Revising Expense Participation Calculations

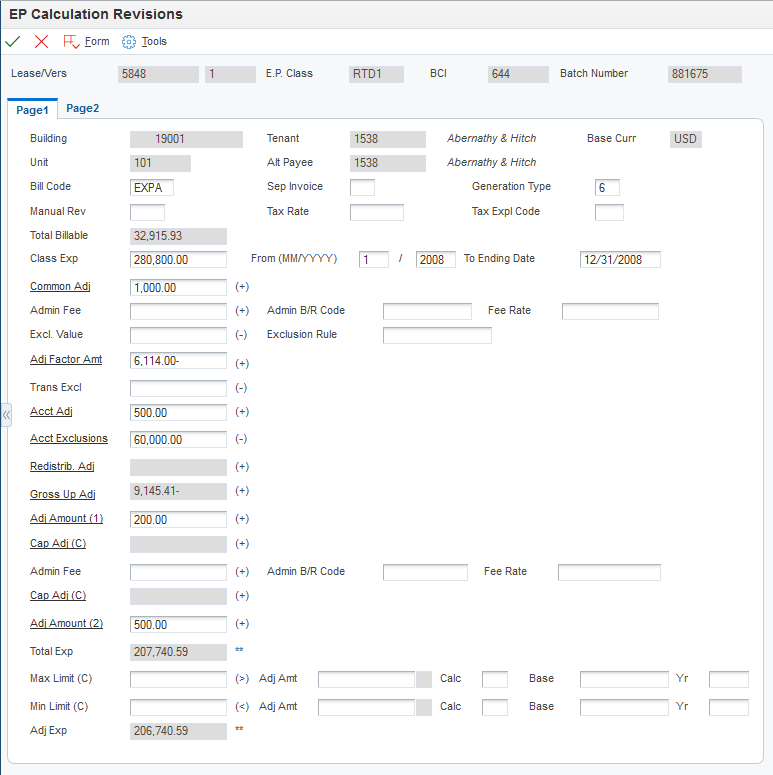

Access the EP Calculation Revisions form.

Complete any of the input-capable fields on the Page 1 tab of the EP Calculation Revisions form.

- Manual Rev

Enter a value that specifies whether a billing record must be reviewed before it can be approved for posting. Values are:

Blank: A review is not required.

Y: A review is required. The batch retains a status of Error until the field for the billing record is changed from Y to blank.

- Sep Invoice (separate invoice)

Enter the one-character alphanumeric code that indicates which billing records to print on the invoice. The system prints a separate invoice for each group of billing records that have the same lease number, alternate payee, and separate invoice code.

- Generation Type

Enter the code that specifies the generation type for an expense participation billing line.

- Class Exp (class exposure)

Enter the sum of the gross amounts for the accounts that are specified by the expense class for the expense participation billing period and that do not include exclusions (account, transaction, and tenant).

- From (MM/YYYY)

Enter the beginning date that the system uses to retrieve expenses that are used to determine the total class exposure.

- To Ending Date

Enter the ending date that the system uses to retrieve expenses that are used to determine the total class exposure.

- Common Adj (class common adjustment amount)

Enter the sum of class adjustment amounts from the E.P. Class Adjustments Revisions form when the calculation placement control value is defined to place the adjustments before the adjustment factor. If you select the Common Adj link, the system accesses the Class Adjustments Audit File form which enables you to review historical class adjustment information.

- Admin Fee (administration fee)

Enter the amount of the administration fee for the lease and expense class.

- Admin B/R Code

Enter the code that the system uses in conjunction with the automatic accounting instruction (AAI) item to retrieve the account to update for the management fee amount that the system calculates when you run the E.P. Calculation Generation program.

The system retrieves the appropriate account to bill based on the AAI item PMxxxx (for invoices) and RMxxxx (for vouchers), where xxxx equals the code that you enter.

