Balance Sheet Lessee Accounting AAIs (Release 9.2 Update)

You use balance sheet lessee accounting to define the account numbers used for lessee accounting journal entries. Balance sheet lessee accounting AAIs follow the structure L*xxxx, where xxxx is a searchable heirarchy that can include:

Major equipment class

Major accounting class

Lease classification (F for finance, or O for operating)

Generic

The major equipment class and major accounting class fields are defined in the Asset Master for the leased asset. The lease classification is defined in the Lease Master for the leased asset. The system searches the AAIs for the asset in the order listed above, stopping when it finds a match.

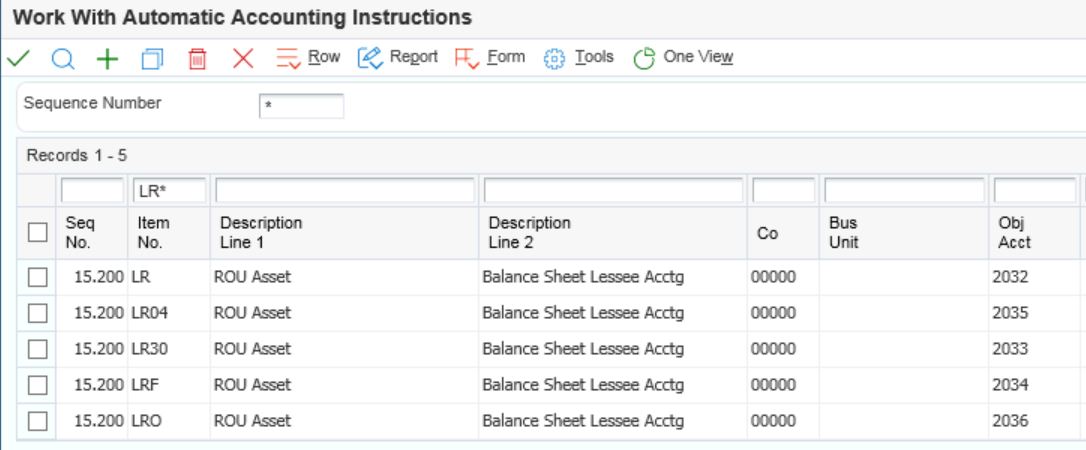

For example, you might set up your LR AAIs as follows:

If you have an asset with no major equipment class, a major accounting class of 30, and a lease classification of finance, the system would perform a hierarchical search, starting with major equipment class, and stopping when it finds a match. In this example, the system would use AAI LR30, where 30 is the major accounting class. The lease classification is not considered, as a higher-level match was found.

Using the same AAIs, if an asset did not have either a major equipment class or major accounting class defined, and had a lease classification of operating, the system would have continued searching until it reached AAI LRO.

This table lists the AAIs that support balance sheet lessee accounting:

AAI |

Name and Account Type |

Description |

|---|---|---|

LC |

Accumulated Amortization Non-current asset |

The contra asset account that allows a company's balance sheet to easily report both the amount of an asset's cost that has been amortized as of the date of the balance sheet, and the asset's cost. This AAI is used for balance sheet accounting. |

LL |

Lease Liability Long term liability |

The account for lease liability reported on the balance sheet. This AAI is used for balance sheet lessee accounting. |

LR |

ROU Asset Non-current asset |

The account for right of use asset reported on the balance sheet. This AAI is used for balance sheet lessee accounting. |

LV |

ROUA Remeasurement Profit/Loss |

(Release 9.2 Update) The account for remeasurement profit/loss adjustments.This AAI is used for balance sheet lessee accounting. |

LG |

Lease Liability Gain/Loss |

(Release 9.2 Update) The account for liability gain/loss adjustments. This AAI is used for balance sheet lessee accounting. |

LU |

ROUA Revaluation Offset |

(Release 9.2 Update) The account for liability gain/loss adjustments.This AAI is used for balance sheet lessee accounting. |

L0 |

Prepaid Rent - Lessee Current asset |

The account for prepaid rent. This account is debited when paying rent and credited when processing the lease liability. This AAI is used for balance sheet lessee accounting. |

L1 |

Lease Expense General expense |

The account for lease expense reported on the income statement. This AAI is used for balance sheet lessee accounting. |

L2 |

Interest Expense Other expense |

The account for interest expense reported on the income statement. This AAI is used for balance sheet lessee accounting. |

L3 |

Amortization Expense Amortization Expense |

The account for amortization expense reported on the income statement. This AAI is used for balance sheet lessee accounting. |

L4 |

LL Rounding Adjustment |

The account for remaining balance adjustments on lease liability schedules from the R15180. This AAI is used for balance sheet lessee accounting. |

L5 |

ROUA Rounding Adjustment |

The account for remaining balance adjustments on ROU asset schedules from the R15180. This AAI is used for balance sheet lessee accounting. |

L6 |

Sublease Expense Offset Amortization expense |

The account for sublease expense reported on the income statement. This AAI is used for balance sheet lessee accounting. |

L7 |

LL Termination Adjustment Offset |

This is the GL offset account used when posting to the Lease Liability account (derived from the LL AAI) when terminating a leased asset early. This AAI is used for balance sheet lessee accounting. |

L8 |

ROUA Termination Adjustment Offset |

This is the GL offset account used when posting to the Accumulated Amortization account (derived from the LC AAI) when terminating a leased asset early. This AAI is used for balance sheet lessee accounting. |

L9 |

As-Of Balance Adjustment |

The account for as-of balance adjustments on ROU asset schedules from the R15170. This AAI is used for balance sheet lessee accounting. |

(Release 9.2 Update) You can automatically populate your AAI table (F0012) with these balance sheet lessee accounting AAIs by running the Insert Lessee Accounting AAIs program (R150012). This program creates a record in the F0012 for each of the balance sheet lessee Accounting AAIs if a record for that AAI does not already exist. The program prints a report listing which AAIs were added to the table.

The program only adds base AAIs, such as LR, LL, and so on. It does not add more specific AAIs, such as LRxxxx and LLxxxx. You must manually create these entries if you want to use them. The system populates the AAI records with pre-defined object account numbers, which are based on the JD Edwards EnterpriseOne delivered data. Therefore, after running this program, you should review the newly created records using the Automatic Accounting Instructions program, and make any necessary updates.

See Setting Up Automatic Accounting Instructions in the JD Edwards EnterpriseOne Applications Financial Management Fundamentals Implementation Guide for additional information.