Example: Using Nonrecoverable VAT

When you set up a tax rate area that has nonrecoverable VAT, you enter the percent of the nonrecoverable tax on a separate line. Although the system requires a tax authority, it does not use the tax authority for reporting. When you specify a nonrecoverable percent, such as 50, the percent applies to the total tax on the tax rate area. However, if you set up the tax rate area for multiple tax authorities, the system applies the nonrecoverable tax to the first tax authority defined.

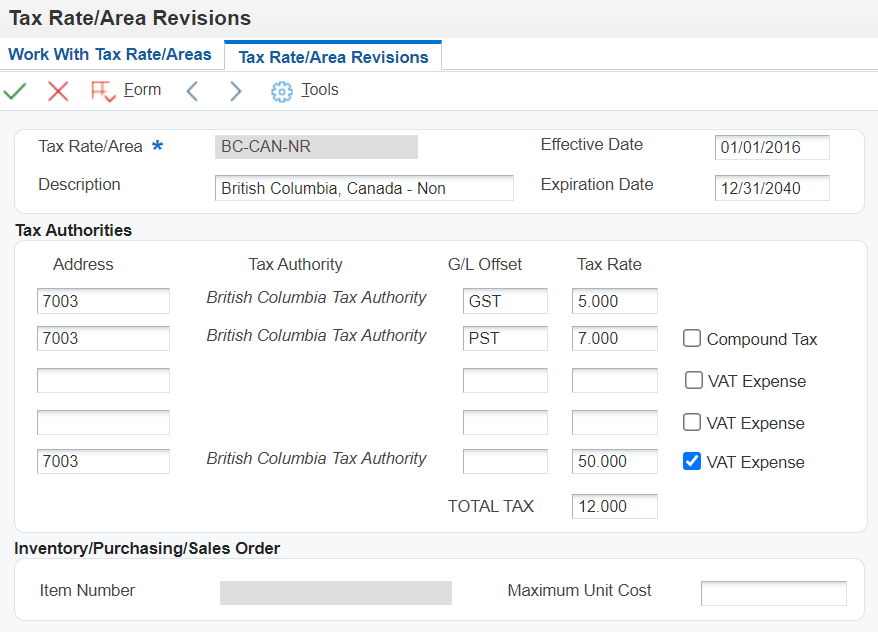

For example, this tax rate/area has two tax authorities specified, as well as a nonrecoverable percent.

When you enter a voucher or invoice and use this tax rate area (ONT), the system will apply the entire 50 percent to the account associated with the GL Offset GST.

In this example, the AAIs associated with the tax rate area point to these accounts:

1.4444 for RTGST

1.4445 for RTPST

If you enter an invoice for a taxable amount of 1,000 USD, the system calculates the tax amount as 150 USD (1,000 x.15) and the gross amount as 1,150 (1,000 + 150). When you post the invoice, the system creates these entries:

Doc Type |

Account |

Account Description |

Debit |

Credit |

Calculation |

|---|---|---|---|---|---|

RI |

3.5010 |

Store Sales |

. |

1,075 |

Taxable + (Tax x 50 percent) |

AE |

1.1210 |

AR Trade |

1,150 |

. |

Taxable + Tax |

AE |

1.4444 |

VAT Payable (GST) |

5* |

. |

(1,000 x 7 percent) - 75 = - 5 |

AE |

1.4445 |

VAT Payable (PST) |

. |

80 |

1,000 x 8 percent = 80 |

*Normally, the entry to VAT Payable is a credit, but because the system calculates a - 5 (credit), it debits the account.