The system retrieves the offset account (Accounts Receivable trade or Accounts Payable trade), based on the AAI item RCxxxx (for invoices) and PCxxxx (for vouchers), where xxxx equals the code that you enter.

If you leave this field blank, the system uses the same account that it uses for the billing amount.

- Excl. Value (exclusion value)

Enter the amount to exclude based on either the tenant exclusion rule or the exclusion override in the expense participation information.

- Exclusion Rule

Enter a value that identifies a tenant exclusion rule.

The system does not include amounts specified by the tenant exclusion rule when it calculates the tenant's share factor. For example, a tenant exclusion rule might specify to deduct amounts associated with bill code EXPA from all tenants who lease any unit that is defined as an anchor and that has an area of more than 5,000 square feet.

The system uses the tenant exclusion rule only when you assign it to the expense participation information for the lease.

- Adj. Factor Amnt. (class adjustment factor amount)

Enter the sum amount of all adjustment factors as defined at the class level or at the account level. If you select the Adj Factor Amnt link, the system accesses the Adjustment Factor Audit File form, which enables you to review historical adjustment factor information.

- Trans. Excl. (transaction exclusions)

Enter the amount to subtract from the class exposure. The system does not update this field; it is reserved for manual entry.

- Acct Adj (account adjustment)

Enter the amount that the system subtracts from the class exposure based on the expense participation adjustment information. The account adjustment amount is the total amount of adjustments made to the EP Class as defined in the tenant Expense Participation billing information when the adjustment level type is set to 1 for adjustment. The amount represents either an account balance or an override adjustment amount, depending on the adjustment calculation methods.

Method 5 is an amount adjustment to the account. The system adds or subtracts (depending on whether the amount specified is positive or negative) the adjustment amount from the class exposure amount.

Method 6 calculates the account exclusion adjustment amount by multiplying the adjustment percentage by the account balance and then subtracting that result from the account balance.

Note:If you specify a positive adjustment amount, the system adds it to the expense class (it appears as a negative amount that is subtracted). If you specify a negative adjustment amount, the system subtracts it from the expense class (it appears as a positive amount that the system subtracts).

Select this link to access the Account Adjustments Audit File form, which enables you to review historical account adjustment information.

- Acct Exclusions (account exclusions)

Enter the amount that is excluded from the tenant's expense participation class based on the specific account factors defined in the tenant expense participation billing information.

Select this link to access the Account Exclusions Audit File form, which enables you to review historical account exclusion information.

- Redistrib. Adj (redistribution adjustment)

Select this link to access the Exclusion/Redistribution Adjustments Audit program (P1538B2), which enables you to review the account adjustments for leases participating in an expense.

- Gross Up Adj (gross up adjustment)

Select this link to access the Gross Up Adjustments Audit program (P1538B1), which enables you to review the account adjustments for gross up processing.

- Adj Amount (1) (adjustment amount 1)

Enter the amount that is added to the class exposure immediately before the system adds administration fee.

Select this link to access the Class Adjustments Audit File form, which enables you to review historical class adjustment information.

- Cap Adj (C) (cap adjustment)

Displays the amount of adjustment to exposure necessary based on a cap rule defined at the EP Class level, when the system calculates caps before the administration fee.

Select this link to access the Expense Cap Detail program (P1538B3), which enables you to review cap details.

- Admin Fee

Enter An amount that represents the administration fees associated with a tenant's expense participation. This fee is calculated by multiplying the tenant's billable amount by the fee rate. Fee Amount 2 refers specifically to the total amount of administration fee applied when Fee Basis is set to 1.

- Cap Adj (C) (cap adjustment)

Displays the amount of adjustment to exposure necessary based on a cap rule defined at the EP Class level, when the system calculates caps after the administration fee.

Select this link to access the Expense Cap Detail program (P1538B3), which enables you to review cap details.

- Adj Amount (2) (adjustment amount 2)

Enter the amount that the system adds to the class exposure immediately after the administration fee is added.

Select this link to access the Class Adjustments Audit File form, which enables you to review historical class adjustment information.

