Defining Federal and Institutional Methodologies

This section provides an overview of IM and FM and discusses how to:

Define global and federal options.

Use EFC proration options.

Define FM budget durations.

Define IM budget durations.

Define IM tax and assessment parameters.

Define EFM yes and no options.

Define IM value parameters 1.

Define IM value parameters 2.

Define IM yes and no options.

Define minimum student contribution.

Define asset options.

Define home and asset projections.

Define minimum parental contribution.

Define budget options.

For more information, see the INAS Users Manual.

IM is based on The College Scholarship Service—Institutional Methodology formula. College Board CSS Profile users should refer to the College Board's Financial Aid Services Information Center (https://groups.collegeboard.org/fas) for supporting documentation, including the IM and FM tables and worksheets.

Note: With the exception of the first page, all pages in this component are related to IM specific processing.

For federal methodology, you use this component to set EFC proration options and budget durations.

Note: Numeric values in screen shots used to document Global Processing Options are examples only. For information regarding Aid Year specific settings, College Board CSS Profile users should refer to the College Board's Financial Aid Services Information Center (https://groups.collegeboard.org/fas) for tables and worksheets for IM/Alternate IM and FM.

Note: The navigation paths for the pages listed in the following table are for aid year 20nn-20nn. Oracle supports access for three active aid years.

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Global and Federal Options |

INAS_LCL_PLCY1_nn |

|

Define your global policy options for the majority of your student population. You can override these options on a student-by-student basis. The options affect your INAS calculations. The system sets the CSS Base Rules/Values by default. You can enter values for additional INAS rule sets developed by your institution. |

|

EFC Proration Options (expected family contribution proration option) |

INAS_FM_PRORTN_SEC |

Click the EFC Proration Options link on the Global and Federal Options page. |

Define your proration parameters. |

|

FM Budget Durations |

INAS_FM_DUR_SEC |

Click the FM Budget Durations link on the Global and Federal Options page. |

Define global options for federal academic and nonstandard budget durations. |

|

IM Budget Durations |

INAS_IM_DUR_SEC |

Click the IM Budget Durations link on the Global and Federal Options page. |

Define global options for institutional academic and nonstandard budget durations. |

|

IM Tax/Assess Parms (institutional methodology tax assessment parameters) |

INAS_LCL_PLCY2_nn |

|

Define IM INAS calculation options for parents and students |

|

EFM Yes/No Options (estimated federal methodology yes/no options) |

INAS_LCL_PLCY3_nn |

|

Define EFM INAS calculation options for parents and students. |

|

IM Value Parms 1 (institutional methodology value parameters 1) |

INAS_LCL_PLCY4_nn |

|

Define IM INAS calculation options for parents and students. |

|

IM Value Parms 2 (institutional methodology value parameters 2) |

INAS_LCL_PLCY11_nn |

|

Define value parameters for multi-college enrollment to define treatment for more than one student in college. |

|

IM Yes/No Options (institutional methodology yes/no options) |

INAS_LCL_PLCY10_nn |

|

Define IM INAS calculation options for parents and students. |

|

Minimum SC Income (minimum student contribution income) |

INAS_LCL_PLCY5_nn |

|

Define the minimum institutional student contribution values for dependent students and independent students. |

|

Asset Options |

INAS_LCL_PLCY6_nn |

|

Define options and limitations for assessing parent and student assets other than the home. |

|

Home/Asset Projections |

INAS_LCL_PLCY7_nn |

|

Define options and values for assessing home equity for parents and students. Define asset assessment rates. |

|

Minimum PC Range (minimum parental contribution range) |

INAS_LCL_PLCY8_nn |

|

Define institutional minimum parental contribution values based on income ranges. |

|

Budget Options |

INAS_LCL_PLCY9_nn |

|

Define allocation of total parental contribution to children on the basis of educational costs. |

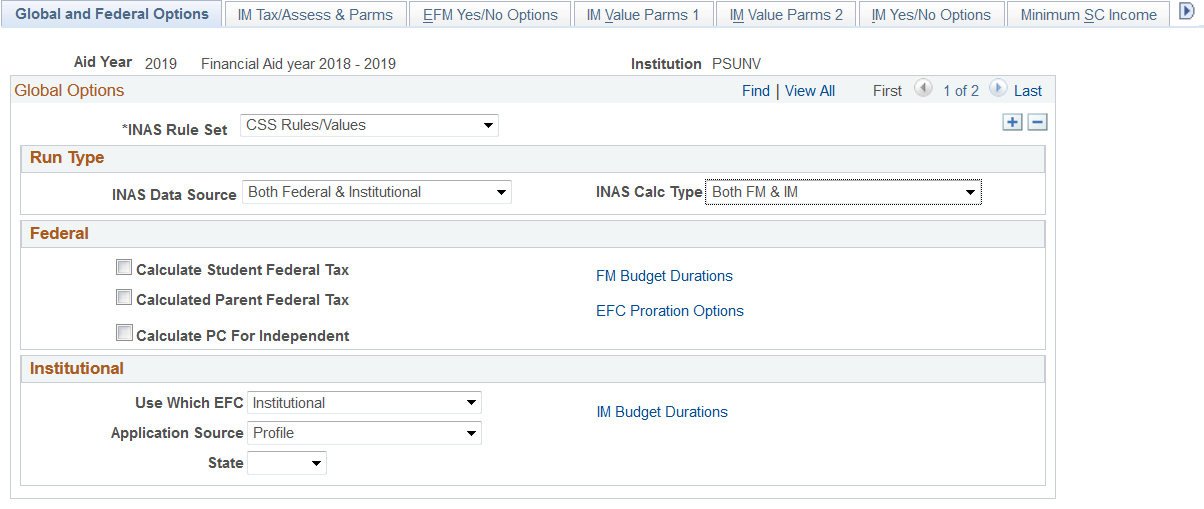

Access the Global and Federal Options page ().

