(USF) Specifying Deduction Processing Sequence

To specify deduction processing sequence, use the Federal OPM Sort Sequence (GVT_OPM_SORT) component.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GVT_OPM_SORT |

Specify the order in which deductions for retirement, basic health and life insurances are processed where there is insufficient net pay. |

The Office of Personnel Management (OPM) issued guidelines that determine the order in which authorized deductions are processed from federal employees’ pay when the pay is insufficient to cover all deductions.

In case of insufficient net pay, the payroll program processes deductions in the following order, in accordance with OPM guidelines:

Retirement Deductions

Social Security (OASDI) Tax

Medicare Tax

Additional Medicare Tax

Federal Income Tax

Basic Health Insurance Deductions

Basic Life Insurance Deductions

State Income Tax

Local Income Tax

Payroll administrators can use the Federal OPM Sort Sequence Page to specify deduction codes for plan types in the Retirement (item #1), Basic Health Insurance (item #6), and Basic Life Insurance (item #7) categories, and determine the order in which the payroll program processes these specified deduction codes within each category.

Use the Federal OPM Sort Sequence page (GVT_OPM_SORT) to specify the order in which deductions for retirement, basic health and life insurances are processed where there is insufficient net pay.

Navigation:

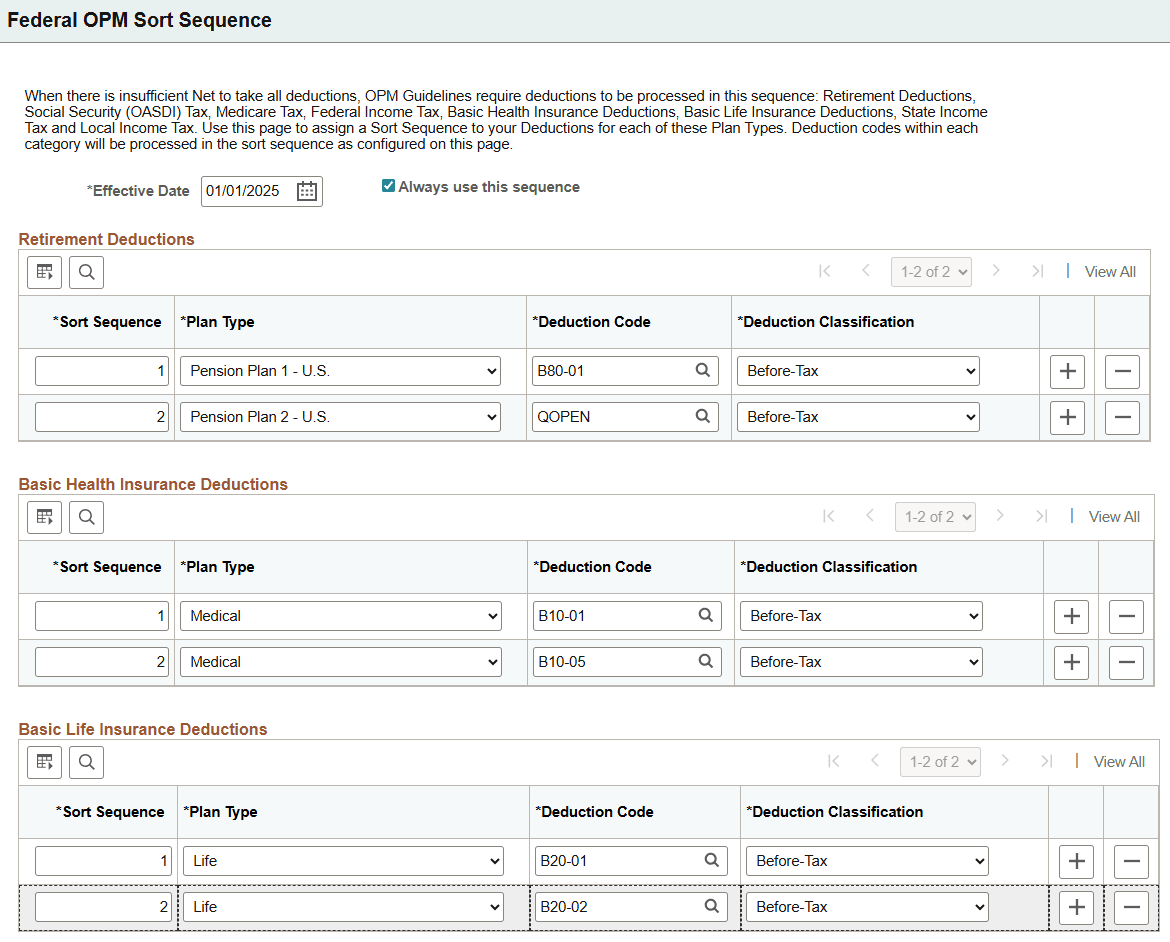

This example illustrates the fields and controls on the Federal OPM Sort Sequence page.

Based on the setup shown in the screenshot, if there is insufficient net pay to cover all deductions, payroll deductions will be processed in the following order:

(Retirement Deduction) Pension deduction B80-01

(Retirement Deduction) Pension deduction QOPEN

Social Security (OASDI) Tax

Medicare Tax

Additional Medicare Tax

Federal Income Tax

(Basic Health Insurance Deduction) Medical deduction B10-01

(Basic Health Insurance Deduction) Medical deduction B10-05

(Basic Life Insurance Deduction) Life deduction B20-01

(Basic Life Insurance Deduction) Life deduction B20-02

State Income Tax

Local Income Tax

|

Field or Control |

Description |

|---|---|

|

Always use this sequence |

Select for the system to use this setup as the default for processing deductions when employees do not have sufficient net pay. |

Specify the deduction processing order for plan types in the Retirement Deductions, Basic Health Insurance Deductions, and Basic Life Insurance Deductions sections.

|

Field or Control |

Description |

|---|---|

|

Sort Sequence |

Enter the priority order of the deduction code to be processed. The lower the number, the higher the priority. Each sort sequence within the same section must be unique. |

|

Plan Type |

Select the plan type of the deduction code. |

|

Deduction Code and Deduction Classification |

Select the deduction code to be used. Specify whether it's a After-Tax or Before-Tax deduction. |