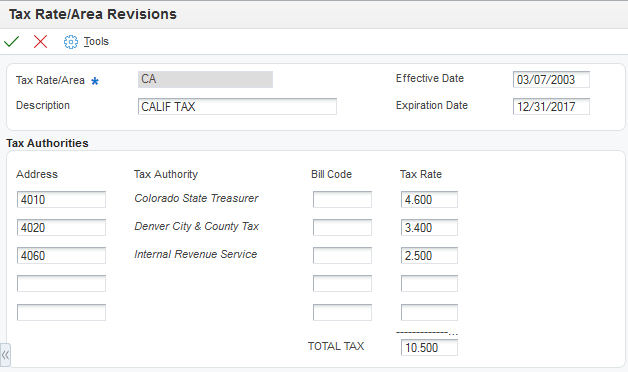

Setting Up Tax Rate Areas

Access the Tax Rate/Area Revisions form.

- Tax Rate/Area

Enter the code that identifies a tax or geographic area that has common tax rates and tax authorities. The system validates the code that you enter against the Tax Areas table (F4008). The system uses the tax rate area, the tax explanation code, and tax rules to calculate tax and GL distribution amounts when you create an invoice or voucher.

- Effective Date and Expiration Date

Enter the dates when a transaction, contract, obligation, preference, or policy rule becomes effective or ceases to be in effect.

- Address

Enter the address book number of the tax authority.

- Bill Code

Enter a code that indicates how to locate the tax account for general ledger entries. This field corresponds to AAIs that, in turn, correspond to the tax account. Examples are:

PTyyyy for AP (VAT only).

RTyyyy for AR (VAT only).

GTyyyy for GL (VAT only).

4320 for sales orders

4400 and 4410 for purchase orders.

When setting up VAT and Canadian GST, PTyyyy, RTyyyy, and GTyyyy are the only values. For the AP system, a second GL offset (PTxxxx) is required when the tax setup involves VAT plus use taxes (tax explanation code B). Use the AAI PTxxxx to designate the use tax portion of the setup.

For sales taxes, the Accounts Payable and Accounts Receivable systems do not use the values in this field. However, the Sales Order Management and Procurement systems require values in this field.

You must complete this field for tax rate areas that are used with tax explanation code AR.

- Tax Rate

Enter the percentage of tax that is assessed or paid to the corresponding tax authority, based on the tax area.

Enter the percentage as a whole number and not as the decimal equivalent. For example, to specify 7 percent, enter 7, not.07.

If the tax rate area is used with tax explanation codes B (VAT plus use) or C (VAT plus sales), you must enter the VAT tax authority and tax rate on the first line of the tax rate area.