Setting Up Sales and Use Tax for Third-Party Tax Vendors

This topic provides an overview of the tax setup for third-party tax vendors, lists the common elements used in this topic, and discusses how to set up sales and use tax for third-party tax vendors.

To enter sales and use tax, use the Tax Parameters (RF_TAX_PARAM) component. To load data into the tables for this component, you can also use the RF_TAX_PARAM component interface.

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Tax Parameter Definitions |

RF_TAX_PARAM |

|

Set up sales and use taxes for service, material, labor, expenses, and cases for third-party tax vendors. |

Use the Tax Parameter Definitions page to integrate with third-party tax vendors, such as Taxware or Vertex. The system passes the values in the fields that appear on the page to the Transaction Billing Processor with every PeopleSoft CRM transaction and uses the values during invoice finalization when the taxes are calculated.

You can calculate Sales and Use Tax in one of two ways in PeopleSoft Billing, either the third-party tax calculations or the PeopleSoft internal tax calculation. Basically, the tax code and the address overrides are used for calculating taxes through the PeopleSoft internal system.

The data required for the internal tax calculation is sent through the integration with the Transaction Billing Processor. If the Billing business unit on the SCM side is configured for the PeopleSoft internal tax calculation, it calculates the taxes. It is basically the tax code.

You can define fields for each type of transaction (agreement fees, service order fees, and case fees) independent of each other. Use the fields listed in the next section only if you have a third-party integration with either Taxware or Vertex.

See PeopleTools: Integration Broker Testing Utilities and Tools and PeopleTools: Integration Broker Service Operations Monitor product documentation.

|

Field or Control |

Definition |

|---|---|

| Product Tax Group |

Identify special tax-related charge information associated with individual transaction lines. For example, a laptop computer for the hearing impaired might receive a better rate than a laptop computer that doesn't have a feature for the hearing impaired. The values for this field come from the Product Group table. You may, however, enter free-form values. This is not a required field, so you may leave it blank. See PeopleSoft Product and Item Management . Note: These values should match the values defined by either Taxware or Vertex. As the administrator, you must enter the values accurately because no interface exists to verify that the tax group is a valid Taxware product code or Vertex product group. |

| Transaction Type |

Determines how a vendor can calculate taxes. For example, the State of Illinois charges a six percent sales tax for purchases. This field includes these translate values: Rental, Sales, and Service. It is not a required field and may be left blank. |

| Transactions Sub Type |

Use for reporting purposes with the Vertex product only. This field is tied to the Transaction Type field and has predefined translate values that include Expense, Freight, Misc, None, Property, Rental, and Service. It is not required and may be left blank. |

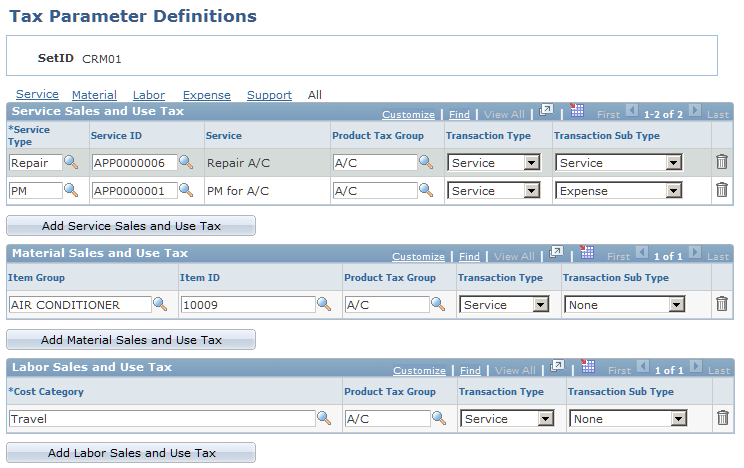

Use the Tax Parameter Definitions page (RF_TAX_PARAM) to set up sales and use taxes for service, material, labor, expenses, and cases for third-party tax vendors.

Navigation

Image: Tax Parameter Definitions page (1 of 2)

This example illustrates the fields and controls on the Tax Parameter Definitions page (1 of 2).

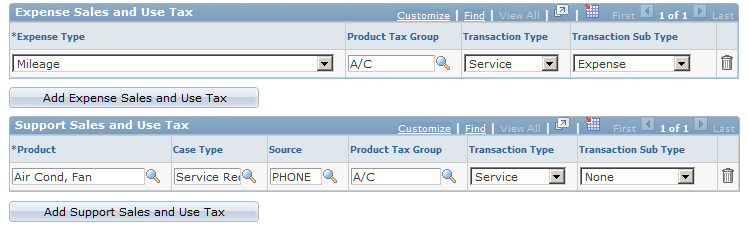

Image: Tax Parameter Definitions page (2 of 2)

This example illustrates the fields and controls on the Tax Parameter Definitions page (2 of 2).

Service Sales and Use Tax

Select the service type and service ID for which you want to enter tax information. To add additional rows of information, click the Add Service Sales and Use Tax button.

Material Sales and Use Tax

Select the item group and item ID for which you want to enter tax information. To add additional rows of information, click the Add Material Sales and Use Tax button.

Labor Sales and Use Tax

Select the cost category for which you want to enter tax information. To add additional rows of information, click the Add Labor Sales and Use Tax button.

Expense Sales and Use Tax

Select the expense type for which you want to enter tax information. To add additional rows of information, click the Add Expense Sales and Use Tax button.

Support Sales and Use Tax

Select the product and case type for which you want to enter tax information. To add additional rows of information, click the Add Support Sales and Use Tax button.