Note: The system always makes available the three most recent Aid Year versions of the INAS Global Options component.

Image: Global and Federal Options page

This example illustrates the fields and controls on the Global and Federal Options page. You can find definitions for the fields and controls later on this page.

Use this page to set INAS calculation options for ISIR records or Profile records.

|

Field or Control |

Definition |

|---|---|

| INAS Rule Set |

Select the INAS rule set. The INAS rule set value enables full flexibility to determine how need analysis is processed for different academic careers or academic programs; it is linked to a specific academic career or program through the valid careers for aid year and valid programs for aid year tables. Your institution can create additional INAS rule sets. The INAS rule set refers to the INAS base rules delivered with the Financial Aid system. Values are: CSS Rules/Values, Health Professional, and Undergraduate/Graduate. |

Global

Use the Global group box to define the parameters that control general processing options related to methodologies used.

|

Field or Control |

Definition |

|---|---|

| INAS Data Source |

Select the INAS data source for the INAS process to use to retrieve student information. Select: Both F/I (both federal and institutional) to use both sets of data to calculate INAS for either Profile or ISIR records. Federal to use only federal data to calculate INAS for ISIR records only. Institutnl (institutional) to use only institutional data to calculate INAS for PROFILE records only. |

| INAS Calc Type (INAS calculation type) |

Select the INAS calculation type: FM (federal methodology) to calculate INAS for ISIR records only. FM & IM (federal methodology and institutional methodology) to calculate INAS for either PROFILE or ISIR records. IM (institutional methodology) to calculate INAS for PROFILE records only. |

Federal

Use the Federal group box to define how INAS processes federal ISIR data.

|

Field or Control |

Definition |

|---|---|

| Calc Fed Tax - Student (calculate federal tax - student) |

Select to calculate and display federal tax for the student as defined by INAS. |

| Calc Fed Tax - Parent (calculate federal tax - parent) |

Select to calculate and display federal tax for the parent as defined by INAS. |

| Calc PC For Independent (calculate parental contribution for independent) |

Select to calculate a parental contribution for independent students if parental data is available. Parental contribution is calculated but not added to the EFC. |

| FM Budget Durations |

Click this link to access the FM Budget Durations page, which shows academic and non-standard durations for both dependent and independent students. |

| EFC Prorations Options |

Click this link to access the EFC Proration Options page. |

Institutional

Use the Institutional group box to define how INAS computes your IM.

|

Field or Control |

Definition |

|---|---|

| Use Which EFC |

Select a value to determine the institutional EFC displayed on the Need Summary page and used in the Award Entry component. Values are: Est Fed (estimated federal methodology): Select to display and use the EFM-EFC. Greatest: Select to compare base, IM with options, and estimated federal EFC, and then use the greatest EFC value of the three. Inst W/Opt: Select to use the IM-EFC as a result of the calculation of IM with options. Inst: Select to use the IM-EFC as a result of the base IM calculations. |

| Application Source |

Select an application source. Values are: FT CSL (full-time Canada Student Loan): Used in Canadian Need Analysis. Inst App (institutional application). PT CSL (part-time Canada Student Loan): Used in Canadian Need Analysis. Profile. |

| State |

Select the state in which your institution is located. INAS uses this field to determine a student's budget requirements. |

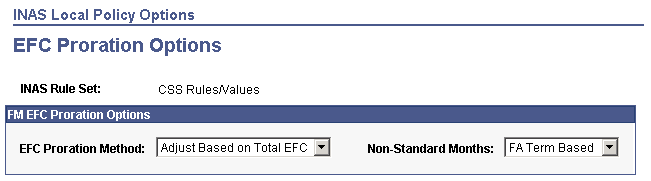

Access the EFC Proration Options page (click the EFC Proration Options link on the Global and Federal Options page).

Image: EFC Proration Options page

This example illustrates the fields and controls on the EFC Proration Options page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| EFC Proration Method |

Select one of the following: Adjust Based on Total EFC: If you select this option, the system displays the Non-Standard Months field. The system adjusts the EFC based on the total number of budget duration months for the academic and nonstandard award periods. You can use the default functionality by selecting FA Term Based for Non-Standard Months or force the use of leading or trailing months to determine the nonstandard award period contribution regardless if the nonstandard term leads or trails. Proportion Monthly Share: If you select this option, the system uses the total EFC based on the total number of budget duration months for academic and nonstandard and distributes the EFC proportionally between the award periods. Use Monthly EFC: If you select this option, the system uses the actual monthly EFC based on the total number of budget duration months for each award period. For example, if academic budget duration is set to 9 and nonstandard is set to 2, then the system uses the actual 9-month EFC for academic and the actual 2-month EFC for nonstandard. No calculations are performed to subtract one or the other from the total EFC. Note: Using this method might cause your total EFC to exceed the 12-month EFC. |

| Non-Standard Months |

The system uses this field in conjunction with the EFC Proration Method, Adjust Based on Total EFC. Select from: FA Term Based: Determines which award period leads based on terms set in FA Term and award period designation in Valid Terms for Careers. Leading Months: Treats the nonstandard term as leading regardless of nonstandard term designation in FA Term. Trailing Months: Treats the nonstandard term as trailing regardless of nonstandard term designation in FA Term. |

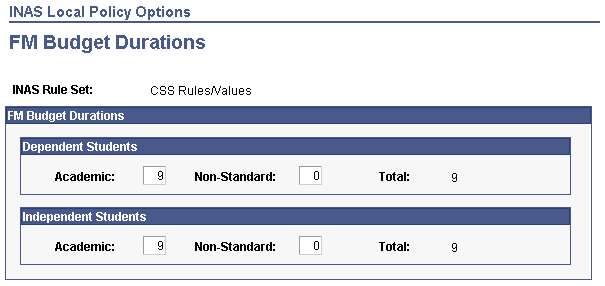

Access the FM Budget Durations page (click the FM Budget Durations link on the Global and Federal Options page).

