Understanding Lessee Accounting Multicurrency Integrity Information

The Balance Sheet Lessee Accounting feature for multicurrency leases requires certain rules to be followed for currency codes and exchange rates for lease headers, lease details, recurring billing, and manual billing information. Even if certain conditions were not met by multicurrency leases, the system enabled users to enter the leases and processed them. The system will no longer process multicurrency leases if they do not conform to the new rules and if they are classified as operating or finance leases. The Lessee Accounting Multicurrency Integrity program (R15920) has been created to assist you to identify the existing multicurrency leases that do not conform to these rules. When you run this report, you will get a list of multicurrency leases that will not be processed and the reason they will not be processed.

You will need to manually correct these leases to abide by the new rules so that these leases are processed by the Balance Sheet Lessee Accounting processes feature. Manual correction may include any combination of the following:

Bring the lease back to its original state and correct it by:

Voiding monthly balance sheet journal entries

Voiding recurring or manual billing entries

Voiding lease commencement journal entries

Deleting amortization schedules

Updating the lease header, lease details, recurring billing, or manual billing to meet the new rules

Creating amortization schedules

Commencing a lease with as of processing activated

Terminate the lease and make adjustments for previous entries for monthly amortization and recurring and manual billing then create a new lease.

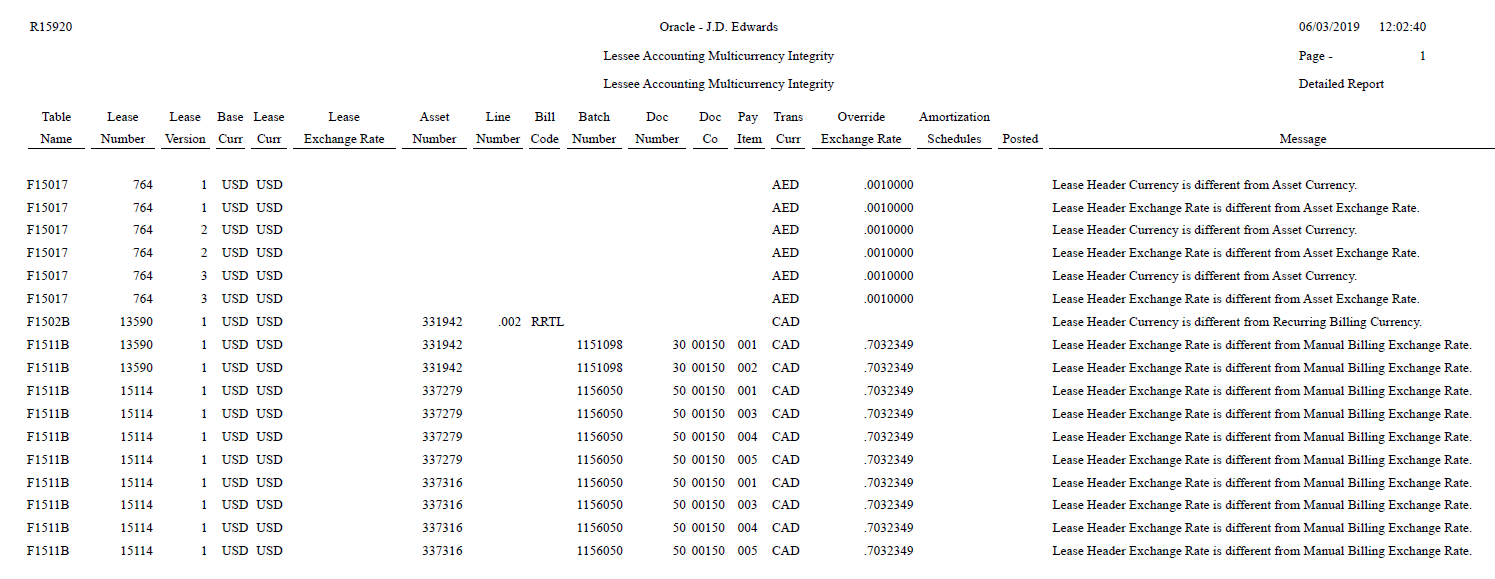

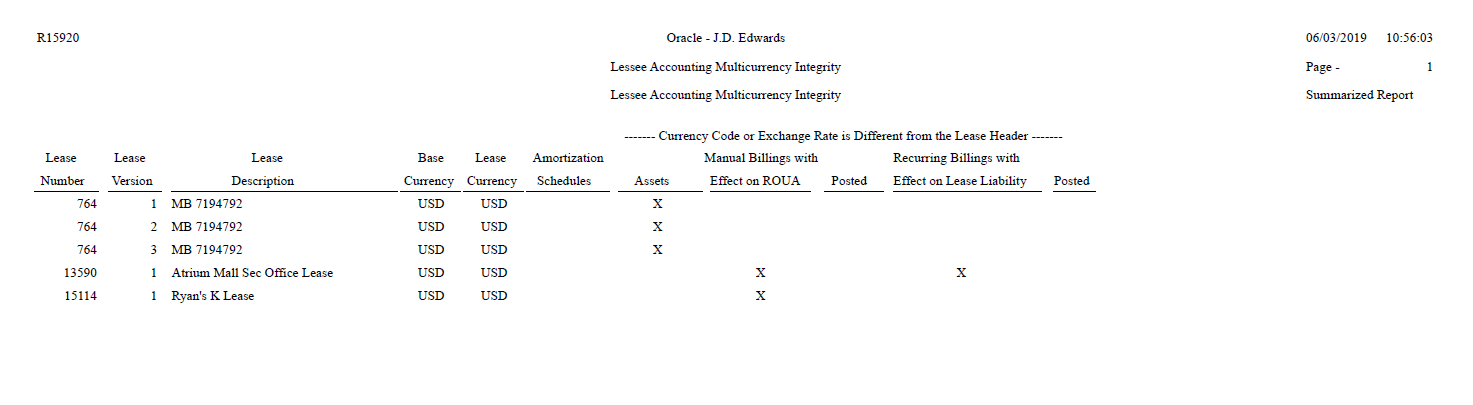

For recurring billing records having an effect on lease liability and manual billing records having an effect on ROUA, the program will detect and report the following issues:

Any lease in which the currency code is different between the lease header (F1501B), lease details (F15017), recurring billing (F1502B), or manual billing (F1511B)

Any lease in which the exchange rate is different between the lease header (F1501B), lease details (F15017), recurring billing (F1502B), or manual billing (F1511B)

Apart from the above issues, the program also reports if an amortization schedule exists and if manual or recurring billing has been processed for the lease.

Use the processing option on Lessee Accounting Multicurrency Integrity program (R15920) to specify whether you want a detailed report or a summarized report.

The following image illustrates the detailed report:

The following image illustrates the summarized report:

The lessee accounting multicurrency integrity report processes only lessee leases.