Updating Recurring Billing Records (Release 9.2 Update)

This section has been updated to include the Lessee Recurring Billing Update (R151161) and the Estimated Lessee Recurring Billings table (F1502WC). These objects support the global update of recurring billing lines that have an effect on lease liability of Yes (1) or Guaranteed Residual Value (2), and are used in balance sheet lessee accounting processing. If you are not maintaining lessee leases, the system does not use these objects when processing recurring billing global updates.

See Balance Sheet Lessee Accounting (Release 9.2 Update) for additional information.

You can simultaneously change many recurring billing records to indicate increases or decreases in the billing amounts or to change the dates for those records using the recurring billing global update process.

This process is most commonly used to increase rents in the same manner for multiple assets.

If you are using this process to update billing records associated with lessee leases, you can perform only these actions using the global update process:

Modify billing amount on selected step only.

Add a new last step.

Extend the end date of last step.

Modify billing amount on selected and future steps.

Terminate early by changing end date of last step.

Update amount on guaranteed residual value (GRV) records.

Update date range on GRV records.

To complete this process, you:

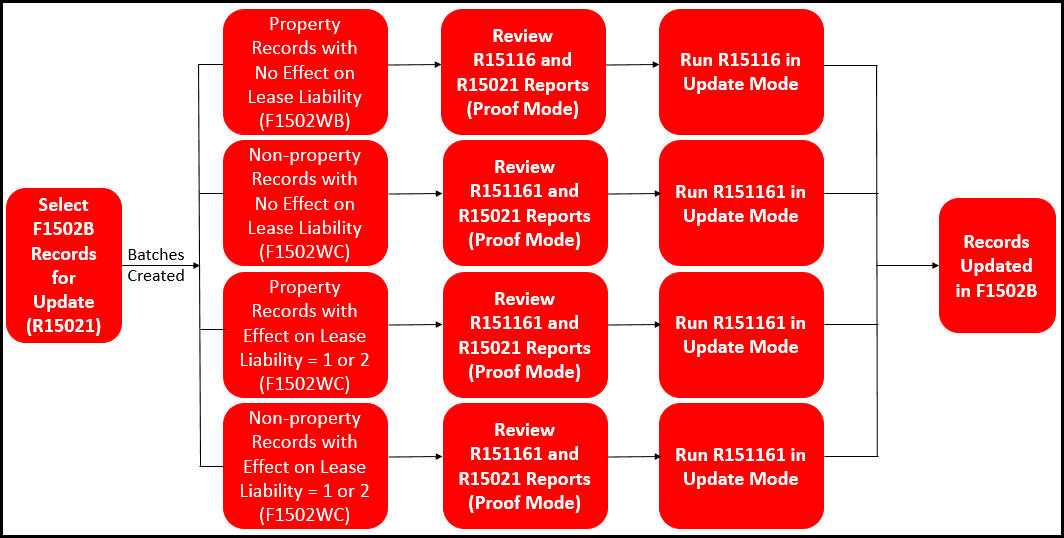

Run the Recurring Billing Global Selection program (R15021) to identify and select bill code lines from the F1502B table for which you want to revise amounts or dates.

This program creates up to four different batches, each with a different batch number, depending on the records you select. The batches contain records for:

Property assets with no effect on lease liability.

Non-property assets with no effect on lease liability.

Property assets with effect on lease liability set to 1 or 2.

Non-property assets with effect on lease liability set to 1 or 2.

This program also populates the F1502WB and F1502WC worktables with selected records, and assigns batch numbers to those records.

Finally, this program runs the Recurring Billing Global Update program (R15116) and the Lessee Recurring Billing Update program (R151161) in edit (proof) mode, using the versions you specify in the processing options. You can specify a different program version for each type of batch. All three programs produce reports to identify the updates, batch numbers, and any errors or exceptions that occur.

Review the reports generated by the R15021, R15116 and R151161 to determine if your updates are accurate. Oracle strongly recommends completing this step before you run any programs in update mode.

Run the R15116 and R151161 in update (final) mode for the batch numbers associated with your groups of records.

This graphic illustrates the global update process:

When you run the R15021, you use data selection and processing options to specify which records in the F1502B table you want to update. You also use processing options to specify which versions of the update programs you want to run. The system then populates worktables with the recurring billing records you have selected for update. Once the worktables are populated, the R15021 automatically runs one or more of these update programs in proof mode (even if the specified version is set to run in update mode), depending on which worktables were populated by the R15021:

Recurring Billing Global Update program (R15116)

The R15021 program creates property records with no effect on lease liability, that meet your selection criteria, in the Estimated EP Recurring Billings worktable (F1502WB). The R15116 then processes those records. If there are no records that meet this criteria, the R15021 does not generate a batch of records in the F1502WB, and therefore, does not run the R15116 program.