Image: FM Budget Durations page

This example illustrates the fields and controls on the FM Budget Durations page. You can find definitions for the fields and controls later on this page.

Dependent Students

|

Field or Control |

Definition |

|---|---|

| Academic |

Enter the number of months for the academic term to be considered during need analysis for dependent students. |

| Non-Standard |

Enter the number of months for the nonstandard term to be considered during need analysis for dependent students. |

Independent Students

|

Field or Control |

Definition |

|---|---|

| Academic |

Enter the number of months for the academic term to be considered during need analysis for independent students. |

| Non-Standard |

Enter the number of months for the nonstandard term to be considered during need analysis for independent students. |

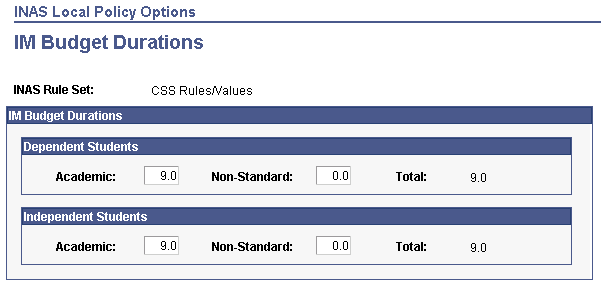

Access the IM Budget Durations page (click the IM Budget Durations link on the Global and Federal Options page).

Image: IM Budget Durations page

This example illustrates the fields and controls on the IM Budget Durations page. You can find definitions for the fields and controls later on this page.

Dependent Students

|

Field or Control |

Definition |

|---|---|

| Academic |

Enter the number of months for the academic term to be considered during need analysis for dependent students. |

| Non-Standard |

Enter the number of months for the nonstandard term to be considered during need analysis for dependent students. |

Independent Students

|

Field or Control |

Definition |

|---|---|

| Academic |

Enter the number of months for the academic term to be considered during need analysis for independent students. |

| Non-Standard |

Enter the number of months for the nonstandard term to be considered during need analysis for independent students. |

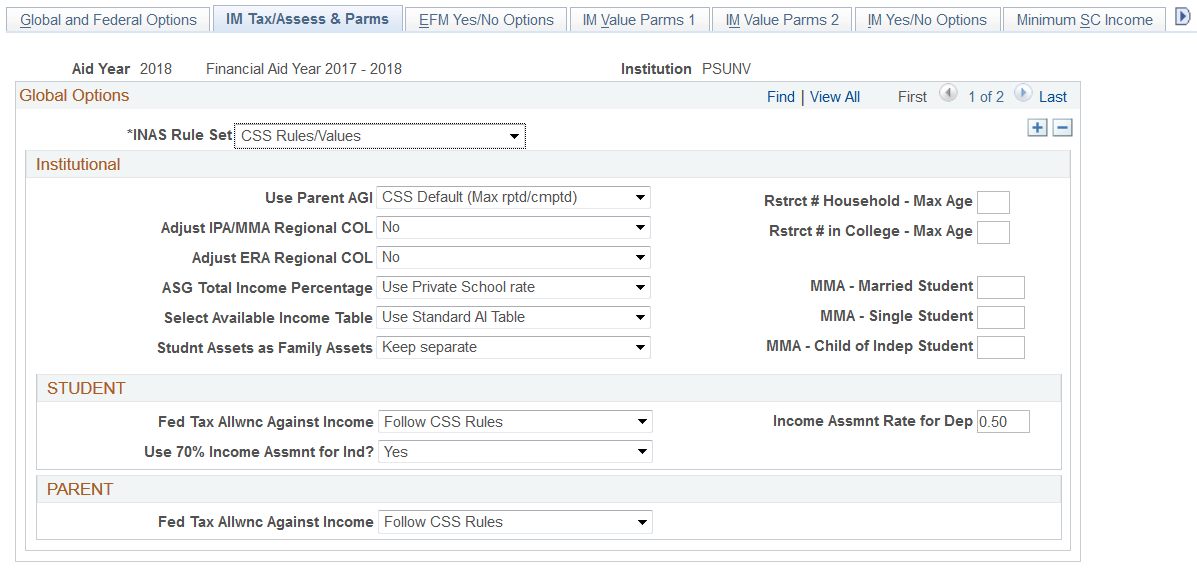

Access the IM Tax/Assess & Parms page ().

Image: IM Tax/Assess & Parms page

This example illustrates the fields and controls on the IM Tax/Assess & Parms page. You can find definitions for the fields and controls later on this page.

The system displays the aid year and institution.

Institutional

|

Field or Control |

Definition |

|---|---|

| Use Parent AGI (use parent adjusted gross income) |

Select how the parent AGI is represented. Values are: CSS Deflt (CSS default) Use Cmptd (use computed) Use Rptd (use reported) Use TaxRtrn (use tax return) |

| Adjust IPA/MMA Regional COL (adjust income protection allowance/monthly maintenance allowance regional cost of living) |

Select to adjust the cost of living calculation based on regional COL differences for an independent student or for the parent of a dependent student. Values are: No Stu/Par (student/parent) Yes Par (yes parent) Yes Stu (yes student) |

| Adjust ERA Regional COL (adjust emergency reserve allowance regional cost of living) |

Select to adjust the emergency reserve allowance for both students and parents, for independent students, or for parents only. Values are: No Yes-Both Yes-Indep (yes independent) Yes-Parent |

| ASG Total Income Percentage (annual savings goal total income percentage) |

Select a value to determine an appropriate ASG total income percentage. This percentage is used as an allowance against income. Values are:

