Maintaining Institutional Financial Aid Applications

Your institution can gather additional resource information about students and their families by using the College Board PROFILE application which is electronically supported by the System or by entering your institutional application on the pages in this component.

Note: The College Board PROFILE and institutional application data share the same pages. You might unintentionally create multiple institutional aid records for a student from these three sources, which could cause unintended INAS calculation results.

Note: Question marks or blanks on College Board PROFILE data files are converted or appear as zeros in currency based numeric fields.

For further information about the fields in this component, please refer to the College Board's Financial Aid Services Information Center (https://groups.collegeboard.org/fas) for supporting documentation.

This section lists common elements and discusses how to:

Review student information.

Review custodial parent information.

Review non-custodial parent information.

Review currency information, family information, and institutional questions.

Review all computed data for student and parents.

|

Field or Control |

Definition |

|---|---|

| Need Summary |

Click this link to access the Need Summary page, where you can review the student's federal and institutional need calculations. |

| FM (federal methodology) |

Click this link to access the INAS Fed Extension page, where you can override INAS Local Policy Options for federal data. |

| IM (institutional methodology) |

Click this link to access the Institutional Need Calculation Extension 1 page, where you can override INAS Local Policy Options for institutional data. |

| INAS (institutional need analysis system) |

Click this button to calculate an unofficial federal and institutional Expected Family Contribution (EFC) by using the College Board's Institutional Need Analysis System (INAS). A COBOL program is used to perform the INAS calculation. |

| INAS NCP (institutional need analysis system non-custodial parent button) |

Click this button to calculate the non-custodial parent contribution. Note: Calculate the non-custodial parent contribution before invoking the regular INAS calculation. Calculating a non-custodial parent contribution creates an INAS Extension record, selects the Use Non-Custodial Parent Contribution check box and populates the PC From Non-Custodial Parent (parent contribution from non-custodial parent) field in INAS Extension 5. After this, when the regular INAS calculation is invoked, the non-custodial parent contribution is added to the custodial parent contribution and overall expected family contribution. |

The system displays the student's name, ID, HouseHold Type (HHA for custodial parent, HHB for non-custodial parent, HHA/HHB for both custodial and non-custodial parent), institution, dependency status, application source, and aid year at the top of each review page. These two terms also appear at the top of each review page:

|

Field or Control |

Definition |

|---|---|

| HouseHold Type (household type) |

Displays the type of PROFILE application received:

|

| HHB Indicated (non-custodial parent PROFILE application received indicator) |

Displays whether or not a non-custodial parent PROFILE application is indicated or can exist for a custodial parent household.

|

Note: The navigation paths for the pages listed in the following page introduction table are for aid year 20nn-20nn. Oracle supports access for three active aid years with valid INAS calculations. Earlier aid year institutional application data is available for display only at

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Student Data |

INST_STUDENT_nn |

|

View or enter student information. |

|

Custodial Parent Data |

INST_PARENT_nn |

|

View or enter custodial parent information. |

|

Non Custodial Parent Data |

INST_NCPARENT_nn |

|

View or enter non-custodial parent information. |

|

Miscellaneous Data |

INST_MISC_nn |

|

View or enter signature, family member, school selection, and institutional question (the College Board PROFILE Section Q) information. You can also view FNAR messages on this page. |

|

Computation Summary |

INST_COMP_SUMM_nn |

|

View or enter computed parent and student income, allowance, and asset information using your institutional and federal methodology. The computed values appear here. |

Access the Student Data page ().

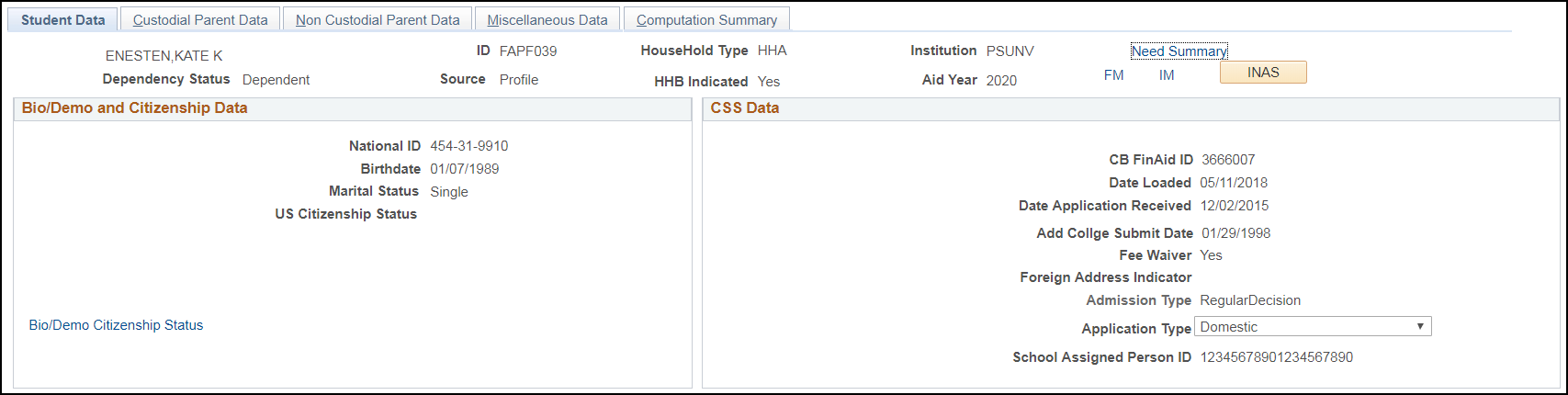

Image: Maintain Institutional Application, Student Data tab (page 1 of 5)

This example illustrates the fields and controls on the Maintain Institutional Application, Student Data tab (page 1 of 5). You can find definitions for the fields and controls later on this page.

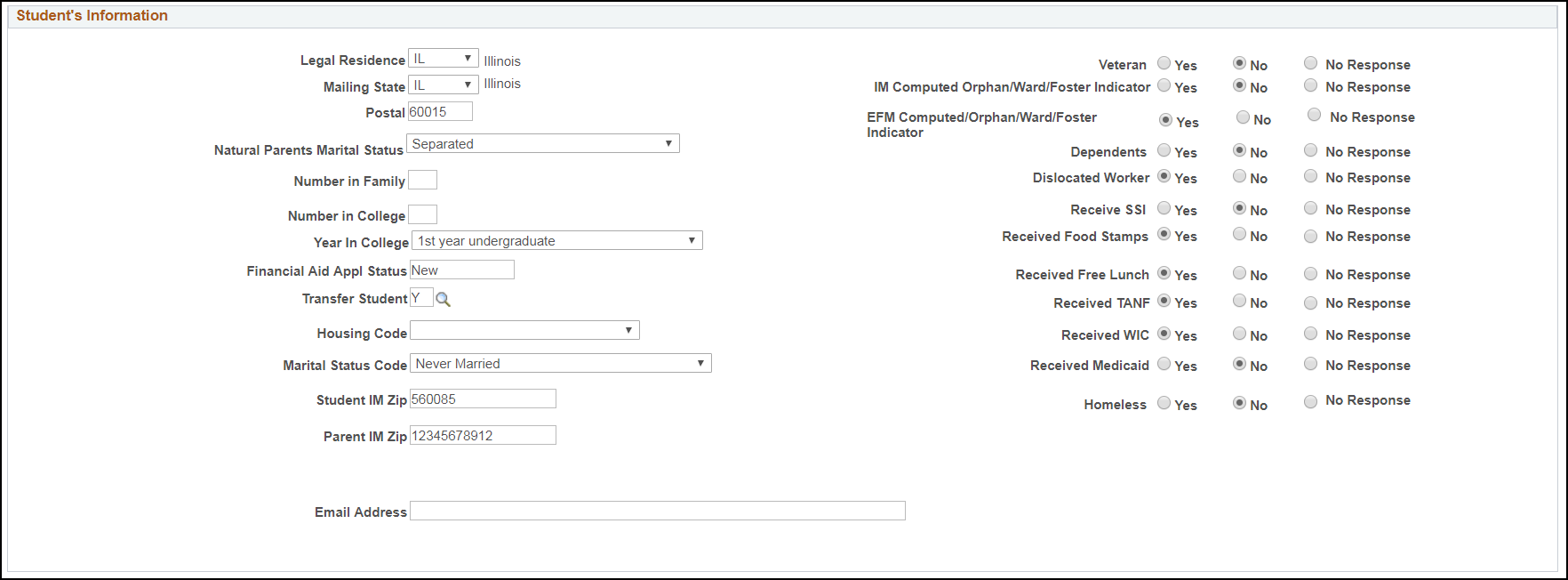

Image: Maintain Institutional Application, Student Data tab (page 2 of 5)

This example illustrates the fields and controls on the Maintain Institutional Application, Student Data tab (page 2 of 5). You can find definitions for the fields and controls later on this page.

