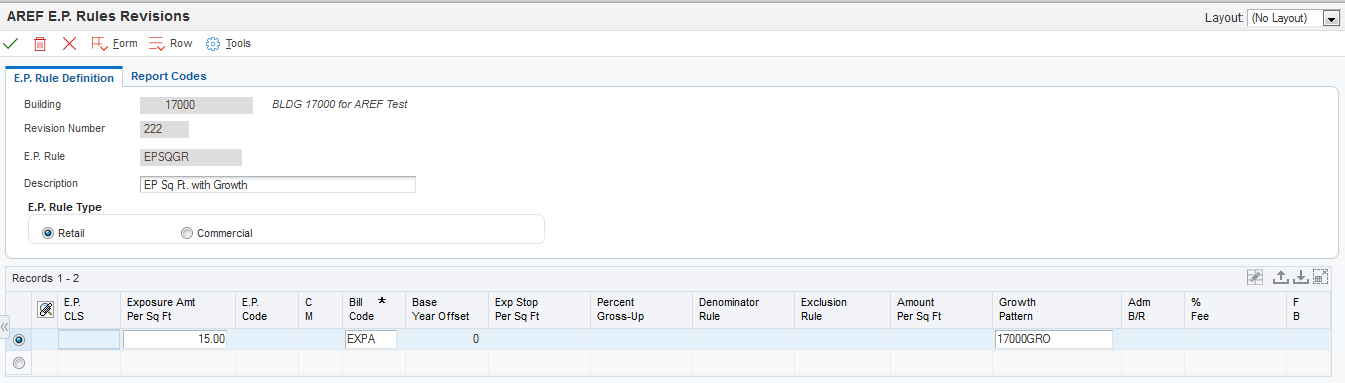

Setting Up Expense Participation Rules

Access the AREF E.P. Rules Revisions form.

- E.P. Rule (expense participation rule)

Enter a user-defined 10-character value that identifies the expense participation rule.

This value is a unique key in the F15L104 and the F15L114 tables.

- Retail and Commercial

Select the expense participation rule type. This option also controls the expense participation recovery type that you can select.

If you select the Retail button, the recovery type is not available.

If you select the Commercial button, the recovery type can be defined as net, gross, or mixed.

- Net, Gross, and Mixed

Select the option that specifies who pays for property expenses and maintenance on commercial properties. Each option corresponds to a hard-coded value in the UDC table 15L/RV (E.P. Recovery Type). Values are:

Net: The tenant (lessee) agrees to pay all expenses.

Gross: The property owner (lessor) agrees to pay all expenses. If you select this option, the expense participation rule is informational only. The system disables all of the fields in the detail area and does not perform a calculation.

Mixed: The tenant agrees to pay a pro-rata share of expenses.

- E.P. CLS (expense participation class)

Enter a user-defined code from the E.P. Class Header table (F1530H) that identifies a expense participation class.

You can only enter a value if the Exposure Amount Per Sq Ft field is blank.

- Exposure Amount Per Sq Ft (exposure amount per square foot)

Enter a value that indicates that annual amount per square foot.

You can enter a value only if the E.P. CLS field is blank.

- E.P. Code (expense participation code)

Enter a code from UDC table 15/EP that identifies a log line used for the control square footage of a property or building. The system uses this control square footage to calculate expense participation.

The system uses this code only when you do not use a share factor denominator. If you use a share factor denominator, the system ignores this field.

- C M (computation method)

Enter a code from UDC table 15L/EM that specifies the method for calculating the denominator value in the expense participation calculation. Values are:

B: Building

N: Building SF/Occupied SF. This computation method compares the gross up percentage to the percentage of occupied space. The system calculates a gross up factor for the occupied space by dividing the area of the unit by the total area of the building.

O: Property SF/Occupied SF. This computation method compares the gross up percentage to the percentage of occupied space. The system calculates a gross up factor for the occupied space by dividing the area of the unit by the total area of the property.

P: Property

U: Building SF/Occupied SF. This computation method compares the gross up percentage to the percentage of occupied space. The system calculates a gross up factor for the occupied space by dividing the area of the unit by the total area of the building.

V: Property SF/Occupied SF. This computation method compares the gross up percentage to the percentage of occupied space. The system calculates a gross up factor for the occupied space by dividing the area of the unit by the total area of the property.

X: Average Occupied SF/Building. This computation method multiplies the gross up percentage by the exposure to determine the adjusted exposure.

Y: Average Occupied SF/Property. This computation method multiplies the gross up percentage by the exposure to determine the adjusted exposure

If the gross up percentage on the rule is greater than the calculated gross up factor, the system divides the gross up percentage by the gross up factor to determine a new gross up percentage. If the gross up percentage on the rule is less than the calculated gross up factor and the method is N or O, the system divides 1 by the gross up factor to determine a new gross up percentage. If the gross up percentage on the rule is less than the calculated gross up factor and the method is U or V, the system does not use a gross up percentage.

- Bill Code

Enter a code that determines the trade account that the system uses as the offset when you post invoices or vouchers.