Note: College Board CSS Profile users should refer to the College Board's Financial Aid Services Information Center (https://groups.collegeboard.org/fas) for supporting documentation. |

| Select Available Income Table |

Select a value to determine which Available Income Assessment Rate table to use. Values are:

|

| Student Assets as Family Assets (student assets as family assets) |

Select 5%-25% to have the EFC calculation process assess student assets at 5 percent and the student's trust funds at 25 percent when calculating the student contribution portion of the EFC. Select All Assets to have all of the student's assets count as parent assets. Student assets are summed in the parent column. These calculation adjustments occur:

Select Not Trusts to have all of the student's assets except for the value of trust funds count as parent assets. The only student assets summed in the student column are trust funds. These calculation adjustments occur:

Select Separate to use the default calculation. Parent assets are summed in the parent column and student assets are summed in the student column. If you leave this field blank, the system automatically enters Separate and uses the default calculation. Important! If you selected the Calc PC for Independent check box on the Global and Federal Options page or the IM Yes/No Options page, then the system ignores the value in the Student Assets as Family Assets field, and instead uses the default calculation. |

|

Field or Control |

Definition |

|---|---|

| Rstrct # Household - Max Age (restrict number in household - maximum age) |

Enter the value. You can restrict the family size used in the calculation by establishing an age threshold for siblings or dependents. For example, the calculation would not include an allowance for a member in the household over the maximum age set by the institution. |

| Rstrct # in College - Max Age (restrict number in college - maximum age) |

Enter the value. You can restrict the number in college used in the calculation by establishing an age threshold for family members in college. For example, the calculation would not include an allowance for a member of the household in college over the maximum age set by the institution. |

| MMA-Married Student (monthly maintenance allowance for married student) |

Enter a value to override the default MMA rate for a married student. |

| MMA-Single Student (monthly maintenance allowance for single student) |

Enter a value to override the default MMA rate for a single independent student. |

| MMA Child of Indep Student (monthly maintenance allowance for child of an independent student) |

Enter a value to override the default MMA rate for a child of an independent student. |

STUDENT

|

Field or Control |

Definition |

|---|---|

| Fed Tax Allwnc Against Income (federal tax allowance against income) |

Select from these values to calculate federal tax allowance against income: CSS Rules: According to CSS Rules, if a student's tax filing status is Completed Tax Return, reported tax is used to calculate federal tax allowance against income. If the student's tax filing status is Will File, the lower amount of reported tax or calculated tax is used to calculate the allowance. If reported tax is blank, negative, or invalid, the calculated tax amount is used to calculate the allowance. Calc Tax: Select to use the calculated tax amount if a student's tax filing status is Will File; otherwise, CSS Rules apply. Reptd Tax (reported tax): If a student's tax filing status is Will File, the reported tax is used to calculate the federal tax allowance against income. |

| Use 70% Income Assmnt for Ind (use 70 percent income assessment for independent) |

This field refers to the available income assessment rate for independent students. Select from these values: Yes: Uses 70 percent for income assessment. This is the default. No: Select if you elect not to use the 70 percent income assessment; the Alt Income Assessment Rate field appears on the page. |

| Income Assmnt Rate for Dep (income assessment rate for dependent) |

Enter an income assessment rate for dependent students. The default is 50 percent. |

| Alt Income Assessment Rate (alternate income assessment rate) |

Enter an alternate rate for assessing the student's income. This field appears on the page when you select No in the Use 70% Income Assmnt for Ind field. |

PARENT

|

Field or Control |

Definition |

|---|---|

| Fed Tax Allwnc Against Income (federal tax allowance against income) |

Select from these values to calculate federal tax allowance against income: CSS Rules: According to CSS Rules, if a parent's tax filing status is completed tax return, reported tax is used to calculate federal tax allowance against income. If the student's tax filing status is Will File, the lower amount of reported tax or calculated tax is used to calculate the allowance. If reported tax is blank, negative, or invalid, the calculated tax amount is used to calculate the allowance. Calc Tax: Select to use the calculated tax amount if a parent's tax filing status is Will File; otherwise, CSS Rules apply. Reptd Tax: If a parent's tax filing status is Will File, the reported tax is used to calculate the federal tax allowance against income. |

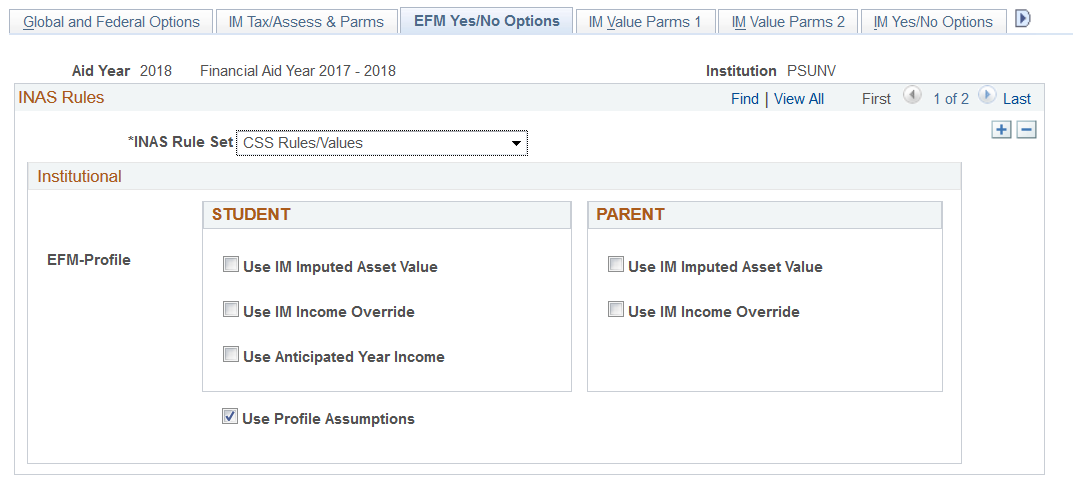

Access the EFM Yes/No Options page ().

