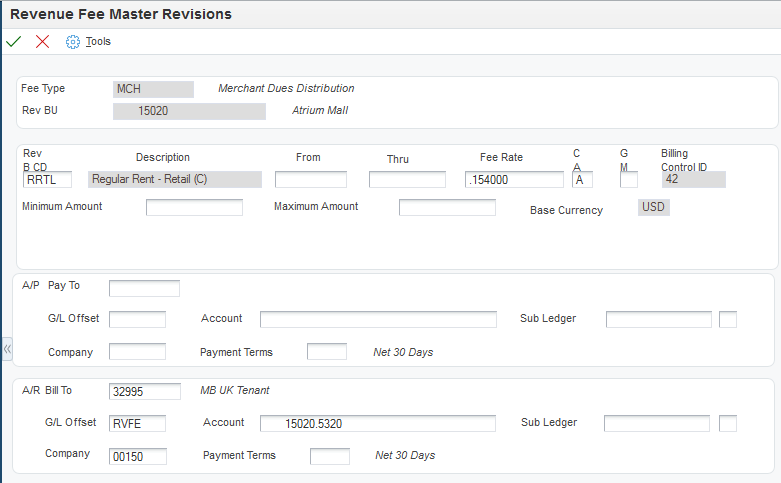

Setting Up Business Unit and Lease Fee Tables

Access the Revenue Fee Master Revisions form.

- Fee Type

Enter a code from UDC 15/FE that specifies a fee type. For example, LCM is Lease Commissions.

In situations where property is managed on a fee basis, different types of fees may be distinguished. For example, simple management fees associated with rent roll billings may be distinguished from fees associated with the billing and collection of special tenant assessments.

- Rev B CD (revenue bill code)

Enter the code that the system uses in conjunction with the AAI item to retrieve the accounts to update when the billing record is posted.

The system retrieves the appropriate account to bill based on the AAI item PMxxxx (for invoices) and RMxxxx (for vouchers), where xxxx equals the code that you enter.

The system retrieves the offset account (Accounts Receivable trade or Accounts Payable trade), based on the AAI item RCxxxx (for invoices) and PCxxxx (for vouchers), where xxxx equals the code that you enter.

- Fee Rate

Enter the percentage to allocate for an administration fee. Enter the percentage in a decimal format. For example, enter.01 to specify a 1 percent fee.

- C A (cash or accrual fee basis)

Enter a value that specifies whether the system calculates the fee from the amounts billed or the amounts collected. Values are:

A: Accrual basis. The system calculates the fee based on the amount billed.

C: Cash basis. The system calculates the fee based on the amount collected.

For revenue fees, the fees can be calculated from the amounts billed or the amounts collected. Values are:

A: Accrual basis (amounts billed if AR-based).

C: Cash basis (amounts collected if AR-based).

- G M (generation mode)

Enter a value that specifies whether invoices or vouchers are created while generating revenue fees. Values are:

Blank: Revenue fee invoices or vouchers are created using the account numbers entered in the fold area as the revenue or expense accounts and the corresponding bill codes as the offsets.

1: Bypass creating invoices or vouchers. In this case, the system creates journal entries to debit the Pay To account and credit the Bill To account in the fold area.

- Minimum Amount

Enter the amount that the system uses as the revenue fee when the system-calculated amount is less than the amount specified.

- Maximum Amount

Enter the amount that the system uses as the revenue fee when the system-calculated amount is greater than the amount specified.

- A/P Pay To

Enter a value that specifies the address book record.

- A/R Bill To

Enter a value that specifies an address book record.

- G/L Offset

Enter the GL offset, or Billing/Receipt code, for the AP vouchers that are automatically generated for revenue fees.

- Account

Enter the value that identifies an account in the General Ledger.

- Sub Ledger

Enter a subledger. A subledger provides for detailed subsidiary accounting within any General Ledger account. This provides an audit trail of the transactions posted to a General Ledger account by other related numbers. These related numbers can be defined by Address Book, Business Unit Master, Equipment Master, Order Header, Work Order Master or Lease Master files. See Subledger Type (SBLT) for how to define these different subledgers. User-defined subledgers are also available.

For example, the balance of two different Notes Receivable could be tracked by two different accounts or by two different subledgers within one account.

Use discretion in using the subledger concept. An extra record is added to the General Ledger Account Balances File - F0902 for each subledger, subledger type, ledger type, fiscal year, and account.