Setting Up Sales Overage Rules

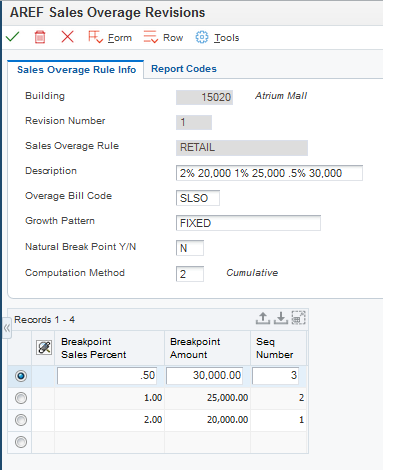

Access the AREF Sales Overage Revisions form.

- Sales Overage Rule

Enter a user-defined, 10-character (maximum) value that specifies the sales overage rule.

This code is a unique key in the F15L103 and the F15L113 tables.

- Growth Pattern

Enter a code that specifies the growth pattern to apply to sales amounts that the system forecasts.

- Natural Break Point Y/N

Enter a code that specifies whether the sales overage rule uses a breakpoint sales percent and breakpoint amount or a fixed breakpoint percentage (natural breakpoint) of sales to determine the amount of rent due.

You set up rent billing by determining sales breakpoints and percentages associated with those breakpoints. If you specify a natural breakpoint, the system multiplies sales by the breakpoint percentage to calculate the rent to be billed. If you do not specify a natural breakpoint, then the rent is calculated based on a breakpoint amount and a breakpoint percentage.

An example of how the breakpoint works is as follows:

Sales for Month = 27,000

Breakpoint Amount = 25,000 with a breakpoint percentage of 6 percent

Breakpoint Amount = 30,000 with a breakpoint percentage of 5 percent

In this case, 27,000 is greater than 25,000 but less than 30,000. Because sales have not reached 30,000, the system uses 25,000 as the natural breakpoint.

Values are:

Y: Use a natural breakpoint.

The system calculates the natural breakpoint by dividing the annual rent revenue by the breakpoint sales percentage.

N: Do not use a natural breakpoint.

You must specify the computation method and breakpoint amounts that the system uses to calculate sales overage.

- Computation Method

Enter the value that specifies the method to use to calculate sales overage (percent rent).

The system does not display this field when you enter Y in the Natural Break Point (Y/N) field. Values are:

1: Each Period

The system separately calculates the sales overage amount for each period. The system annualizes (multiplies by 12) the sales amount for the period, processes the sales overage amount (adds the growth pattern, subtracts the breakpoint amount, and multiplies the result by the sales breakpoint percentage), and divides the result by 12.

2: Cumulative

The system calculates the sales overage amount using cumulative period balances. To determine the sales overage amount, the system adds the growth pattern to the cumulative period balance, subtracts the breakpoint amount, multiplies the result by the sales breakpoint percentage, and subtracts the sales overage amounts that the system calculated for the previous periods.

3: Cumulative Pro Rata

The system calculates the sales overage amount using annualized cumulative period balances. To determine the sales overage amount, the system divides the annualized amount by the period number to provide a prorated amount. Then, the system adds the growth pattern, subtracts the breakpoint amount, multiplies the result by the sales breakpoint percentage, divides the result by 12, and subtracts the sales overage amounts that the system calculated for the previous periods.

4: Modified Cumulative

This method is similar to Method 2 (Cumulative) except that, when the system reaches a higher breakpoint, it applies the rate that is associated with the higher breakpoint to all sales that exceed the first breakpoint.

Note: If you have recapture amounts, the system divides the annual amount by 12 and subtracts the result at the end of the calculation, as described in all of the calculation methods listed previously.- Break Point Sales Percent

Enter the percentage to apply to the sales amount when it exceeds the breakpoint amount that you specified.

For example, if the breakpoint sales percentage is 5.0, and the breakpoint amount is 10,000, the system multiplies the sales amount by 5 only when the sales equal or exceed 10,000.

Enter the percentage as a whole number. For example, enter 3.0 to specify three percent.

Note: If you specify to use a natural breakpoint, the system calculates it by dividing the annual rent revenue by the breakpoint sales percentage that you specify.- Breakpoint Amount

Enter the amount that tenant sales must exceed before the system applies the sales breakpoint percentage.

Depending on the computation method, the system compares the period, cumulative period, cumulative period annualized, or annual sales amounts to the breakpoint. If you set up multiple breakpoint amounts, the system applies the sales breakpoint percentage to the difference between the breakpoint amounts.

The system does not display this field when you enter Y in the Natural Break Point (Y/N) field.

- Report Code 01 through Report Code 05

Enter codes from UDC table 15/U1 to use for reporting purposes.