Image: EFM Yes/No Options page

This example illustrates the fields and controls on the EFM Yes/No Options page. You can find definitions for the fields and controls later on this page.

Select the EFM options for the aid year, institution, and selected INAS rule set.

STUDENT

|

Field or Control |

Definition |

|---|---|

| Use IM Imputed Asset Value |

Select to impute the value of EFM assets based on the interest and dividend income reported on the PROFILE form. |

| Use Anticipated Year Income |

Select to use the student's anticipated year earnings instead of base year for EFM. |

| Use IM Income Override |

Select to use the IM adjusted gross income and untaxed income overrides for the EFM student contribution. |

PARENT

|

Field or Control |

Definition |

|---|---|

| Use IM Imputed Asset Value |

Select to impute the value of EFM assets based on the interest and dividend income reported on the PROFILE form. |

| Use IM Income Override |

Select to use the IM's adjusted gross income and untaxed income overrides for the EFM parent contribution. |

EFM-Profile

|

Field or Control |

Definition |

|---|---|

| Use Profile Assumptions |

Select to enable the system to perform calculations using assumptions made by the system. For example, if Parent 1 reports income of 50,000.00 USD, and Parent 2 reports income of 50,000.00 USD, and the adjusted gross income is left blank, the system assumes the total income to be 100,000.00 USD. The calculation then uses an assumed adjusted gross income of 100,000.00 USD. |

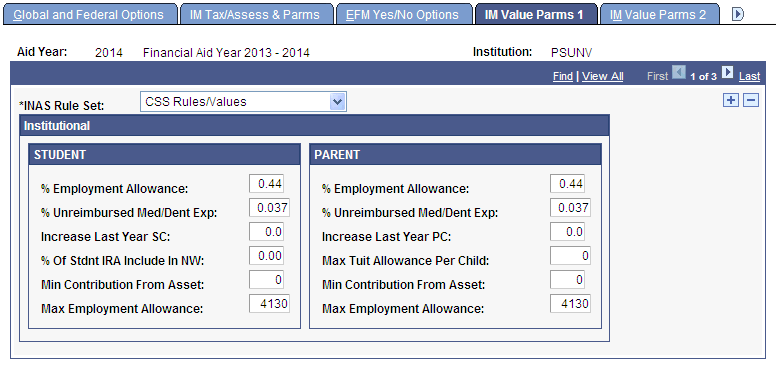

Access the IM Value Parms 1 page ().

Image: IM Value Parms 1 page

This example illustrates the fields and controls on the IM Value Parms 1 page. You can find definitions for the fields and controls later on this page.

Enter the IM values for the aid year, institution, and selected INAS rule set. Use the default values or enter the percentages and values set by your institution for students and parents.

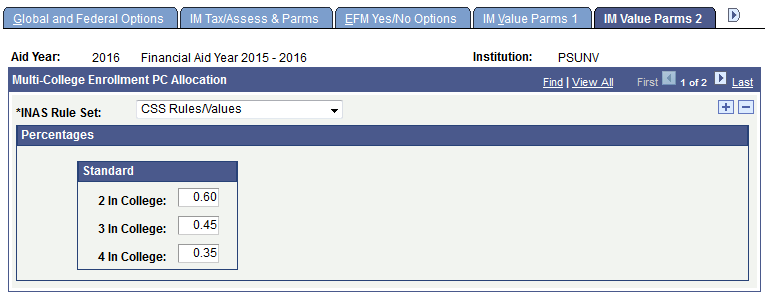

Access the IM Value Parms 2 page ().

Image: IM Value Parms 2 page

This example illustrates the fields and controls on the IM Value Parms 2 page.

Select the IM options and enter the IM values for the aid year, institution, and selected INAS rule set.

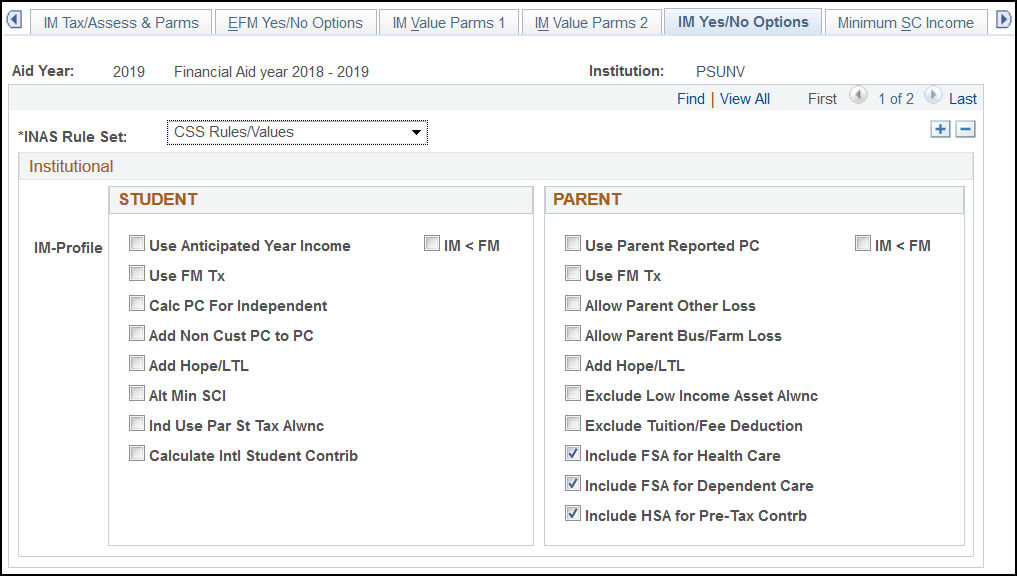

Access the IM Yes/No Options page ().

Image: IM Yes/No Options page

This example illustrates the fields and controls on the M Yes/No Options page. You can find definitions for the fields and controls later on this page.