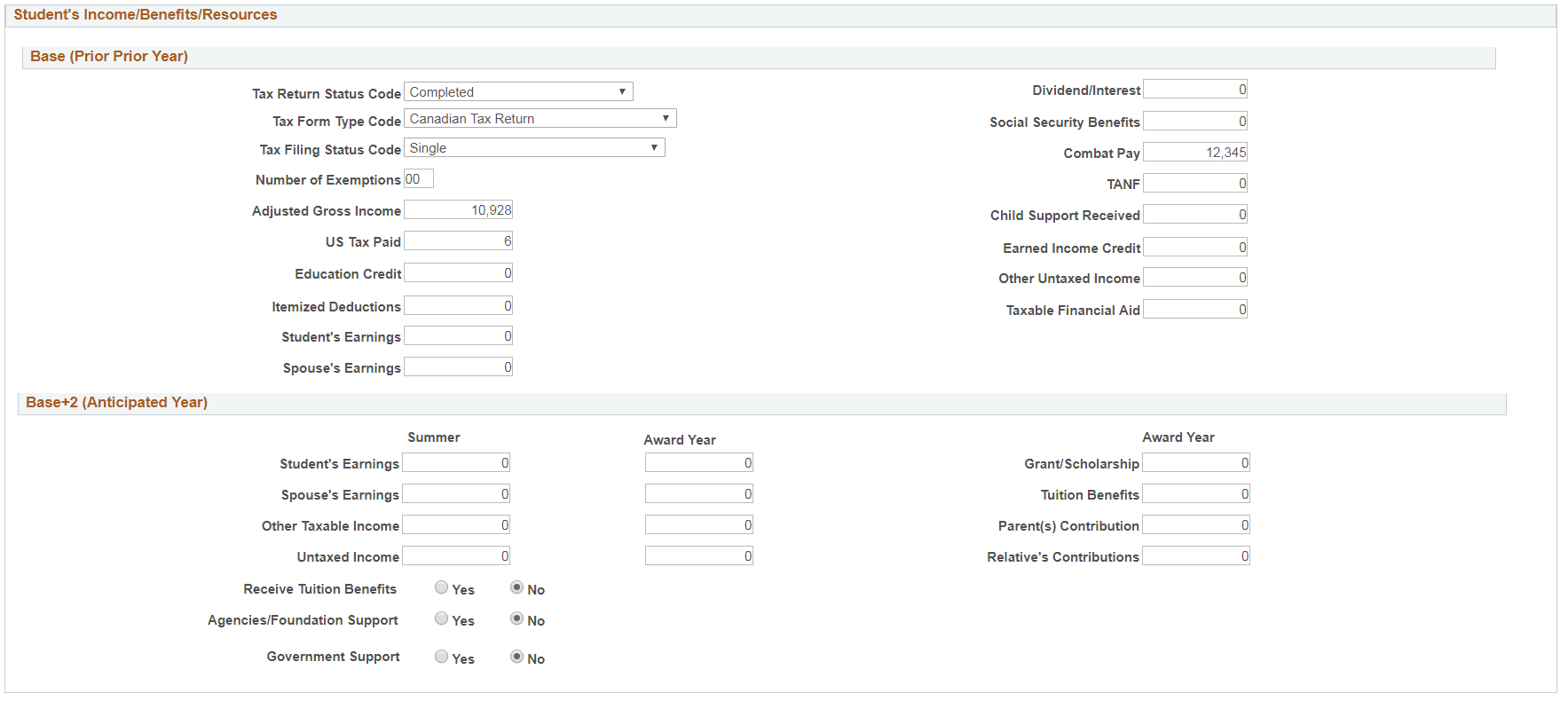

Image: Maintain Institutional Application, Student Data tab (page 3 of 5)

This example illustrates the fields and controls on the Maintain Institutional Application, Student Data tab (page 3 of 5). You can find definitions for the fields and controls later on this page.

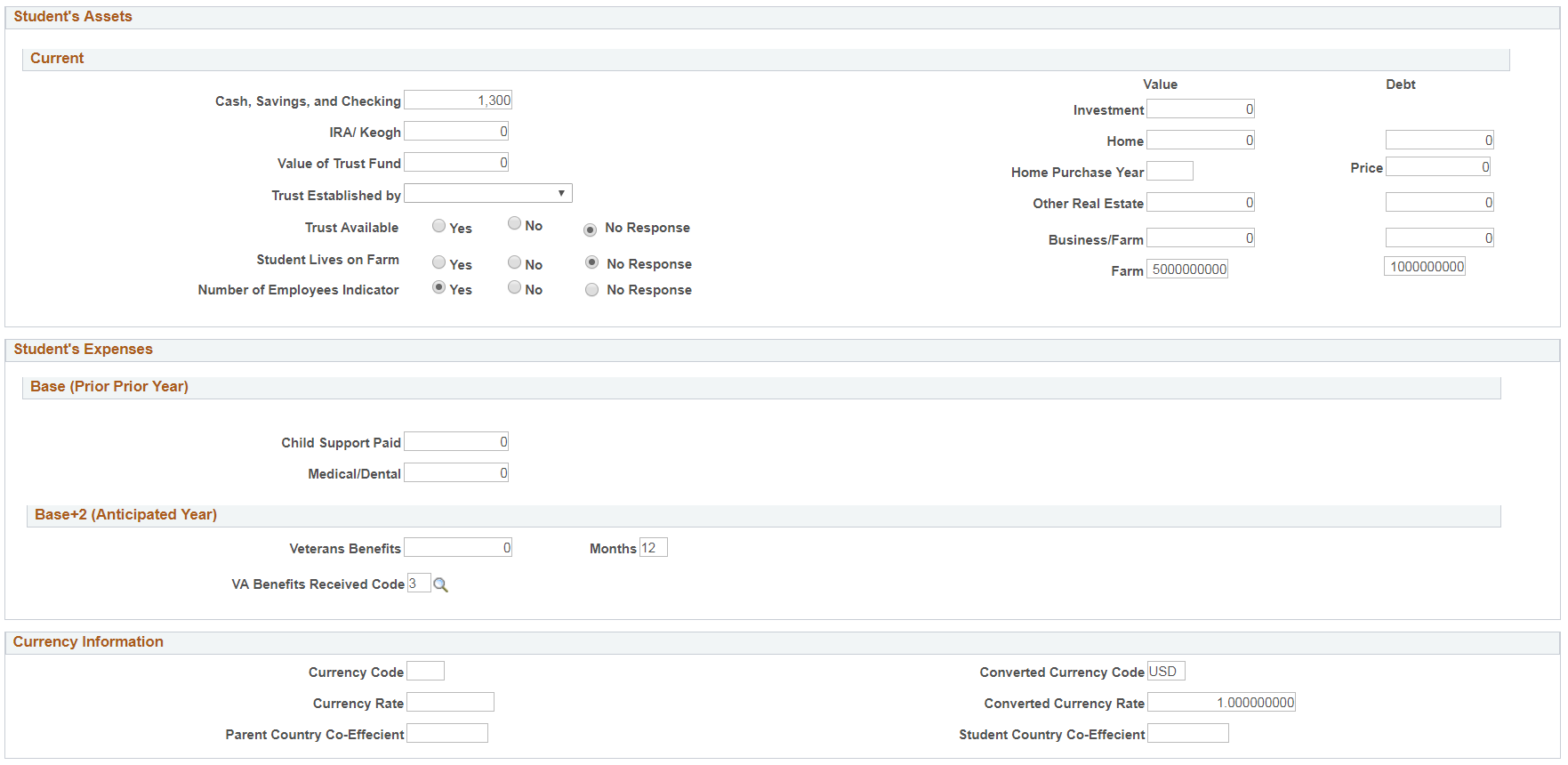

Image: Maintain Institutional Application, Student Data tab (page 4 of 5)

This example illustrates the fields and controls on the Maintain Institutional Application, Student Data tab (page 4 of 5). You can find definitions for the fields and controls later on this page.

Image: Maintain Institutional Application, Student Data tab (page 5 of 5)

This example illustrates the fields and controls on the Maintain Institutional Application, Student Data tab (page 5 of 5). You can find definitions for the fields and controls later on this page.