Lessee Recurring Billing Update (R151161)

The R15021 program writers up to three batches of records to the Estimated Lessee Recurring Billings worktable (F1502WC). These batches include non-property records with no effect on lease liability, property records with effect on lease liability set to 1 or 2, and non-property records with effect on lease liability set to 1 or 2, and that meet your selection criteria. Processing options on the R15021 specify which versions of the R151161 to run for each batch type. If a specific batch type is not created in the F1502WC, the associated version of the R151161 is not run.

Additionally, a processing option on the R15021 determines whether you can include records for update if an amortization schedule exists for those records. If you update records that already have amortization schedules, you might be required to remeasure your lease. See Changing Lease Terms After Schedule Creation for additional information.

Depending on your selection criteria, the R15021 will run one or both of these update programs. For example, if you are selecting billing records for property assets that have no effect on lease liability (records written to the F1502WB), and records that do have an effect on lease liability (records written to the F1502WC), the R15021 will process both update programs using the versions you specify in the processing options.

Both programs produce reports that enable you to review the changes that will be made to the Recurring Billing Records table (F1502B). Each report includes the batch number associated with each set of records in the associated worktable. You will use these batch numbers when you run the update programs in update mode.

For lessor leases, the R15021 uses both the anniversary date of a lease and the effective dates for the recurring billings to select records. You specify date updates that you want to make to your recurring billing records on the Dates and the Select tabs of the processing options. You specify amount updates in the processing options of the R15116.

For lessee leases, the R15021 uses the beginning and ending dates on the recurring billing records to select records. You can also select property assets on the Select tab. You specify date updates that you want to make to your recurring billing records on the Lease Liability tab of the processing options. You cannot use the Start Date Anniversary processing options to select records for lessee leases.You specify amount updates in the processing options of the R151161.

Using the global update process to update recurring billing records provides this flexibility:

On a single set of records, you can apply different calculations by running different versions of the R15116 or R151161 programs in edit (proof) mode.

This action lets you review and compare the results before you commit to a particular update.

If you consistently make the same amount increase to a set of records, you can create specific versions of the selection and update programs for that update and maintain only the date control in the versions of the selection program.

For example, you have a quarterly 1% increase in the rent amount for lease 12345 (a lessor lease), you might create a version of the R15021 and a version of the R15116 called Lease 12345 Quarterly. You can specify all of the details of the update in the versions, and simply change the date each quarter before processing the update.

The billing frequency for the selection program (R15021) must be the same as the frequency for the update programs (R15116 and R151161). Otherwise, different frequencies could be involved in the same calculation and the results would not be correct, such as if monthly billings were calculated with an annual increase.

This is important because:

-

In the calculation, a flat amount is applied to the selected records, regardless of the billing frequency.

-

The billing frequency controls how the calculated amounts are expressed.

Monthly billings are expressed as monthly amounts, annual billings as annual amounts, and so on. However, the totals on the report do not consider any difference in the billing frequency.

If exceptions occur during record selection, the R15021 produces an exception report that identifies records that would be omitted from the update, along with an explanation.

The system honors specific conditions for each type of record to determine whether a bill code line is included in the selection.

This list includes the conditions for records with no effect on lease liability:

The new begin date cannot occur on or after the suspend date if the bill code line is suspended.

The bill code line cannot be associated with a non-billable lease unless the processing options are set to allow it.

The original (current) end date cannot be blank if the new begin date is not specified in the processing options.

The original begin and end dates cannot be blank if the new begin and end dates are not specified in the processing options, and non-billable lease are not allowed.

This list includes the conditions for records with an effect on lease liability:

The billing records must be active. Inactive records are automatically excluded.

The Effective Date or New End Date cannot occur on or after the suspended date if the billing record is suspended.

When using the Effective Date to update a billing record, the Effective Date must be within the date range of the billing record.

The one exception to this rule is if the Billing Step to Update processing option is set to 1 to update both the selected billing step and all future steps. In this case, the updated future billing steps will have date ranges greater than the Effective Date.

When using the New End Date processing option to update a billing record, the billing record must belong to the last billing step.

The Lessee Accounting Journal Entry Through Date for the billing record's unit or asset must be less than the Effective Date or New End Date.

When using both the Effective Date and New End Date processing options to update billing records for the last billing step, both updates from the two dates must be successful or all records for the billing step will be excluded from the select batch.

In this scenario, the updates could not be completed for all selected records in the last billing step, so the entire billing step is excluded in order to preserve the date integrity of the billing step. To resolve this situation, process the two updates separately.

This list includes the conditions for records with effect on lease liability set to GRV:

The billing records must be active.

If only using an Effective Date, the suspend date must be greater than the Effective Date.

If only using a New End Date, the suspend date must be greater than the New End Date.

To change the amount, the Effective Date must be equal to the begin and end date of the record.

The New End Date PO is automatically applied to GRV records. No further conditions exist. However, by changing the date of a GRV record, the record is also eligible for a change in amount by the R151161, if needed.