The system displays the aid year and institution.

STUDENT

|

Field or Control |

Definition |

|---|---|

| Use Anticipated Year Income |

Select to calculate an anticipated estimated annual income if it is lower than the reported base year income. |

| Use FM Tx (use federal methodology tax) |

Select to use the FM state and local income tax computation table in the calculation. When this check box is selected in conjunction with the Ind Use Par St Tax Alwnc check box, Use FM Tx takes priority for independent students. |

| Calc PC For Independent (calculate parental contribution for independent) |

Select to use the parents' information in the calculation for an independent student. |

| Add Non Cust PC to PC (add noncustodial parent contribution to parent contribution) |

Select to combine the noncustodial parent's contribution to the parent contribution. |

| Add Hope/LTL (add Hope/Lifetime Learning Credit) |

Select to let the system determine whether to add this value to taxes, based on federal tax allowance against income and tax filing status, as shown in the following table. The column headings represent the value of the Fed Tax Allwnc Against Income field from the IM Tax/Assess Parameters page. |

|

For this Tax Filing Status: |

CSS Rules will: |

Calc Tax will: |

Rptd Tax will: |

|---|---|---|---|

|

Completed Return |

Add Hope to taxes. |

Not add Hope to calculate taxes. |

Add Hope to taxes. |

|

Will File Return |

Not add Hope to calculate taxes. |

Not add Hope to calculate taxes. |

Add Hope to taxes. |

When the INAS calculates taxes, it compares the values for reported taxes and calculated taxes and uses the lower value in subsequent calculations. This table demonstrates how the system processes the Hope value when reported taxes are lower than calculated taxes:

|

For this Tax Filing Status: |

CSS Rules will: |

Calc Tax will: |

Rptd Tax will: |

|---|---|---|---|

|

Completed Return |

Add Hope to taxes. |

Add Hope to taxes only if reported is lower than calculated. |

Add Hope to taxes. |

|

Will File Return |

Add Hope to taxes only if reported is lower than calculated. |

Add Hope to taxes only if reported is lower than calculated. |

Add Hope to taxes. |

Note: Reported tax amounts are generally higher than calculated tax amounts.

|

Field or Control |

Definition |

|---|---|

| Alt Min SCI (alternate minimum student contribution from income) |

Clear to indicate No (default); select to indicate Yes for this Yes/No option. If the check box is not selected, the application performs the Alternate Minimum Student Contribution from Income calculation using the following calculations

|

| Ind Use Par St Tax Alwnc (independent use parent state tax allowance) |

Select if the student is independent with dependents but you want to use the parent's state tax allowance table in the calculation. When this check box is selected in conjunction with the Use FM Tx check box, Use FM Tx takes priority for independent students. |

| Calculate Intl Student Contrib (calculate international student contribution) |

Select to calculate an international student contribution if there is enough information available. |

| IM < FM (institutional methodology is less than federal methodology) |

Select to allow the calculated IM EFC to be below the calculated FM. |

PARENT

|

Field or Control |

Definition |

|---|---|

| Use Parent Reported PC (use reported parent contribution) |

Select to enforce the amount that the parents volunteered to contribute, if that amount is higher than the amount calculated by the system. |

| Use FM Tx (use federal methodology tax) |

Select to use the FM state and local income tax computation table in the calculation. |

| Allow Parent Other Loss |

Select to allow losses taken on a parent's income tax. This results in a lower EFC. |

| Allow Parent Bus/Farm Loss |

Select to allow losses taken on a parent's income tax, such as depreciation in a business. This results in a lower EFC. |

Note: By default, the system disallows losses on business, farm, or other. By selecting Allow Parent Other Loss or Allow Parent Bus/Farm Loss, you allow the loss to be included in the calculation.

|

Field or Control |

Definition |

|---|---|

| Add Hope/LTL (add Hope/Lifetime Learning Credit) |

Select to have the system determine whether to add this value to taxes based on federal tax allowance against income and tax filing status, as shown in the previous table. The column headings in the table represent the value of the Fed Tax Allwnc Against Income field from the IM Tax/Assess Parameters page. |

| Exclude Low Income Asset Alwnc (exclude low income asset allowance) |

Select to calculate without using the low income asset allowance. |

| Exclude Tuition/Fee Deduction |

Use this check box to determine whether the tuition and fee deductions reported by the parents of dependent students are excluded from parental income:

|

| Include FSA for Health Care |

Select to add Flexible Spending Account for Health Care funds to total untaxed income. Default is selected. |

| Include FSA for Dependent Care |

Select to add Flexible Spending Account for Dependent Care funds to total untaxed income. Default is selected. |

| Include HSA for PreTax Contrib |

Select to add Health Saving Account funds to total untaxed income. If not selected, Health Saving Account funds are excluded from total untaxed income. |

| IM < FM |

Select to allow the calculated IM EFC to be less than the calculated FM. |

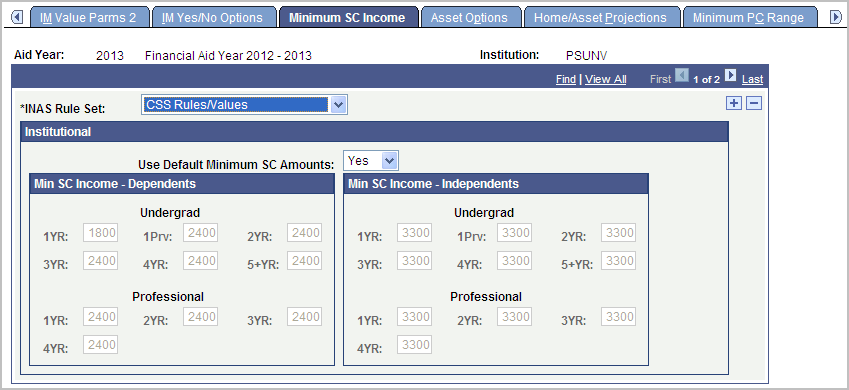

Access the Minimum SC Income page ().