Bio/Demo and Citizenship Data

The data for the fields in this group box are populated from Campus Community Bio/Demo data.

|

Field or Control |

Definition |

|---|---|

| National ID |

Displays the student's National ID. Note: If the PROFILE Application type = 4 (International PROFILE) and the National ID is blank, the student is loaded into PROFILE Staging with XXX-XX-XXXX. This permits Search/Match to take place and potentially load the student into the Institutional Application tables with the NID rendered as XXX-XX-XXXX. |

| Reported Country |

Displays the student's reported country if not United States of America. |

| Bio/Demo Citizenship Status |

Click this link to access the Campus Community Citizenship/Passport page to confirm the citizenship status of the student's Biographic/ Demographic data against the values in the Reported Country and Reported Status fields. |

CSS Data

|

Field or Control |

Definition |

|---|---|

| CSS ID (college scholarship service ID) |

Note: CSS ID was the identifier assigned by College Board to ensure both privacy and quick retrieval of records. CSS ID was removed from PROFILE XML files by College Board effective Aid Year 2019-2020. It will not be displayed for Aid Year 2019-2020 forward. |

| CB FinAid ID (College Board Financial Aid ID) |

Displays a unique lifetime ID assigned to the student's record by the PROFILE system to ensure both privacy and quick retrieval of records. When you call the College Board inquiry number with questions about specific records, it is helpful to know the student's College Board Financial Aid ID number. |

| Application Type |

Displays:

|

Student's Information

|

Field or Control |

Definition |

|---|---|

| Financial Aid Status |

Enter the student's status as it relates to receiving financial aid. |

| Marital Status Code |

Select the marital status to be used for financial aid purposes. This marital status can differ from the Bio/Demo Data page marital status. |

| Student IM Zip (student institutional methodology zip code) |

The student zip code used for cost of living adjustment calculations. Typically matches the student permanent zip code but can be updated independently of student permanent zip code if needed. |

| Parent IM Zip (parent institutional methodology zip code) |

The parent zip code used for cost of living adjustment calculations. Typically matches the parent permanent zip code but can be updated independently of parent permanent zip code if needed. |

Student's Income/Benefits/Resources – Base (Prior Prior Year)

These fields are items from the United States federal income tax forms or data gathered from other applicable sources such as an institutional application or a third party source.

Student's Income/Benefits/Resources – Base+2 (Anticipated Year)

|

Field or Control |

Definition |

|---|---|

| Receive Tuition Benefits |

Indicate whether or not the student receives tuition benefits from the parents' employers. |

| Agencies/Foundation Support |

Indicate whether the student expects to receive from agencies or foundations to pay for educational expenses during any year of attendance. |

| Government Support |

Indicate whether the student expects to receive from her government to pay for educational expenses during any year of attendance. |

Student's Assets – Current

|

Field or Control |

Definition |

|---|---|

| Price |

Enter purchase price of the student's home. |

Student's Expenses – Base (Prior Prior Year)

|

Field or Control |

Definition |

|---|---|

| Child Support Paid |

Enter the child support paid by the student. |

| Medical/Dental |

Enter the medical and/or dental out of pocket expenses paid by the student. |

| Veterans Benefits |

Enter the monthly amount of VA Benefits received by the student. |

| Months |

Enter the number of months the veterans benefits were received in the calendar year. |

Currency Information

|

Field or Control |

Definition |

|---|---|

| Currency Code |

Enter the currency in which the original data was reported by the student. |

| Currency Rate |

Enter the currency conversion rate used to process the student's data. |

| Parent Country Co-Efficient |

Enter the country coefficient used to process the parents’ financial data. |

| Converted Currency Code |

Enter the original currency converted into US dollars reported by citizens living abroad and Canadians. |

| Converted Currency Rate |

Enter the rate the student used in converting their currency into US dollars. Reported by citizens living abroad and Canadians. |

| Student Country Co-Efficient |

Enter the country coefficient used to process the student’s financial data. |

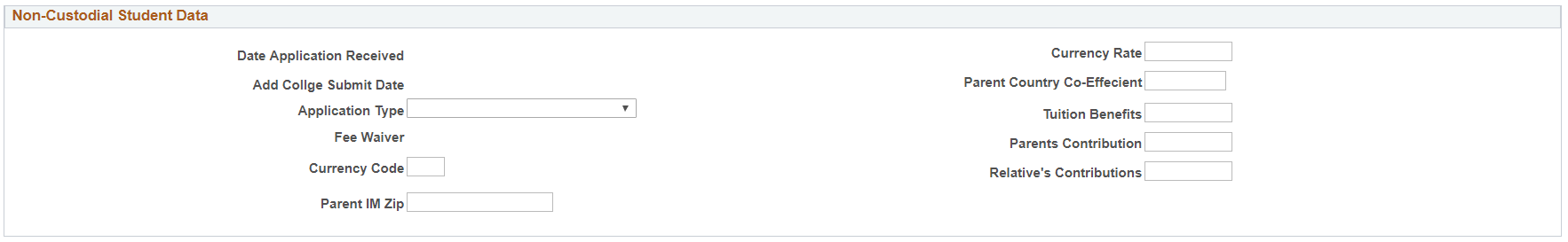

Non-Custodial Student Data

These fields display student information as reported on the non-custodial PROFILE.

Access the Custodial Parent Data page ().

