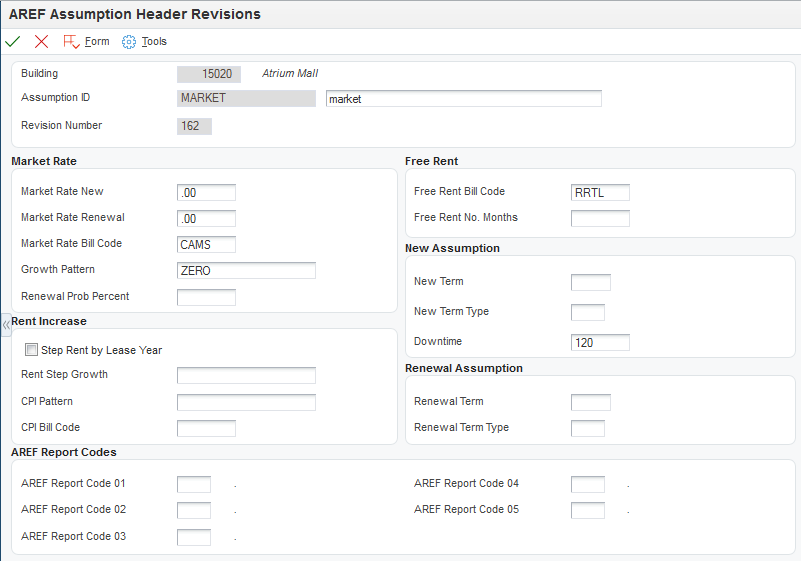

Setting Up Unit Assumption Header Information

Access the AREF Assumption Header Revisions form.

- Assumption ID (assumption identification)

Enter an alphanumeric code that specifies the name of the base assumption rule. The maximum code length is 10 characters.

In the field to the right of the Assumption ID field, you can enter a description of the assumption. The maximum code length is 50 characters.

- Market Rate New and Market Rate Renewal

Enter the amount per square foot to use in conjunction with the area of the unit to forecast revenue amounts.

The system multiplies the amount by the area of the unit to forecast the rent amounts for leased units when the lease expires or for vacant units. The assumption action that you assign, either on the unit or in the AREF Building Constants program (P15L100), determines whether the system uses the new, renewal, or blend rate.

- Market Rate Bill Code

Enter a bill code that the system uses to retrieve the account from the corresponding AAI to which the system updates forecasted revenue amounts after applying the market rate or rent-step growth pattern.

- Growth Pattern

Enter a code that specifies the growth pattern to use to forecast revenue amounts.

- Renewal Prob Percent (renewal probability percent)

Enter a value that represents the likelihood that a tenant renews the lease. Enter the percentage as a whole number.

The system uses this value to calculate forecasted revenue amounts when the assumption action for the unit is B (market blend) in the AREF Building Constants program (P15L100). When the assumption action is market blend, the system uses the percentage in this formula: [(100 unit assumptions − probability percent ÷100) × market rate new] + [(probability percent ÷ 100] ×market rate renewal)

- Step Rent by Lease Year

If you select this check box, the system steps rent following the anniversary of the AREF lease year. The anniversary does not include downtime.

If you do not select this check box, the system steps rent following the fiscal year.

- Rent Step Growth

Enter a code that specifies the growth pattern to apply to forecasted revenue amounts. Enter a code only when the CPI Pattern field is blank.

- CPI Pattern (consumer price index pattern)

Enter a code that specifies the percentage growth pattern, based on the CPI, to apply to forecasted revenue amounts. Enter a code only when the Rent Step Growth field is blank.

- CPI Bill Code (consumer price index bill code)

Enter the bill code that the system uses to retrieve the account from the corresponding AAI to which the system updates forecasted revenue amounts after applying the CPI growth.

- Free Rent Bill Code

Enter the bill code that the system uses to retrieve the account from the corresponding AAI to which the system updates the amount of free rent.

- Free Rent No. Months (free rent number of months)

Enter the number of months that the landlord (lessor) does not collect rent for the unit.

- New Term

Enter a number that specifies the length of the new assumption. The system uses this value with the value in the New Term Type field. For example, if you enter 36 and the new term type value is MO, the term is valid for 36 months.

- New Term Type

Enter a user-defined code from UDC table 15L/LT that specifies whether the number in the New Term field represents months or years.

The system uses this field only when the value in the Assumption Action field in the AREF Building Constants program (P15L100) is N (new) or B (market blend). Values are:

MO: Months

AN: Years

- Downtime

Enter the duration, in months, of the anticipated vacancy of a unit. The system defers forecasting revenue for the amount of time specified.

Note: The system uses the 15th of the month to determine the duration of the downtime. For example, if you enter 2 in this field, specify a budget start period of 01, and indicate that the effective date of the assumption is on or before the 15th of January, the system does not forecast rent revenue until March. However, if the effective date of the assumption were the 20th of January, the system would not forecast rent revenue until April.- Renewal Term

Enter a number that specifies the length of the renewal assumption. The system uses this value with the value in the Renewal Term Type field. For example, if the term of renewal assumption is 36 and the renewal term type is MO, the term is valid for 36 months. If the renewal term type is AN, the term is valid for 36 years.

If you leave this field blank, the system performs calculations for each year of the Budget Calculation (R15L1091).

- Renewal Term Type

Enter a user-defined code from UDC table 15L/LT that specifies whether the number in the Renewal Term field represents months or years.

The system uses this field only when the value in the Assumption Action field in the AREF Building Constants program (P15L100) is R (renewal). Values are:

MO: Months

AN: Years

- AREF Report Code 01 through AREF Report Code 05

Enter user-defined codes from UDC table 15L/01 for reporting purposes.