Image: Minimum SC Income page

This example illustrates the fields and controls on the Minimum SC Income page. You can find definitions for the fields and controls later on this page.

Enter the minimum institutional student contribution values set by your institution for dependent and independent students for the selected INAS rule set. IM uses a minimum student contribution from income, which you can adjust. The system uses these values to determine whether the calculated or minimum contribution is used.

Institutional

|

Field or Control |

Definition |

|---|---|

| Use Default Minimum Student Contribution Amounts |

Select from these values: Yes: Use the defaults. No: Make manual changes to the minimum student contribution amounts. |

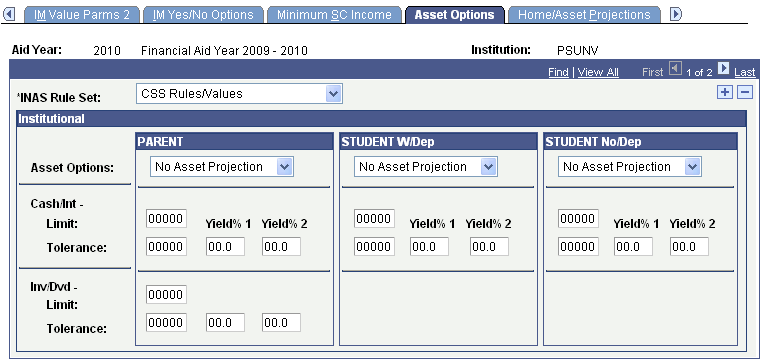

Access the Asset Options page ().

Image: Asset Options page

This example illustrates the fields and controls on the Asset Options page. You can find definitions for the fields and controls later on this page.

The system displays the aid year and institution.

Institutional

|

Field or Control |

Definition |

|---|---|

| Asset Options |

Select asset options. Values are: No Asset Projection: INAS does not impute a value for assets, reported amounts are used. Combined Projection: INAS combines Cash/Int (cash and interest) and Inv/Dvd (investment and dividends) imputed values in the calculation. The entire amount is reported as cash savings. Individual Projection: INAS calculates Cash/Int and Inv/Dvd imputed values individually. Cash/Int and Inv/Dvd can have a different yield and tolerance. You can compare income with reported cash, savings, checking, and investments to identify cases where the asset value appears to be under-reported. Specify both an expected rate of return (yield) and a tolerance level for both Cash/Int and Inv/Dvd. Based on the interest reported, you can impute a value of the parents' or student's cash savings, using the specified yield. This helps you to determine whether the reported savings are under-reported. You can also impute a value for the parents' or student's investments and dividends. |

| Limit and Tolerance |

Enter the limit and tolerance values for Cash/Int. You can set a limit for cash and interest. For example, you can enter a value of 10,000.00 USD. You can set up the system to assess the first 10,000.00 USD (Limit) at 3.8% (Yield% 1) and any portion greater than 10,000.00 USD at 5.6% (Yield% 2). Based on the reported interest from the tax return, if the value is less than 10,000.00 USD, the system uses the percentage that appears in Yield% 1 in calculation. The system uses the percentage in Yield% 2 in the calculation for the amount above 10,000.00 USD. If the tolerance is set to 500.00 USD, and the imputed value when compared to the reported value is within the specified tolerance, you can decide to use the reported value. INAS uses the reported income and the expected rate of return to project the asset value required to produce that income. If the projected value is greater than the reported asset value by more than the tolerance level, the projected value is substituted for the reported asset value. |

| Inv/Dvd (investment and dividend) |

Set up the appropriate limit and tolerance to compare the reported value to the imputed value, as described previously. |

Note: The Asset Option Ind Proj (asset option individual projection) field is not available for students.

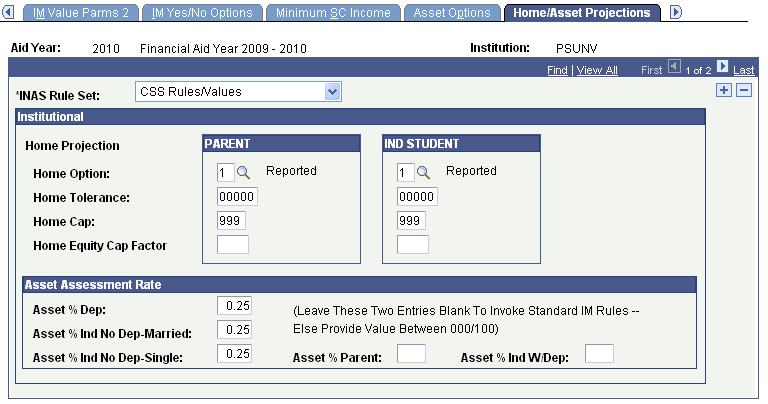

Access the Home/Asset Projections page ().

Image: Home/Asset Projections page

This example illustrates the fields and controls on the Home/Asset Projections page. You can find definitions for the fields and controls later on this page.

The system displays the aid year and institution.