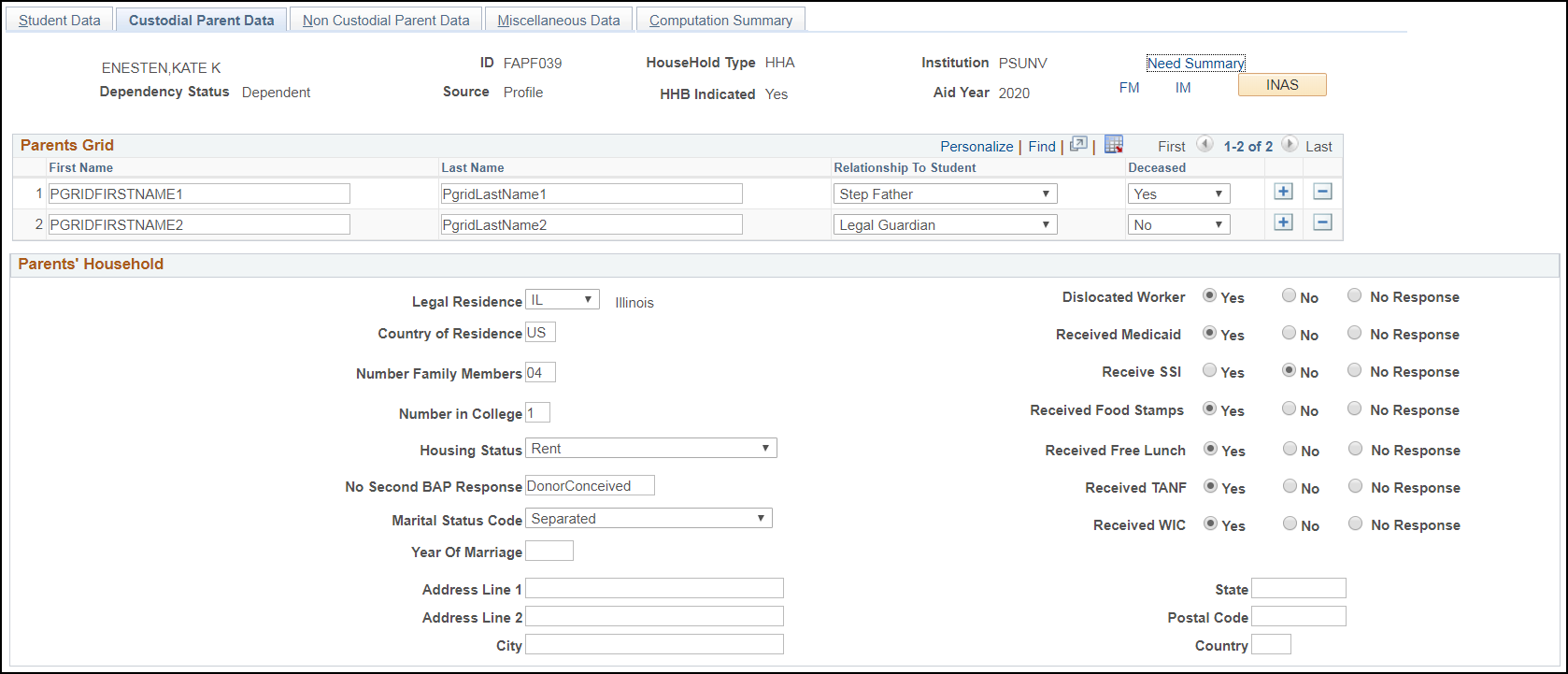

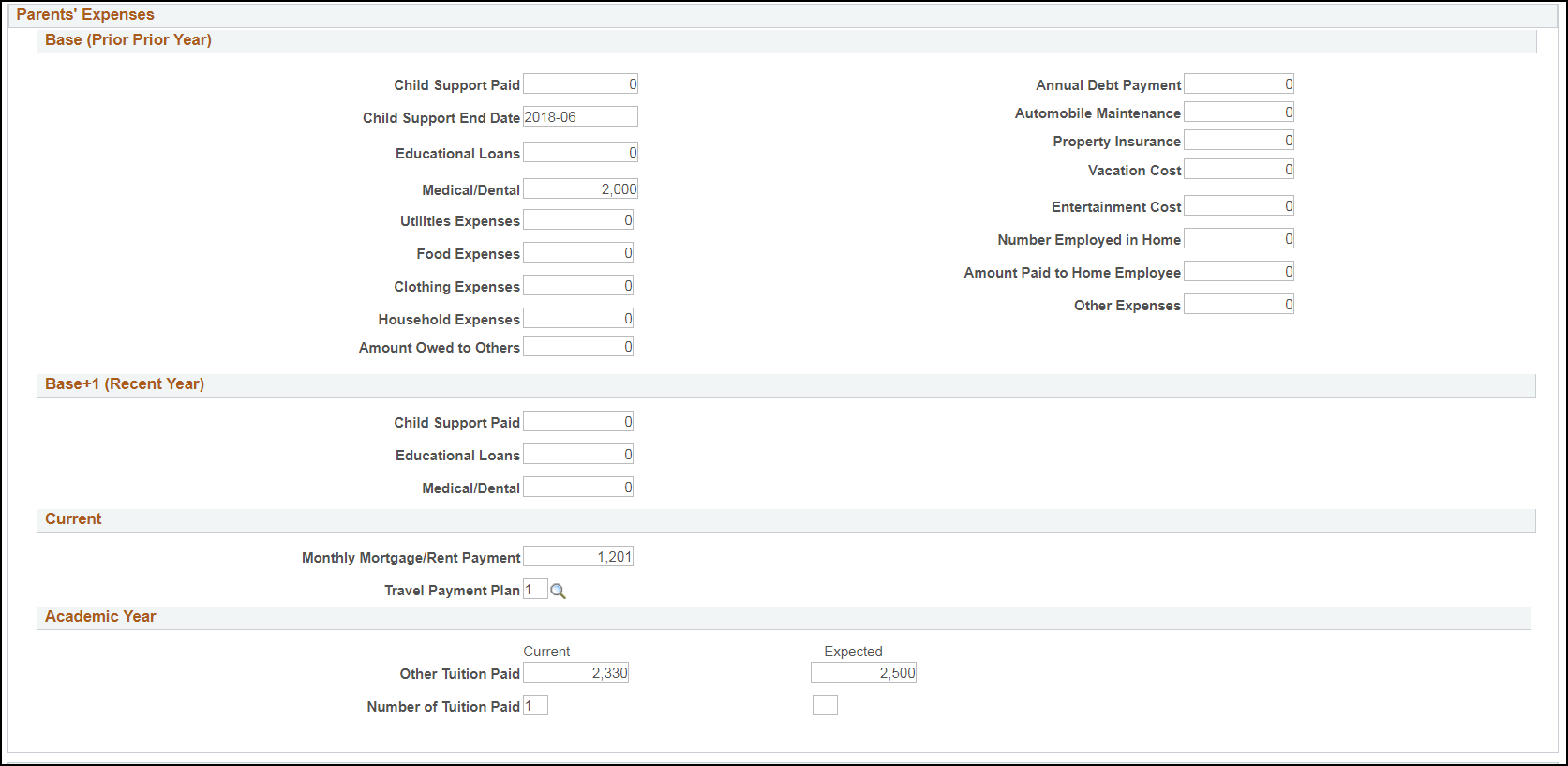

Image: Maintain Institutional Application, Custodial Parent Data tab (page 1 of 6)

This example illustrates the fields and controls on the Maintain Institutional Application, Custodial Parent Data tab (page 1 of 6). You can find definitions for the fields and controls later on this page.

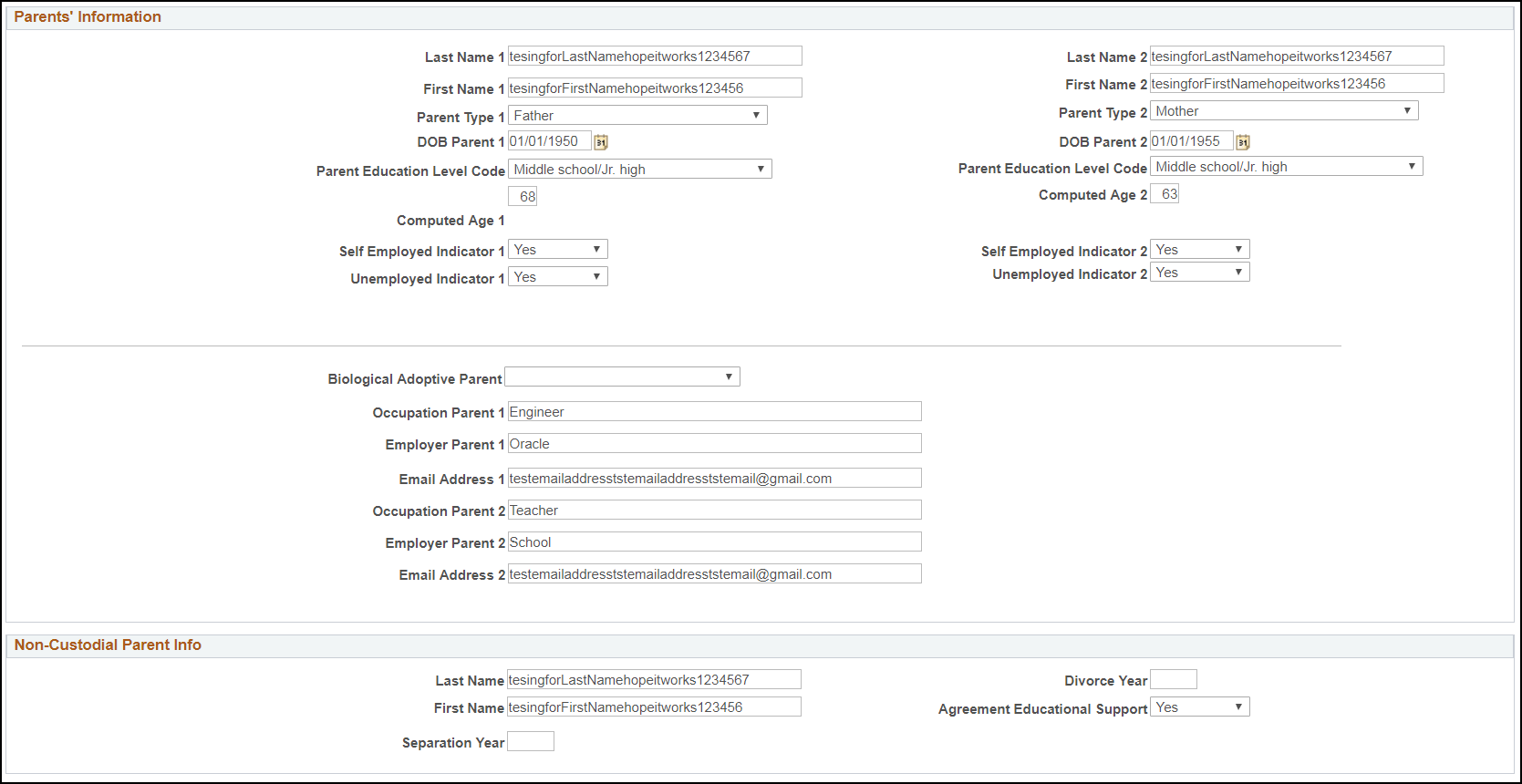

Image: Maintain Institutional Application, Custodial Parent Data tab (page 2 of 6)

This example illustrates the fields and controls on the Maintain Institutional Application, Custodial Parent Data tab (page 2 of 6). You can find definitions for the fields and controls later on this page.