The system concatenates the value that you enter to the AAI item RC (for Accounts Receivable) or PC (for Accounts Payable) to locate the trade account. For example, if you enter TRAD, the system searches for the AAI item RCTRAD (for receivables) or PCTRAD (for payables).

You can assign up to four alphanumeric characters to represent the G/L offset or you can assign the three-character currency code (if you enter transactions in a multicurrency environment). You must, however, set up the corresponding AAI item for the system to use; otherwise, the system ignores the G/L offset and uses the account that is set up for PC or RC for the company specified.

If you set up a default value in the G/L Offset field of the customer or supplier record, the system uses the value during transaction entry unless you override it.

Note: Do not use code 9999. It is reserved for the post program and indicates that offsets should not be created.- Base Year Offset

Enter a code that specifies an offset value that the system uses to determine the base year.

This value defines a unit's base year offset for the base year amount values. The base year amount is defined by the offset value in the expense participation rules. Values are:

0: Use the current year. If these values do not exist, or if you select 0, then the system uses the base account definition values to calculate that month's base year amount. This amount is used to determine the class exposure of a unit.

1: Use the previous year. The system uses the values from the previous year from the F15L109 table. If the system cannot locate the account balances for the previous year, it retrieves the account balances for the current year.

If you specified Retail as the E.P. Rule Type or Commercial as the E.P. Rule Type and Net as the E.P. Recovery type, this field is disabled.

- Exp Stop Per Sq Ft (expense stop per square foot)

Enter a value that specifies the expense base amount for the class. This is a per square foot amount that is used to reduce the class exposure before the exposure is multiplied by the share factor.

The system uses this amount to calculate the compounded base exclusion, which it then subtracts from the adjusted exposure before calculating a tenant's share.

If you specified Retail as the E.P. Rule Type or Commercial as the E.P. Rule Type and Net as the E.P. Recovery Type, this field is disabled.

- Percent Gross Up

Enter a value that specifies a percentage the system uses to gross up the class exposure. Typically, the gross up factor is used when the building or properties occupancy rate is not at a specified level. Usage of the gross up factor allows for expenses to be grossed up to reflect a higher occupancy level.

If you enter a value in this field in conjunction with a computation method of N,O,U, or V, then the system calculates the percentage of the building or property which is occupied. If the occupancy percentage is less than the gross up percentage, the system divides the gross up percentage by the occupancy percentage to derive the gross up factor. If the computation method is N or O and the occupancy percentage is greater than the gross up percentage, the gross up factor is calculated by dividing 100 percent by the occupancy percentage. The tenant's class exposure is multiplied by the gross up factor before subtracting account or transaction exclusions.

If you enter a value in conjunction with any other computation method, the system multiplies the class exposure by the gross up percentage prior to transaction and account exclusions.

- Denominator Rule

Enter a value that specifies a share denominator rule that you set up in the Share Factor Denominator Revisions program (P150122).

For example, a share factor denominator rule might specify: For any anchor tenants over 16,000 square feet, deduct the over square footage from the denominator calculations in the R15110 program.

If you specified Commercial as the E.P. Rule Type and either Net or Gross as the E.P. Recovery Type, this field is disabled.

You can enter a share denominator rule with any computation method.

- Exclusion Rule

Enter a value that specifies a tenant exclusion rule that you set up in the Tenant Exclusion Revisions program (P150120).

For example, a tenant exclusion rule might specify: Deduct amounts associated with bill code EXPA from all tenants who lease any unit that is defined as an anchor and that has an area of more than 5,000 square feet.

The system does not include amounts specified by the tenant exclusion rule when it calculates the tenant's share factor.

If you specified Commercial as the E.P. Rule Type and either Net or Gross as the E.P. Recovery Type, this field is disabled.

You can enter a tenant exclusion rule with any computation method.

- Amount Per Sq Ft (amount per square foot)

Enter a number that specifies the currency amount per square foot that is deducted from the total E.P. billable amount.

The system applies the growth pattern to the amount, divides the result by 12, and then deducts that result from each period amount that the system calculates as the expense participation billing amount.

If you specified Commercial as the E.P. Rule Type, this field is disabled.

- Growth Pattern

Enter a value that specifies a defined growth pattern. The system uses growth patterns to anticipate increasing amounts for lease revenue and expenses based on several market factors, including square feet, flat amount, percentage amount, and specified number of years.

You must leave this field blank if the Amount/Sq Ft field is blank and E.P. CLS is not blank, or the E.P. CLS and Exposure Amount Per Sq Ft fields are blank.

- Adm B/R (admin fee-billing receipt code)

Enter a billing or receipt code that specifies the accounts that the system uses to calculate administration fees based on a tenant's net share. If you leave this field blank, the system automatically posts the fee to the same accounts as the tenant's billable amount.

- % Fee (percentage fee)

Enter a value to allocate for the administration fee.

Enter the percentage in a decimal format. For example, enter.01 to specify a 1 percent fee.

- F B (fee basis)

Enter a code from UDC table 15L/FB that specifies how the system calculates the administration fee. Values are:

Blank: The system calculates the fee based on the tenant's net share (billable) amount.

1: The system calculates the fee based on the total class exposure after exclusions.

2: The system calculates the fee based on the class exposure prior to exclusions.