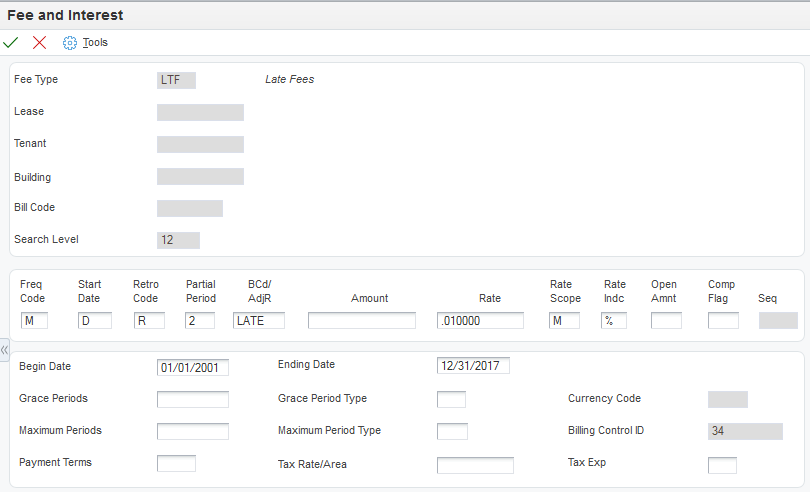

Setting Up Fees and Interest

Access the Fee and Interest form.

Use the Fee & Interest Information program (P1525) to set up tables of charges, interest rates, and calculation patterns, which enables you to maintain information associated with the various fees and interest that applies to the organization.

- Fee Type

Enter the fee type from user-defined code (UDC) table 15/FY that specifies how to group fee tables together for items such as late or interest charges.

- Search Level

Displays the level, 1–12, of the fee and interest table based on the values in the Lease, Tenant, Building, and Bill Code fields.

- Freq Code (fee frequency code)

Enter a code from UDC table 15/FC that specifies the frequency with the system applies or compounds an amount or rate. Values are:

D or 1: Daily

M or 2: Monthly

Y or 3: Yearly

If you select monthly, then each month is a separate generation period. An individual table entry may be applied to an individual invoice only once per generation period. The R15160 program applies the rate or amount once for every generation period between the last date of generation and the current generation date.

- Start Date

Enter a code from UDC table 15/FI that specifies which date, associated with an invoice, the system uses as the starting point for generation. For instance, late fees would be based on the due date of an invoice, whereas interest accrual for security deposits would be based on the G/L date. Values are:

D or 1: Due Date

G or 2: G/L Date/Transaction Date

I or 3: Invoice Date

S or 4: Service/Tax Date

- Retro Code (retroactive start date code)

Enter a value that specifies whether the fee or interest is calculated as of the date after the grace period or retroactively as of the start date. Values are:

Blank: Fee or interest starts after grace period.

1 or R: Fee or interest is retroactive to start date.

- Partial Period

Enter a code from UDC table 15/PP that specifies how the system generates fees and interest when an invoice has been paid during a generation period (see AAPF). Values are:

Blank: The system does not generate fees or interest for a generation period during which the invoice is paid.

1: The system generates fees and interest as if the invoice were open during the entire generation period.

2: The system pro-rates fees and interest according to the number of days the invoice was open during the generation period versus the total number of days in the Generation Period.

- BCd/AdjR (billing receipt code)

Enter the G/L offset (billing/receipt) code that the system uses to retrieve estimated charges. For example, suppose you enter a control record for billing the expense participation class related to common area maintenance. If the tenant has been billed a recurring estimated charge for this class through the recurring billing process, the estimated charges must be subtracted from the calculated actual charge and only the difference billed to the tenant.

- Amount

Enter the amount that the system uses as fee or interest amount.

Note:You can enter either an amount or a rate, but you cannot enter both.

- Rate

Enter the percentage that the system uses to assess the fee or interest. Enter the percentage as a decimal value. For example, enter 0.05 to specify 5 percent.

Note:You can enter either an amount or a rate, but you cannot enter both.

- Rate Scope

Enter a code from UDC table 15/FC that specifies the time period in which to apply the rate.

- Rate Indc (rate indicator code)

Enter a code from UDC table 15/RA that specifies the rate the system uses to calculate the fee or interest amount. Values are:

Blank: Flat rate.

%: Rate from Fee and Interest table.

1: First variable rate.

2: Second variable rate.

3: Third variable rate.

4: Fourth variable rate.

- Open Amnt (open amount code)

Enter a code from UDC table 15/OA that specifies the amount associated with an invoice which is used to generate the fee or interest amount. Values are:

Blank: Original: The gross billing amount of the invoice.

1 or A: Average. The average open amount during a generation period.

2 or L: Last. The open amount at the end of a generation period.

- Comp Flag (compounded flag)

Enter a code from UDC table 15/CP that specifies to the A/R Fee and Interest Generation program whether the rate is compounded. Compounded fee or interest amounts are created as adjustments to the affected invoice. There may be only one compounding entry for any fee and interest table. Values are:

Blank: Non-compounded.

1:Compounded.

- Seq (auto generation sequence number)

Enter the sequence number. The sequence number is used to control the order in which AR Fee and Interest entries are processed and displayed.

- Grace Periods

Enter the number of grace periods. This value, along with the Grace Period Type, determines the amount of time that the grace period, if any, is in effect. The grace period is measured from the Start Date (see FISD). For example, if the start date for an invoice is October 1, 2008, the number of grace periods is 10, and the Grace Period Type is 1 day, then no fee or interest would be generated for the invoice until the generation date was past October 11, 2008.

- Grace Period Type

Enter the amount of time that the grace period covers. For example, if the number of grace periods is eight, then the total grace period could be eight days, eight months, or eight years. Values are:

D: Days.

M: Months.

Y: Years.

- Maximum Periods

Enter the maximum periods. The system uses this value, along with the Maximum Period Type, to determine the amount of time that an individual entry can be applied to an invoice. For example, if the entry is a one-time flat fee, then the Maximum Periods would be 1 and the Maximum Period Type would match whatever the Fee Frequency indicated. If the entry is a monthly rate which is not to be applied more than 12 times, then the Maximum Periods could be 12 and the Maximum Period Type 2 (months) or the Maximum Periods could be 1 and the Maximum Period Type 3 (years). The maximum periods are measured from the start date. If there is a grace period of 10 days, but a maximum of 1 day, the system never bills the fee.

The grace period must be less than the maximum period. The system processes any generation period (see AAPF) that starts before the maximum periods are finished.

For example, if the entry is a monthly fee and if the Maximum Periods are 90 and the Maximum Period Type is 1 (days), then the system processes the first three months, even if the end of the third month falls outside of the 90 days.

- Maximum Period Type

Enter a value that specifies the maximum period type. This value, along with the maximum periods, is used to determine the amount of time that an individual entry can be applied to an invoice. Values are:

D: Days

M: Months

Y: Years

- Payment Terms

Enter a value that specifies the terms of payment, including the percentage of discount available if the invoice is paid by the discount due date. Use a blank code to indicate the most frequently-used payment term. You define each type of payment term on the Payment Terms Revisions form. Examples of payment terms include:

Blank: Net 15.

001: 1/10 net 30.

002: 2/10 net 30.

003: Due on the 10th day of every month.

006: Due upon receipt.

This code prints on customer invoices.

- Billing Control ID

Displays the Billing Control ID, which is used to keep track of all the periods that have been generated and posted. For billing generation type 5, the Billing Control ID is stored with the invoice information in the Lease Billings History table (F1511HB) rather than in the Billings Generation Control Master table (F15011B).