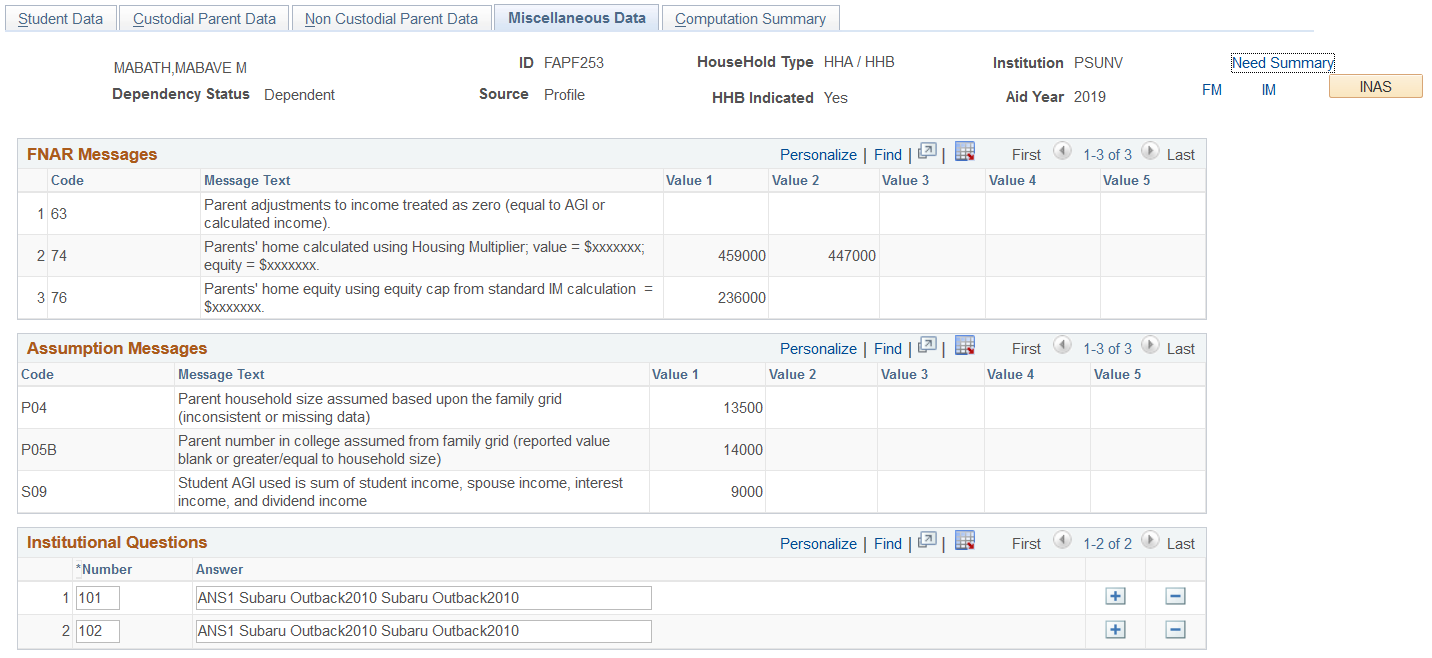

Image: Maintain Institutional Application, Custodial Parent Data tab (page 3 of 6)

This example illustrates the fields and controls on the Maintain Institutional Application, Custodial Parent Data tab (page 3 of 6). You can find definitions for the fields and controls later on this page.

Image: Maintain Institutional Application, Custodial Parent Data tab (page 4 of 6)

This example illustrates the fields and controls on the Maintain Institutional Application, Custodial Parent Data tab (page 4 of 6). You can find definitions for the fields and controls later on this page.

Image: Maintain Institutional Application, Custodial Parent Data tab (page 5 of 6)

This example illustrates the fields and controls on the Maintain Institutional Application, Custodial Parent Data tab (page 5 of 6). You can find definitions for the fields and controls later on this page.

Image: Maintain Institutional Application, Custodial Parent Data tab (page 6 of 6)

This example illustrates the fields and controls on the Maintain Institutional Application, Custodial Parent Data tab (page 6 of 6). You can find definitions for the fields and controls later on this page.

Parents Grid

This section of the page displays parental information including relationship to student as reported on the PROFILE.

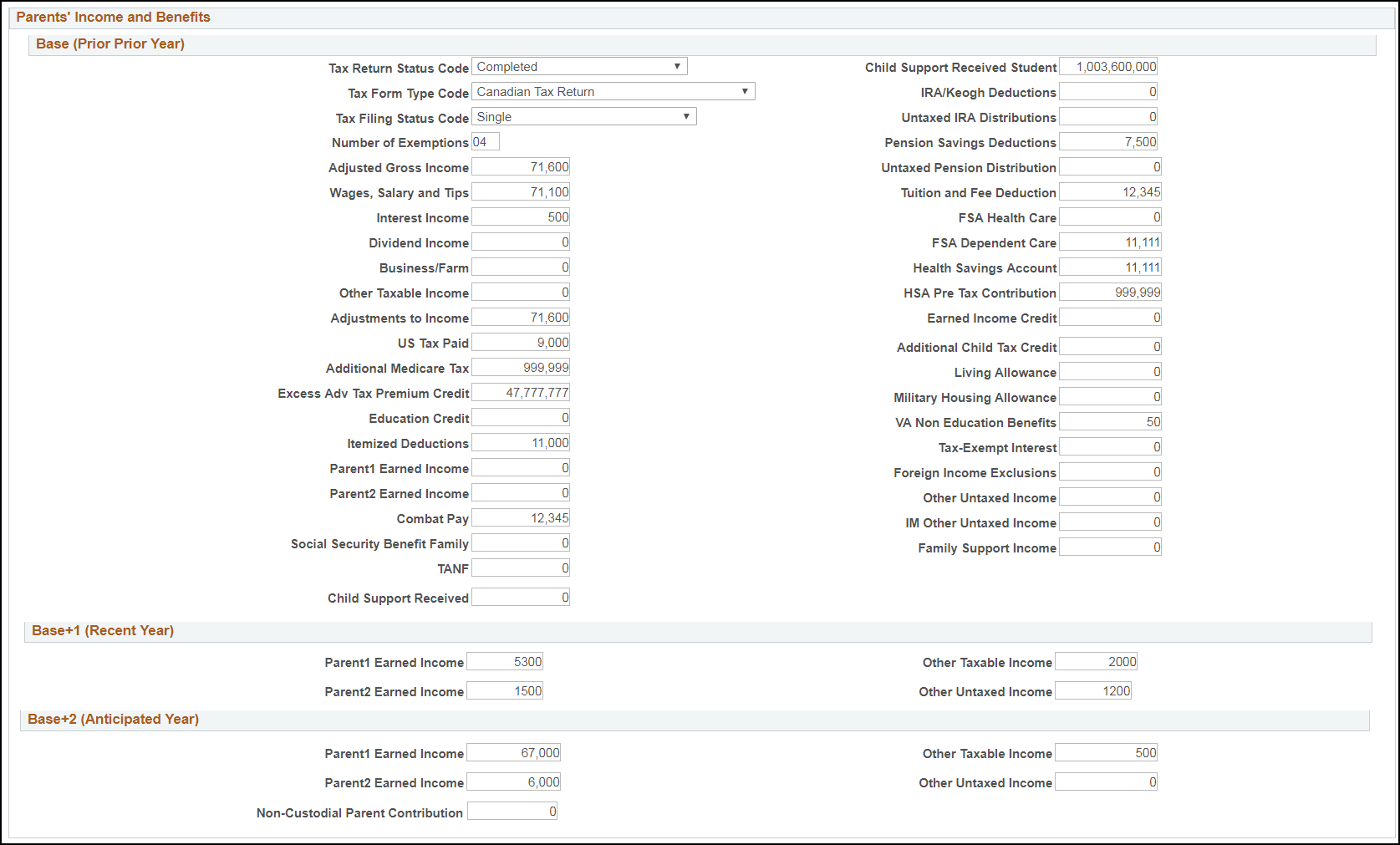

Parent's Income and Benefits – Base (Prior Prior Year)

These fields are items from the United States federal income tax forms or data gathered from other applicable sources such as an institutional application or a third party source.

|

Field or Control |

Definition |

|---|---|

| Child Support Received |

Enter the child support received by the parents for their dependent children. |

| Child Support Received Student |

Enter the amount of child support the custodial household received from the non-custodial household for the applicant. |

Parent's Income and Benefits – Base+1 (Recent Year)

These fields are items from the United States federal income tax forms or data gathered from other applicable sources such as an institutional application or a third party source.