Institutional

|

Field or Control |

Definition |

|---|---|

| Home Option |

Select the home option for parents and independent students. Values are: 1: Reported. INAS uses the value of the home reported on the application, to calculate equity. 2: Projected. The system calculates the value of the home based on the purchase price of the home and the date on which it was purchased, using the Federal Housing Multiplier table. 3: Projected if Significant Difference. The system uses the value set for home tolerance to determine whether reported or projected home values are used to determine home equity. 4: Highest. INAS compares the calculated and reported home value. The system uses the higher value to determine equity. 5:Alt Home Value Calculation. INAS compares projected value to capped value and uses the lower value. |

| Home Tolerance |

Enter a home tolerance value. INAS uses the reported value of the home, unless it exceeds the tolerance when the difference is compared to the calculated home value. If it exceeds the tolerance, the value is adjusted accordingly. |

| Home Cap |

Enter a multiplier if you do not want the reported value or the computed value to exceed a certain multiple of the family's income. The system multiplies this value with total income to adjust the value of the home. |

| Home Equity Cap Factor |

Enter a cap factor from 0.0 to 9.9. Home equity is then capped using the factor times the computed income. |

Asset Assessment Rate

|

Field or Control |

Definition |

|---|---|

| Asset % Dep (asset percentage dependent) |

Enter a value to use as an allowance against assets. |

| Asset % Ind No Dep-Married (asset percentage independent no dependents married) |

Enter a value to use as an allowance against assets. |

| Asset % Ind No Dep-Single (asset percentage independent no dependents single) |

Enter a value to use as an allowance against assets. |

| Asset % Parent (asset percentage parent) |

Enter a value to use as an allowance against assets. Leave this field and the Asset % Ind W/Dep field blank to invoke standard IM rules. |

| Asset % Ind W/Dep (asset percentage independent with dependents) |

Enter a value to use as an allowance against assets. Leave this field and the Asset % Parent field blank to invoke standard IM rules. |

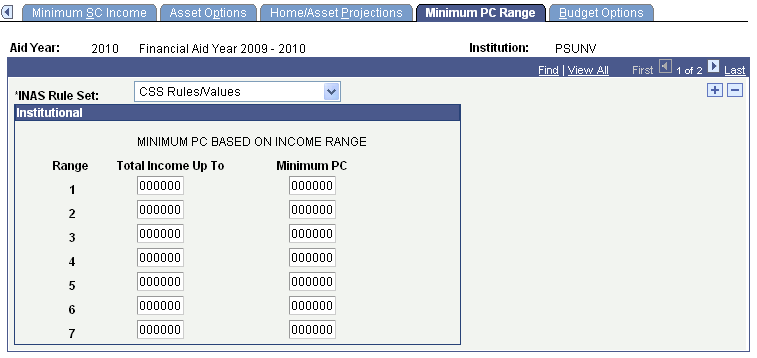

Access the Minimum PC Range page ().

Image: Minimum PC Range page

This example illustrates the fields and controls on the Minimum PC Range page. You can find definitions for the fields and controls later on this page.

Use this page to select the minimum parental contribution for the aid year, institution, and selected INAS rule set.

|

Field or Control |

Definition |

|---|---|

| MINIMUM PC BASED ON INCOME RANGE (minimum parental contribution based on income range) |

Enter the values set by your institution's policy. |

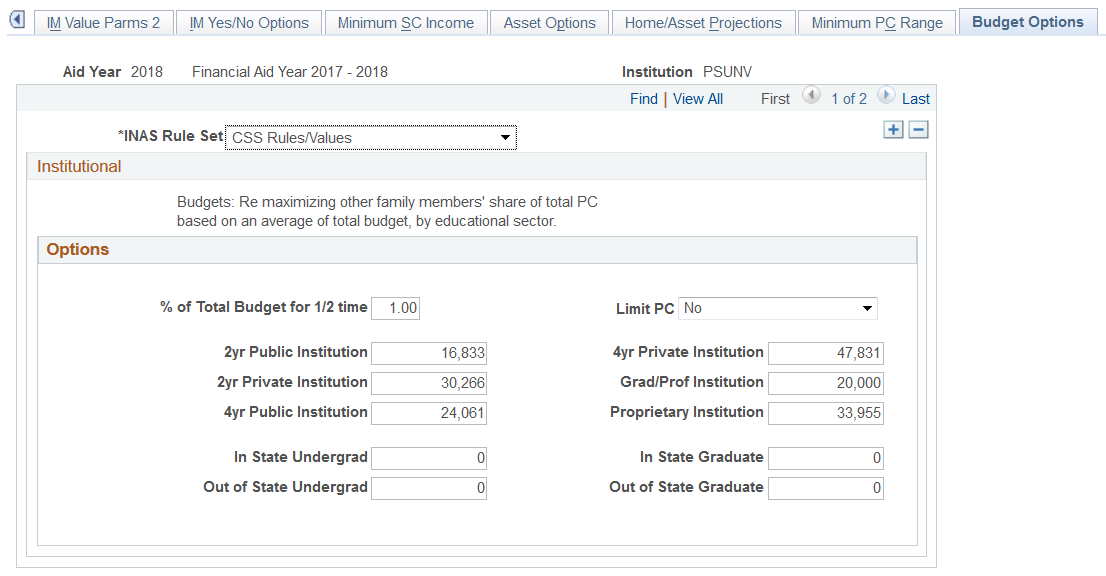

Access the Budget Options page ().

Image: Budget Options page

This example illustrates the fields and controls on the Budget Options page. You can find definitions for the fields and controls later on this page.

The system displays the aid year and institution.

Institutional

|

Field or Control |

Definition |

|---|---|

| % of Total Budget for 1/2 time (percentage of total budget for half-time) |

Enter a percentage of the total budget that you want to use for a student attending an institution half-time. Note: The value 1.00 is equal to 100 percent. |

|

Field or Control |

Definition |

|---|---|

| Limit PC (limit parental contribution) |

Select a parental contribution limit. Values are: % Tot Bdgt (percentage of total budget): Select to have the parental contribution limited to the percentage (calculated as follows: budget total for other children divided by budget total for all children) that their total budget compared to the total budget including the applicant. Lowest: Compare the parental contribution limits set by % Tot Bdgt and Sum Bdgt, and set the limit to the higher value. No: Indicate that no parental contribution limit is set. Sum Bdgt (sum budget): Limit the parental contribution to the sum of the budgets for all other children in the family. Enter the values that your institution set for each type of institution. |