- Total Exp (total exposure)

Displays the calculated exposure.

- Max Limit (C) (maximum limit C)

Enter the maximum allowable amount for the total class exposure. The system uses the value in this field for the adjusted class exposure when the calculated amount for the total class exposure is greater than this value. For example, if the total class exposure is 200,000 and the expense class limit is 175,000, the system uses 175,000 for the adjusted class exposure.

- Adj Amt (adjustment amount)

Enter the adjustment amount. Depending on the adjustment calculation method, this value is the amount or percentage that the system uses to determine the minimum amount for the total class exposure.

- Calc. (adjustment calculation)

Enter a code from UDC 15/CE that specifies the adjustment calculation method that was entered in the corresponding field, Adj Calc, on the Expense Participation Adjustments form.

- Base

Enter the amount from in the Adjustment Base field on the Expense Participation Adjustments form for the detail line that specifies an adjustment calculation method of C and a maximum adjustment amount.

- Yr (base year)

Enter the value that defines the base year for the maximum amount to be charged for the class.

- Min Limit (C) (minimum limit C)

Enter the minimum allowable amount for the total class exposure. The system uses the value in this field for the adjusted class exposure when the calculated amount for the total class exposure is less than this value. For example, if the total class exposure is 150,000 and the class limit minimum is 175,000, the system uses 175,000 for the adjusted class exposure.

- Adj Exp (adjustment exposure)

Enter the amount from which the system subtracts any base exclusions to determine the net exposure amount. The system compares the total exposure amount to the maximum or minimum adjustment amounts to determine the value.

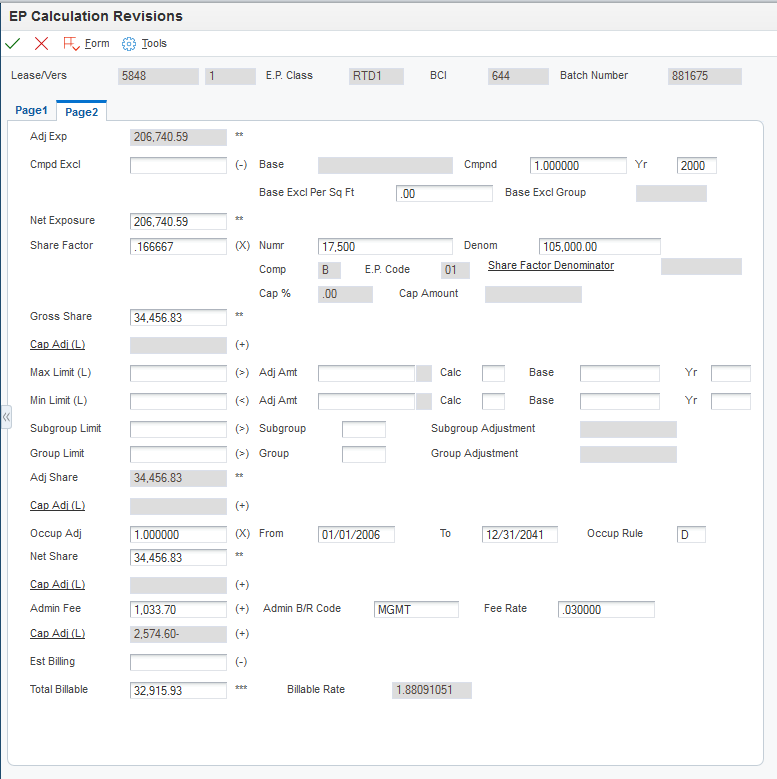

Complete any of the input-capable fields on the Page 2 tab of the EP Calculation Revision form.

- Adj. Exp. (adjusted exposure)

Displays the adjusted exposure amount from the Page 1 tab.

- Cmpd. Excl. (compound exclusion)

Displays the amount that the system calculates based on the values in the Base Exclusion, Compound Factor, and Base Start Year fields on the E.P. Information Revisions form. This amount is calculated by compounding the base exclusion amount over several years.