Parent's Income and Benefits – Base+2 (Anticipated Year)

These fields are items from the United States federal income tax forms or data gathered from other applicable sources such as an institutional application or a third party source.

|

Field or Control |

Definition |

|---|---|

| Non-Custodial Parent Contribution |

The amount the non-custodial parent has offered to pay for the student's educational expenses. |

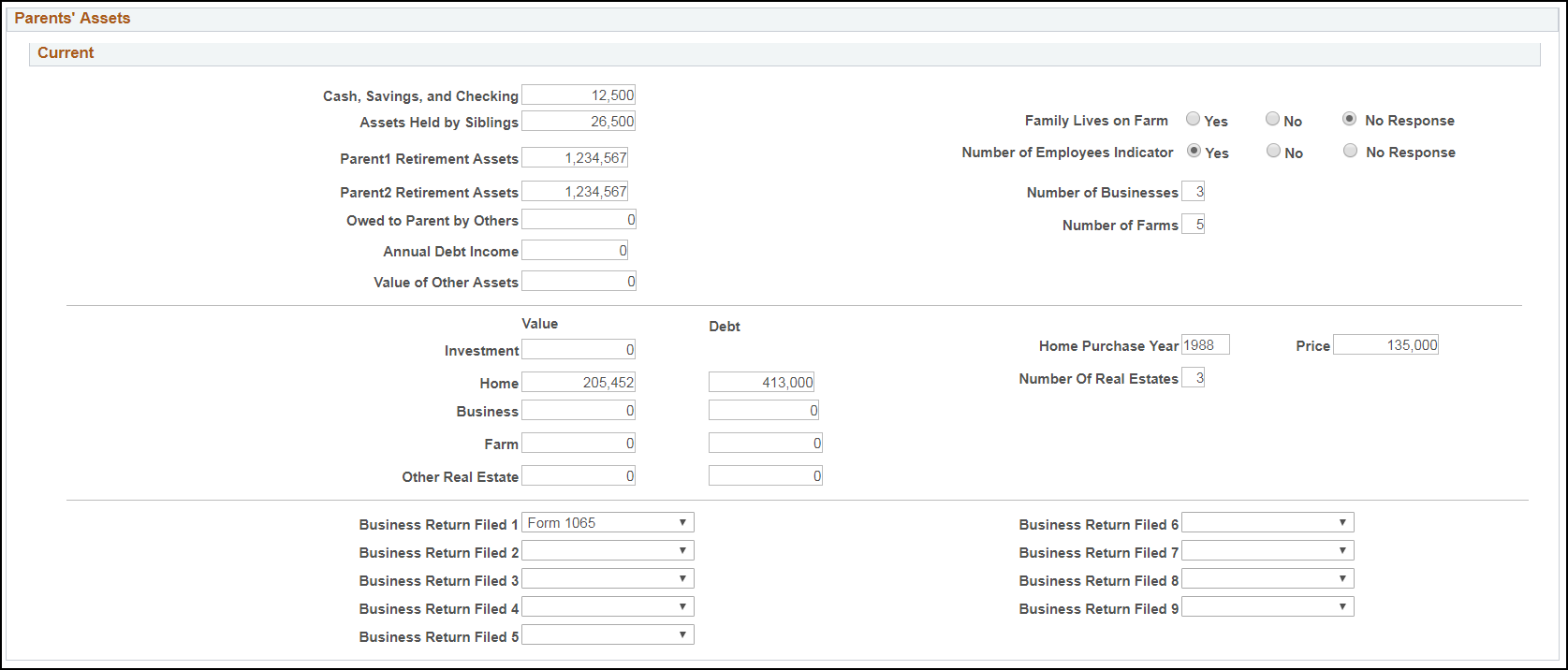

Parent's Assets – Current

|

Field or Control |

Definition |

|---|---|

| Owed to Parent by Others |

Enter the amount owed to parents by others |

| Annual Debt Income |

The annual income realized by the parents from debts owed to them. |

| Value of Other Assets |

Enter the value of any assets not already reported. |

| Price |

Enter purchase price of the parents' home. |

| Real Estate Purchase Year |

Enter purchase year of any other real estate. |

| Price |

Enter purchase price of any other real estate. |

Parents' Expenses – Base (Prior Prior Year)

Enter the parents' expenses from the Base Year for these fields.

|

Field or Control |

Definition |

|---|---|

| Other Expenses |

Enter the cost of any parental expenses not reported anywhere else on the PROFILE. |

Parents' Expenses – Base+1 (Recent Year)

Enter the parents' expenses from the Recent Year for these fields.

Academic Year

|

Field or Control |

Definition |

|---|---|

| Other Tuition Paid |

The amount of private elementary/secondary tuition expected to be paid by the parents during the academic year. |

| Number of Tuition Paid |

The number of children for which private elementary/secondary tuition is expected to be paid by the parents during the academic year. |

Parents' Information

|

Field or Control |

Definition |

|---|---|

| Parent Type 1 and Parent Type 2 |

Select the type of parent providing information on the PROFILE. Values include: Father, Legal Guardian, Mother, Other, Step Father, Step Mother. |

| Computed Age 1 and Computed Age 2 |

Indicates the calculated age for the parent. |

| Biological Adoptive Parent |

Identifies a dependent student's custodial parent when the biological/adoptive parents are separated, divorced, or were never married. Values include: Parent 1 and Parent 2. |

Currency Information

|

Field or Control |

Definition |

|---|---|

| Currency Code |

Enter the currency in which the original data was reported by the student. |

| Currency Rate |

Enter the currency conversion rate used to process the student's data. |

| Country Coefficient |

Enter the country coefficient used to process the student's data. |

| Converted Currency Code |

Enter the original currency converted into US dollars reported by citizens living abroad and Canadians. |

| Converted Currency Rate |

Enter the rate the student used in converting their currency into US dollars. Reported by citizens living abroad and Canadians. |

Explanation / Certification

PROFILE applicants can indicate on their applications a variety of Special Circumstances that may affect the calculation of financial need. These include:

Change in Employment

Scholarships

Medical/Dental Expenses

Siblings Private School

Catastrophic Event

Elder Care

Non-Recurring Income

Financial Support

PROFILE applicants can also indicate if they have no Special Circumstances or Special Circumstances not listed in the PROFILE application.

|

Field or Control |

Definition |

|---|---|

| Explanations Text |

Displays the actual explanations and special circumstances text provided by the filer. |

Access the Non Custodial Parent Data page ().

Please refer to the “Reviewing Custodial Parent Information” section of this topic for similar field descriptions. Notable exceptions are in this section.

|

Field or Control |

Definition |

|---|---|

| INAS NCP (institutional need analysis system non-custodial parent button) |

Click this button to calculate the Institutional Methodology non-custodial parent contribution. Note: Calculate the non-custodial parent contribution before invoking the regular INAS calculation. Calculating a non-custodial parent contribution creates an INAS Extension record, selects the Use Non-Custodial Parent Contribution check box and populates the PC From Non-Custodial Parent (parent contribution from non-custodial parent) field in INAS Extension 5. After this, when the regular INAS calculation is invoked, the non-custodial parent contribution is added to the custodial parent contribution and overall expected family contribution. See the Common Elements Used in This Section and the Reviewing All Computed Data for Student and Parents sections for detailed information. |

Access the Miscellaneous Data page ().

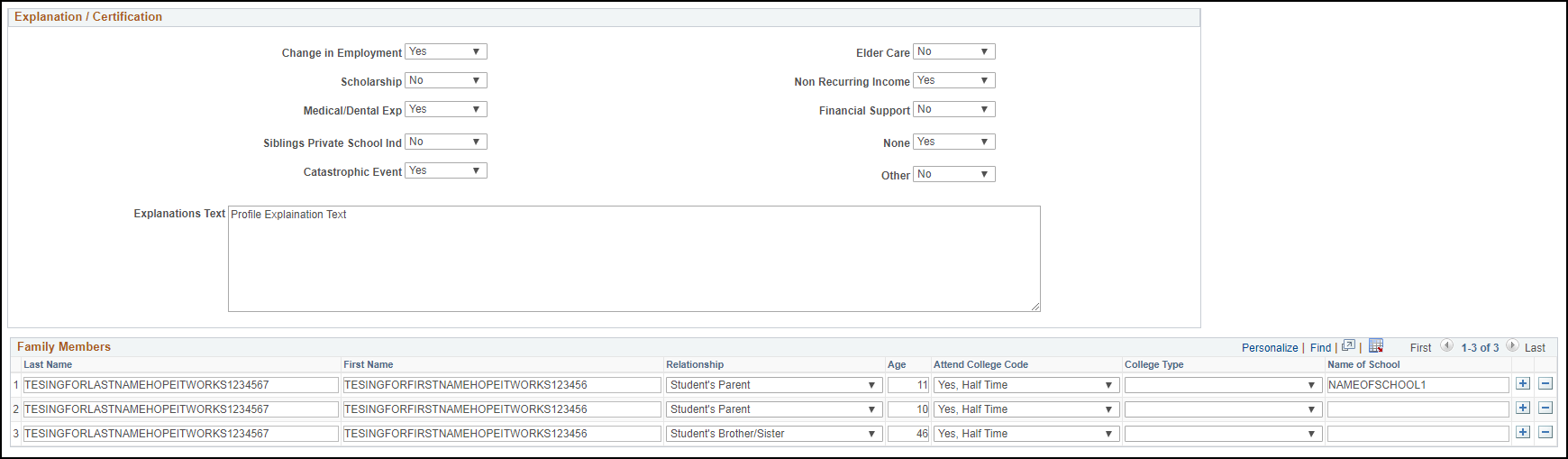

Image: Maintain Institutional Application, Miscellaneous Data tab

This example illustrates the fields and controls on the Maintain Institutional Application, Miscellaneous Data tab. You can find definitions for the fields and controls later on this page.