You can run the R15021 as many times as needed to ensure that you have selected the correct records for update, and that the reports created by the update programs in edit mode accurately reflect the changes that you want to make. The reports also indicate the records that cannot be updated, based on the thresholds that are specified in the processing options of the update programs.

Once the reports are accurate, you can then process the update programs (R15116 and R151161) in update mode.

Running Update Programs in Update Mode to Update Recurring Billing Records

When you run the R15116 and R151161 programs in update mode, the system calculates the new recurring billing information for one or more leases, updates the related bill code lines in the Recurring Billings Master table, and suspends the lines being replaced.

To run these programs in update mode, you must:

Set the Update Recurring Billings processing option to 1 (Update recurring billing records).

Enter the batch number for the associated batch in the Batch Number processing option.

You can find the batch numbers on the header and footer of the reports that were created when you selected your records for processing. Note that the batch numbers are different for each set of records you want to process.

When running the R15116 in update mode, the system retrieves information from the Estimated EP Recurring Billings table (F1502WB) and performs these steps in sequential order to calculate the amount update:

Determines whether the type of square footage to be used is rentable or usable.

Retrieves the original (current) billing amount.

If the method of increase involves the amount per square foot, the system divides the original amount by the appropriate square footage from the Lease Master tables.

Applies the method of increase to the original amount, which results in the new gross billing amount; for example:

For percent, the original amount is multiplied by the specified percent.

For amount or amount per square foot, the specified amount is added to the original amount.

For new amount or new amount per square foot, the original amount is replaced by the specified amount.

Applies the rounding controls to the new amount.

Processes the new rounded amount against the original amount to determine the calculated change. For example:

If the threshold is a percent, the original amount is divided by the rounded amount.

If the threshold is an amount, the original amount is subtracted from the rounded amount.

Compares the calculated change with the threshold.

If the change is greater than or equal to the threshold, the rounded amount is accepted for the new billing amount. This step prevents updates with insignificant amounts.

Writes the new records to the Recurring Billings Master table, and suspends the original recurring billing records on the day before the change becomes effective.

When you run the R151161 in update mode, the system retrieves information from the Estimated Lessee Recurring Billings table (F1502WC), and performs these steps in sequential order to calculate the update amount:

Determines whether the specified method of increase is compatible with the asset associated with the billing record.

For example, you can not use a per square foot update method for non-property assets.

Retrieves the original (current) billing amount.

If the method of increase involves the amount per square foot, the system divides the original amount by the appropriate square footage from the Lease Master tables.

Applies the method of increase to the original amount, which results in the new gross billing amount; for example:

For percent, the original amount is multiplied by the specified percent.

For amount or amount per square foot, the specified amount is added to the original amount.

For new amount or new amount per square foot, the original amount is replaced by the specified amount.

Applies the rounding controls to the new amount.

Processes the new rounded amount against the original amount to determine the calculated change. For example:

If the threshold is a percent, the original amount is divided by the rounded amount.

If the threshold is an amount, the original amount is subtracted from the rounded amount.

Compares the calculated change with the threshold.

If the change is greater than or equal to the threshold, the rounded amount is accepted for the new billing amount. This step prevents updates with insignificant amounts.

For records with effect on lease liability set to Yes or GRV, writes the new records to the Recurring Billings Master table, and suspends the original recurring billing records on the original record's begin date.

For records with effect on lease liability set to No, writes the new records to the Recurring Billings Master table, and suspends the original recurring billing records on the day before the change becomes effective.

If any of the changes that are made to the recurring billing records require the associated lease to be remeasured, the system updates the Recalculate Lease Liability field on the lease detail. You must complete the remeasurement or early termination process for the lease before you can continue processing balance sheet lessee accounting information for the lease. See Changing Lease Terms After Schedule Creation for additional information.

Resetting Records Updated by the Global Update their Previous State

Occasionally, you might find that you accidentally process a global update batch in final mode before you intend to. Or, you might determine after the update is complete that the updates are inaccurate. Depending on the type of batch, you can reset the records in the F1502B to their original state before the update was processed.

The reset feature is available only for these types of global update batches:

Batches that include property assets with no effect on lease liability, which are updated by the R15116.

Batches that include non-property assets with no effect on lease liability, which are updated by the R151161.

You use a processing option on the R15116 and R151161 to specify that you want to run the programs in reset mode, and to specify the batch number you want to reset. Reset mode deletes the new records that were created by the last run of the global update, and updates the records to the state they were in before the update was performed.

The programs generate reports that indicate which records were reset and which records were omitted from the process.

The reset feature is not available for records that have an effect on lease liability, as resetting these records could cause issues with the associated amortization schedules. If you determine that the update you processed for these batches was incorrect, you can manually update the records to correct them, or you can process another global update to change the records as needed. Depending on the changes you make, you might be required to remeasure your lease.