The system uses the following formula: Y C = F x B, where C is the amount of compounded base exclusions, B is the base exclusion amount, F is the compound factor, and Y is the difference in years between the base year and the year for which expenses are extracted. However, if Y is zero then the amount of total exclusions is also zero.

- Base

Enter a number that specifies the expense base amount for the class. The system uses this amount to calculate the compounded base exclusion, which it then subtracts from the adjusted exposure before calculating a tenant's share. If you enter a value, you must also specify a value in the Base St Yr field on the E.P. Information Revisions form.

- Cmpnd (compound)

Enter the percentage by which the system multiples the base exclusion amount to adjust for the next year. To increase the base amount, enter a percentage that is greater than 1. For example, to increase the base exclusion amount by 5 percent, enter 1.05. To decrease the base exclusion amount, enter the percentage in a decimal format. For example, enter 0.95 to specify 95 percent.

- Yr (applicable year)

Enter the applicable year, including the century. For example, 2008.

- Base Excl Per Sq. Ft. (base year exclusion per square foot)

Enter the amount per area unit of measure (square foot) that the system excludes from the expense base amount for the class.

- Base Excl Group (base exclusion group)

Enter a value that identifies a group of expense participation classes that are subject to a common base exclusion.

- Net Exposure

Displays the value that the system multiplies by the share factor percentage to determine the gross share amount.

- Share Factor

Displays a value that the system multiplies by the net exposure to determine the tenant's portion of the expenses of a class. This factor can be entered explicitly or it can be calculated based on the tenant's occupied space relative to the total area to which the expenses are applicable.

- Numr (numerator)

Enter the rentable area of the tenant's unit, which is the numerator that the system uses to calculate the tenant's share of expenses. If you leave this field blank, the system retrieves the area from the lease. You can override the value.

- Denom (denominator)

Enter the total area in square feet that applies to the expenses in which the tenant is participating. This value can be the total square footage of a building or property or the occupied square footage or the gross leaseable area.

- Share Factor Denominator

Enter the code that identifies the units to exclude from the denominator portion of the calculation that the system uses to determine the tenant's share factor. For example, you can specify a share factor denominator that excludes anchor tenants (specified by the E.P unit type) that have more than 16,000 square feet (specified by the share factor area value).

The system uses the share factor denominator only when you assign it to the expense participation information that you set up for the lease. Select this link to access the Share Factor Denominator Audit form, which enables you to review historical information about share factor denominators.

- Cap % (cap percentage)

Enter the percentage of the GLA that represents a minimum amount to use as the denominator to calculate the tenant's share factor if the building area that is retrieved is a lesser amount. For example, if the area method and type specify to use the average leased occupied area (for the rentable area), and that amount is less than the percentage of GLA specified by the cap, the system uses the cap value.

Enter the percentage in a decimal format. For example, enter 0.80 to specify 80 percent. The system does not calculate a cap that is greater than 100 percent.

- Cap Amount

Enter the calculated value of the occupancy floor, which is based on the Average GLA and the cap percentage.

- Gross Share

Displays the amount that the system derives by multiplying the share factor by the net exposure amount. The amount represents the tenant's share of expenses for the expense class before the system calculates the adjustments for occupancy, lease, and group limits. You can revise this value.

- Max Limit (L) (maximum limit L)

Enter the maximum allowable amount for the tenant's share of expenses for the expense class. The system uses the value in this field for the adjusted share when the calculated amount for gross share is greater than this value. For example, if the gross share amount is 1500 and the maximum amount specified is 1200, the system uses 1200 for the adjusted share amount.

- Adj Amt (adjustment amount)

Enter the adjustment amount. Depending on the adjustment calculation method, this value represents the amount or percentage that the system uses to determine the maximum amount for the tenant's share of expenses.

- Calc (calculation type lease)

Enter a value from UDC 15/CE that the system uses to determine the maximum EP (expense participation) lease adjustment amount.