FNAR Messages

The system displays the Financial Need Analysis Report (FNAR) message number, message text, and message Values 1 through 5, if any. These College Board PROFILE messages inform you about processing exceptions to data received and assumptions that should be taken into consideration when reviewing the institutional application. This information is displayed for the custodial and non-custodial parents, as it is provided by PROFILE.

Assumption Messages

The system displays the CSS INAS IM Assumptions alphanumeric code, message text, and value, if any. These are the INAS Assumptions triggered during the need analysis methodology and include the full text of the e-FNAR assumption generated by the PROFILE system and any corresponding values.

Institutional Questions

|

Field or Control |

Definition |

|---|---|

| Number |

Number of an application question that the student/family believes warrants further explanation. This number may also refer to a series of additional questions that have been modified for the institution by College Board PROFILE. |

| Answer |

Answer to the question shown in the Number field. |

Access the Computation Summary page ().

Image: Maintain Institutional Application, Computation Summary tab (page 1 of 4)

This example illustrates the fields and controls on the Maintain Institutional Application, Computation Summary tab (page 1 of 4). You can find definitions for the fields and controls later on this page.

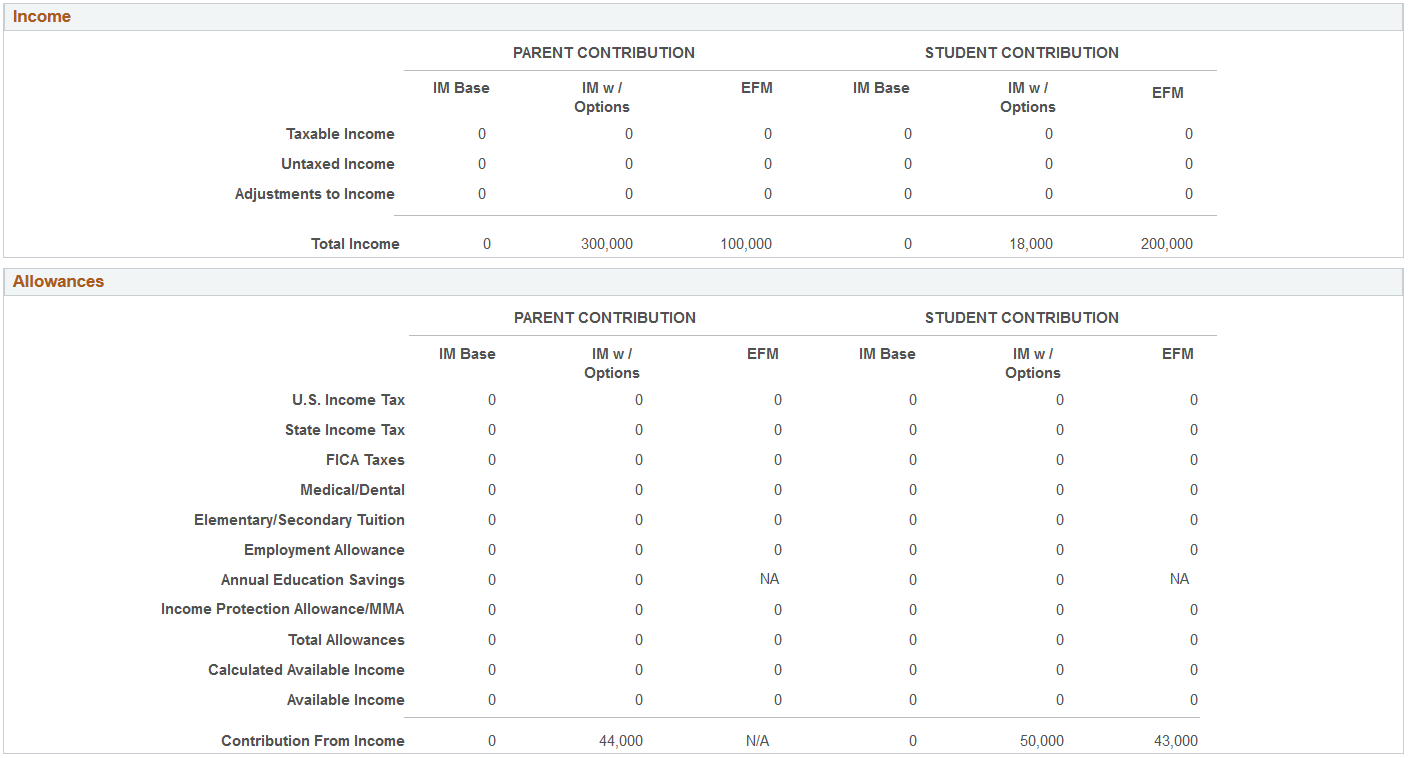

Image: Maintain Institutional Application, Computation Summary tab (page 2 of 4)

This example illustrates the fields and controls on the Maintain Institutional Application, Computation Summary tab (page 2 of 4). You can find definitions for the fields and controls later on this page.

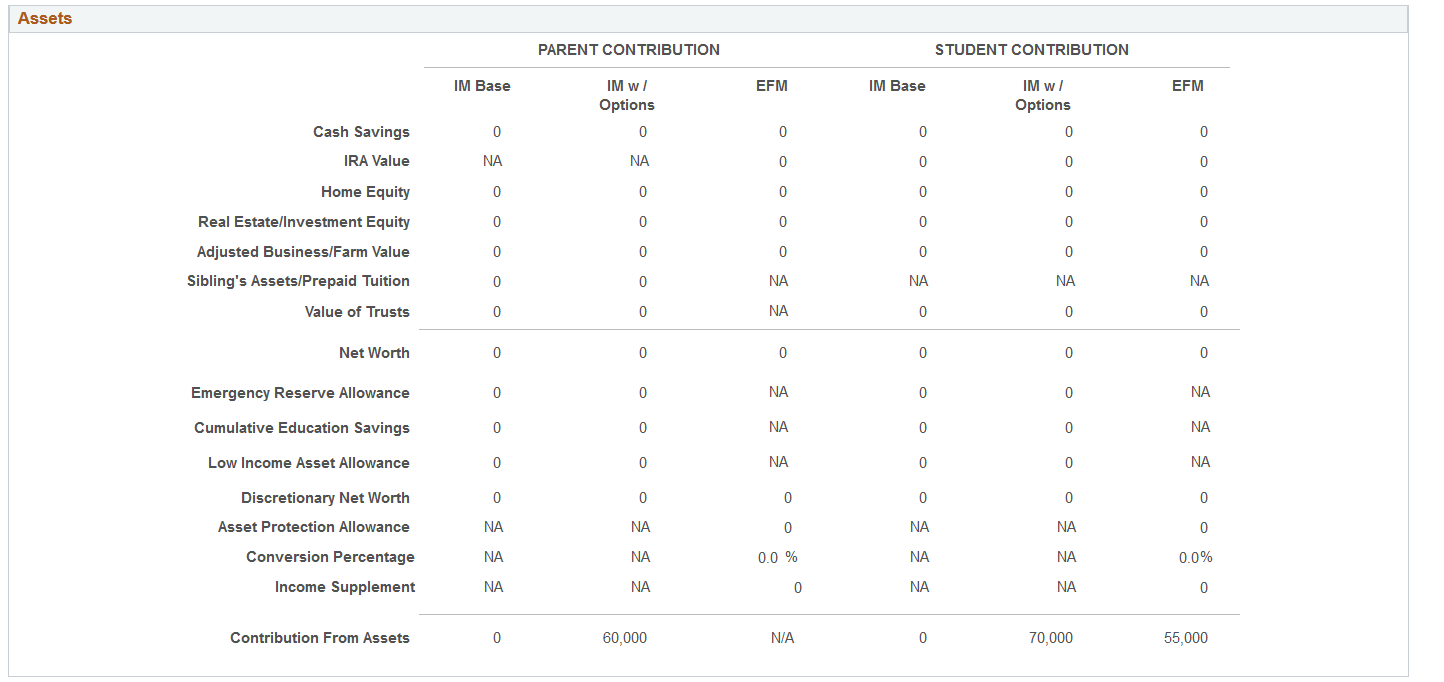

Image: Maintain Institutional Application, Computation Summary tab (page 3 of 4)

This example illustrates the fields and controls on the Maintain Institutional Application, Computation Summary tab (page 3 of 4). You can find definitions for the fields and controls later on this page.

