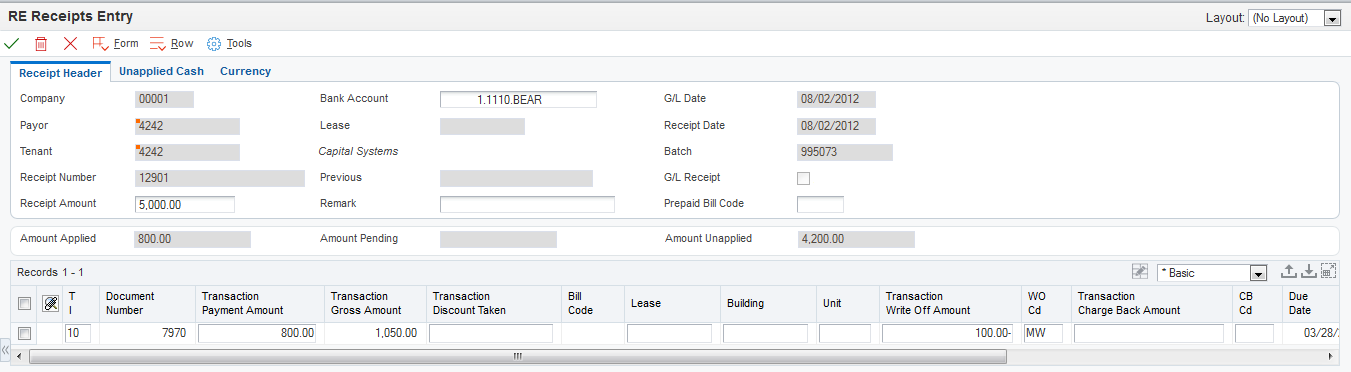

Applying Receipts to Invoices

Access the RE Receipts Entry form.

- T I (type input code)

Enter a type input code to specify the application method to use. The system does not process transactions with a blank or invalid type input. Values are:

10: The system automatically completes the Payment Amount field with the amount of the invoice when you exit this field. If the invoice has an earned discount, the system also completes the Discount Taken field with the amount in the Discount Available field.

11: The system completes the Payment Amount field with the amount of the invoice and the Chargeback Amount field with the amount in the Discount Available field when you exit this field.

15: The system automatically completes the Write-Off Amount field with the difference between the payment amount that you enter and the open amount of the invoice when you exit this field.

16: The system automatically completes the Chargeback Amount field with the difference between the payment amount that you enter and the open amount of the invoice when you exit this field.

17: The system automatically completes the Deduction Amount field with the difference between the payment amount that you enter and the open amount of the invoice when you exit this field.

- Transaction Payment Amount

Override the value in this field if necessary. This is the amount of the receipt that is expressed in the transaction (foreign) currency.

Note:If the payment amount is greater than the open amount of the invoice, the system does not calculate chargeback, write-off, or deduction amounts until you override the payment amount to be less than the open invoice amount.

If you specify a payment amount that is greater than the open amount of the invoice, the system displays the overpayment as a negative open amount on the invoice.

Depending on the processing option settings, the system might automatically write off the difference between the open amount of the invoice and the payment amount that you enter.

- Transaction Disc Avail (transaction discount available)

Enter the amount of discount allowable on the pay item. You can manually assign an amount or let the system calculate it based on either the payment terms in the lease or the terms that you specify when you enter the invoice.

- Transaction Discount Taken

Enter the amount by which an invoice is reduced if paid by a specific date. The discount taken does not have to be the same as the discount available.

If the discount is earned and the invoice is paid in full, the system completes this field with the amount of the discount available.

If the discount is not earned (that is, the general ledger date of the payment is after the discount due date), or the invoice is not paid in full, the system does not complete this field.

You can override the value in this field to specify a different discount amount, including zero.

- Transaction Write Off Amount

Enter the amount that the system subtracts from the open amount of the invoice and does not require the customer to pay.

- WO Cd (write-off code)

If you entered 15 in the TI field, enter the code that identifies the reason for the write-off. Typical reason codes are:

BD: Bad debt

DC: Damaged goods

MW: Minor amount write-off

TF: Tax or freight dispute

- Transaction Charge Back Amount

Enter the unpaid invoice amount for which you want to create a new invoice record to charge the customer.

- CB Cd (chargeback code)

Enter the code that identifies the reason that a chargeback was generated for an invoice during receipt entry if you entered 11 or 16 as the type input code. Typical chargeback reason codes are:

DA: Disputed amounts.

DD: Unearned (disallowed) discount amount.

Note:The system does not accept blank as a value, even if it is defined in the UDC table.

- Transaction Deduction Amount

Enter the amount of the deduction in the currency of the transaction from which the deduction was generated. For example, if the deduction was generated from Customer Ledger Inquiry, the transaction currency is the currency in which the invoice was entered. If the deduction was generated from a receipt, the transaction currency is the currency in which the receipt or draft was entered.

The currency that is associated with this amount appears in the Transaction Currency Code field (TCRC).

- DD Cd (deduction code)

Enter the code that identifies the reason that a customer did not fully pay an invoice if you entered 17 as the type input code. Typical deduction reason codes include:

DG: Damaged goods

SS: Short shipment

UD: Undefined deduction

Note:The system does not accept blank as a value, even if it is set up in the UDCs. Depending on the setting of processing options, the system might automatically supply the value for the reason code.

- Chargeback G/L Offset

Enter the code that indicates the AR trade account that the system uses when you post the chargeback if you entered 11 or 16 as the type input code to direct the offset for the chargeback to a different AR trade account. To locate the account, the system concatenates this code to the AAI item RC. The system uses this hierarchy to locate the AR trade account to use for the chargeback record:

If you use multicurrency, the system searches for RCxxx, where xxx is the currency code of the receipt.

If the system does not locate the AAI, it uses RCxxxx, where xxxx is the value in the Chargeback G/L Offset field.

If the system does not locate the AAI, it uses RCxx, where xx is the chargeback reason code.

If the system does not locate the AAI, it uses RC for the company that is specified on the receipt.

If the system does not locate the AAI, it uses RC for company 00000.

- Amount Pending

Displays the amount pending. If you have fully applied the receipt to invoices, the amount pending should equal the receipt amount that appears in the header portion of the entry form.

- Amount Unapplied

Displays the unapplied record that the system created for the amount.