code |

Specify the overtime earnings codes that are exempt from Alabama withholding tax. Important! It is the customer's responsibility to specify the applicable overtime earnings codes that are exempt from Alabama tax withholding and used to pay overtime to full-time hourly employees for work performed in Alabama. These overtime earnings must not be used for any other types of payments that do not qualify for the Alabama overtime tax exemption. |

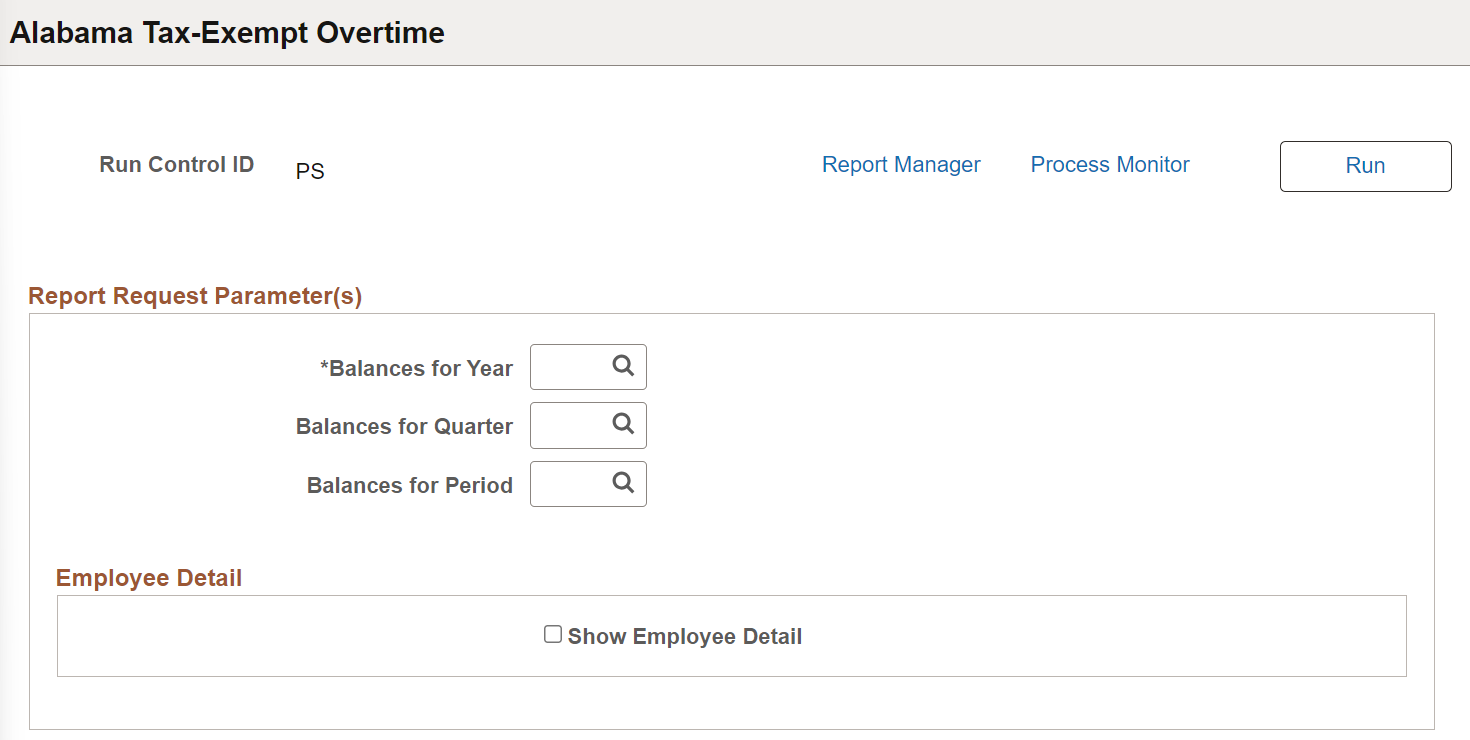

Use the Alabama Tax-Exempt Overtime page (RUNCTL_TAX010AL) to set up parameters for monthly or quarterly reporting related to the exemption of overtime pay from Alabama withholding tax.

Navigation:

This example illustrates the fields and controls on the Alabama Tax-Exempt Overtime page.

Report Request Parameter(s)

|

Field or Control |

Description |

|---|---|

|

Balance for Year |

Enter the year of reporting. |

|

Balance for Quarter |

Enter the quarter of reporting. Must be populated for creating quarterly report. |

|

Balance for Period |

Enter the period of reporting. Must be populated for creating monthly report. |

Employee Detail

|

Field or Control |

Description |

|---|---|

|

Show Employee Detail |

Select to include a list of all the employees who were paid overtime pay exempt from Alabama Tax withholding. |