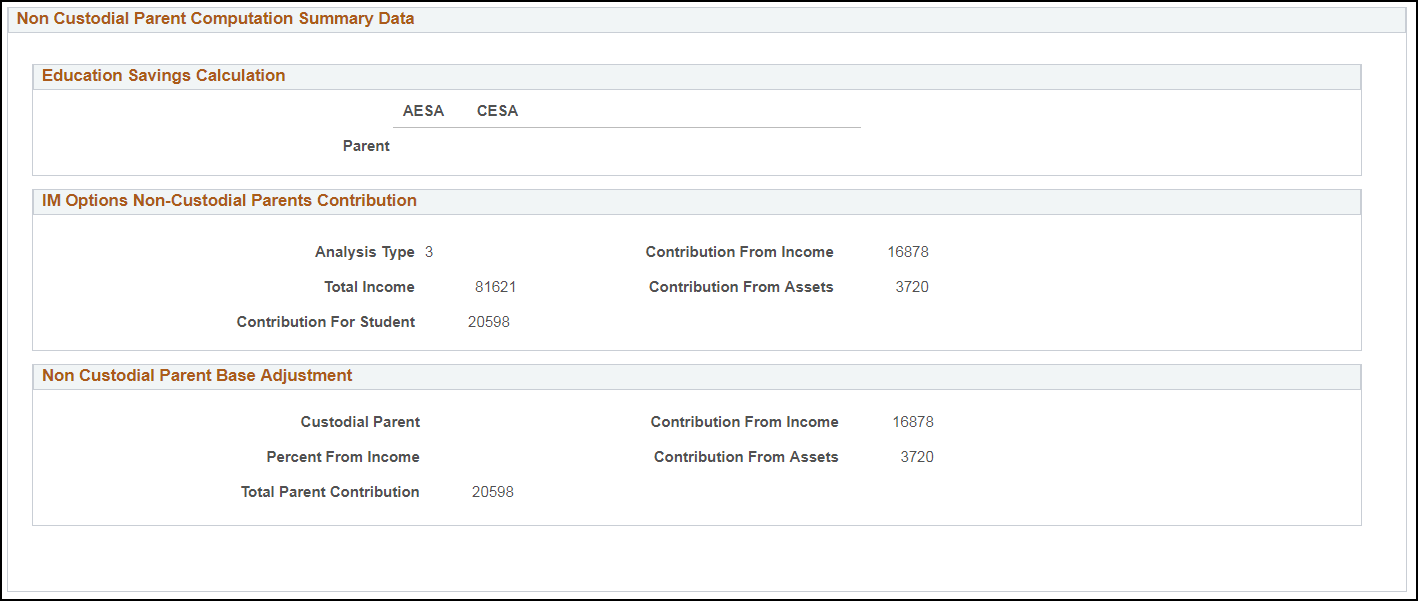

Image: Maintain Institutional Application, Computation Summary tab (page 4 of 4)

This example illustrates the fields and controls on the Maintain Institutional Application, Computation Summary tab (page 4 of 4). You can find definitions for the fields and controls later on this page.

This page is designed to display computed need analysis results based on both the parent's and student's information. Therefore, the page displays a Parent Contribution Section and a Student Contribution Section. The following sections describe what each column represents.

Note: Computation tables display no intermediate values until the INAS calculation is called using batch or online calculation.

Note: To more closely align interim calculation results with the Estimated Federal Methodology (EFM) computation worksheets from the College Board, the Computation Summary page displays an N/A value for several fields. For parents of dependent students and independent students with dependents, EFM calculations display N/A for From Income, From Assets, Total Contribution - Income and Total Contribution - Assets fields.

Contribution Summary

The PARENT CONTRIBUTION section displays three columns: IM Base, IM w/Options, and EFM.

The IM Base column displays standard base INAS calculations. Although the IM Base calculation is not delivered as part of the PROFILE record, Oracle supports calculating the College Board's IM Base calculation if INAS is invoked after the initial load of the PROFILE record.

The IM w/Options column is the result of using the institutional options that you set up when you defined your institutional methodology. IM w/Options is delivered as part of the PROFILE record.

The EFM column displays the estimated federal methodology amount. Financial aid administrators are reminded that the EFM is always estimated and never official.

The STUDENT CONTRIBUTION section displays three columns: IM Base, IM w/ Options, and EFM.

The IM Base column displays standard base INAS calculations. Although the IM Base calculation is not delivered as part of the PROFILE record, Oracle supports calculating the College Board's IM Base calculation if INAS is invoked after the initial load of the PROFILE record.

The IM w/Options column is the result of using the institutional options that you set up when you defined your institutional methodology. IM w/Options is delivered as part of the PROFILE record.

The EFM column displays the estimated federal methodology amount. Financial aid administrators are reminded that the EFM is always estimated and never official.

|

Field or Control |

Definition |

|---|---|

| Total Income |

Indicates the custodial parent's total contribution for the student from the base IM computation. |

Custodial Parent Information

The system displays the calculations for Total Income, Total Contribution, Number in College Adjustment, Contribution for Student, contribution From Income, and contribution From Assets for Parent's Contribution and Student's Contribution.

For the PARENT CONTRIBUTION IM Base:

|

Field or Control |

Definition |

|---|---|

| Percent Income |

Indicates the custodial parent's percentage of total parents income from the base IM computation. |

| Contribution From Income |

Indicates the custodial parent's contribution from income for the student from the base IM computation. |

| Contribution From Assets |

Indicates the custodial parent's contribution from assets for the student from the base IM computation. |

For the PARENT CONTRIBUTION IM w/Options

|

Field or Control |

Definition |

|---|---|

| Percent Income |

Indicates the custodial parent's percentage of total parental income from the option IM computation. |

| Contribution From Income |

Indicates the custodial parent's contribution from income for the student from the option IM computation. |

| Contribution From Assets |

Indicates the custodial parent's contribution from assets for the student from the options IM computation. |

Education Savings Calculations

The system displays the Parent's and the Student's Annual Education Savings Allowance (AESA) and Cumulative Education Savings Allowance (CESA) calculations. These are PROFILE specific calculated values used in INAS calculations for Institutional Methodology.

Income

The system displays the calculations for Taxable Income, Untaxed Income, Adjustments to Income, and Total Income for Parent's Contribution and Student's Contribution.

Allowances

The system displays the calculations for U.S. Income Tax, FICA Taxes, Medical/Dental, Elementary/Secondary Tuition, Employment Allowance, Annual Education Savings, Income Protection Allowance/MMA, Total Allowances, Calculated Available Income, and Available Income for Parent's Contribution and Student's Contribution. The Total Contribution - Income amount is the sum of all the fields in the Allowances section.

Assets

The system displays the calculations for Cash Savings, IRA Value, Home Equity, Real Estate/Investment Equity, Adjusted Business/Farm Value, Sibling's Assets/Prepaid Tuition, Value of Trusts, and Net Worth for Parent's Contribution and Student's Contribution.

The system displays the calculations for Emergency Reserve Allowance, Cumulative Education Savings, Low Income Asset Allowance, Discretionary Net Worth, Asset Protection Allowance, Conversion Percentage, and Income Supplement for Parent's Contribution and Student's Contribution. The Total Contribution - Assets amount is the sum of all the fields in the Assets section.

Non Custodial Parent Computation Summary Data

|

Field or Control |

Definition |

|---|---|

| Education Saving Calculation |

Displays the non-custodial parents’ Annual Education Savings Allowance (AESA) and Cumulative Education Savings Allowance (CESA) calculations. These are PROFILE specific calculated values used in INAS calculations for Institutional Methodology. |

| IM Options Non–Custodial Parents Contribution (institutional methodology options non-custodial parents contribution) |

Displays a logical grouping for the non-custodial parent contribution results under the IM options computation. |

| Non Custodial Parent Base Adjustment |

Displays a logical grouping for the data elements for the biological/adoptive parent base computation results. |