- Base

Enter the amount that the system uses to calculate the maximum adjustment value for the lease.

- Yr (start base year)

Enter the value that defines the start (base) year for the minimum amount to be charged for the lease.

- Min Limit (L) (minimum limit L)

Enter the minimum allowable amount for the tenant's share of expenses for the expense class. The system uses the value in this field for the adjusted share when the calculated amount for gross share is less than this value. For example, if the gross share amount is 1500 and the minimum amount specified is 2000, the system uses 2000 for the adjusted share amount.

- Subgroup Limit

Enter the maximum amount that the system uses for the combined gross share amounts of the expense classes in the subgroup.

- Subgroup

Enter the code that identifies a second level group of expense participation classes that are subject to a common limit.

- Subgroup Adjustment

The system adds the gross share amount for each expense class in the subgroup to calculates the amount. When the combined result is greater than the subgroup limit, the system divides the subgroup limit by the combined result and then multiplies the resulting percentage by each gross share amount to calculate the net share amount for each expense class in the subgroup. The difference between the gross share amount and the net share amount for the subgroup is the subgroup adjustment amount.

When the combined gross share amounts for all of the expense classes in the subgroup is less than the subgroup limit, the system ignores it.

- Group Limit

Enter the maximum amount that the system uses for the combined adjusted share amounts of the expense classes in the group.

- Group

Enter the code that identifies the expense participation classes that are subject to a common group limit. For example, if two expense classes are set up, one for the expenses related to the parking structure and another for the maintenance expenses for the external grounds, you can either define a separate limit for each class or group the two classes and define a limit for the tenant's share of the combined expenses.

- Group Adjustment

The system add the gross share amount for each expense class in the group to calculate the amount. When the combined result is greater than the group limit, the system divides the group limit by the combined result and then multiplies the resulting percentage by the gross share amount of each expense class to calculate the net share amount for each expense class in the group. The difference between the gross share amount and the net share amount for the expense class is the group adjustment amount.

When you specify a subgroup limit, the system adds the net share that it calculated for each subgroup, and adds that amount to the gross share of the expense classes (that do not have subgroups) within the group. Then, the system divides the group limit by the sum of the subgroup net share and group gross share amounts, and then multiplies the result by each subgroup net share and group gross share amount to calculate the group net share for each expense class. The difference between the subgroup net share amount and the group net share amount is the group adjustment amount.

When the combined adjusted share amount for the expense classes in the group is less than the group limit, the system ignores it.

- Occup Adj (occupancy adjustment)

Displays the percentage that represents the number of days in the range specified by the values in the Occupancy From and Occupancy To fields on the expense participation record divided by the number of days in the range specified by the values in the Begin Date and End Date fields. The system uses the occupancy rule to determine the number of occupied days.

- Occup Rule (occupancy rule)

Enter a code from UDC table 15/OC that specifies how the system prorates amounts and areas that are used in the expense participation calculation for units that are occupied for less than a complete billing period. Values are:

Blank: No occupancy factor.

D: Daily proration.

H: Half month proration.

P: Partial month proration.

- Net Share

Enter the amount that represents the tenant's share of expenses for the expense class before the adjustment for the administration fee and estimated billings, if applicable.

- Est Billing (estimated billings)

Displays the total amount of billings posted for the estimated bill code.

- Total Billable

Enter the billable amount for the tenant's share of the expenses for the expense class specified.

- Billable Rate

Displays the total billable amount divided by the tenant area.

Select Recalculate from the Form menu if you revise a field that affects the calculation, such as an amount or percentage field. The system recalculates the billable amount accordingly.

The system does not recalculate the billable amount for changes that you make to these fields: Exclusion Rule, Share Factor Denominator, Cap % (cap percent), Occup Adj (occupancy adjustment), Comp (computation method), and E.P. Code.

To recalculate the billable amount based on the changes that you make to these fields, you must delete the calculation batch, revise the expense participation information, and regenerate the calculation.