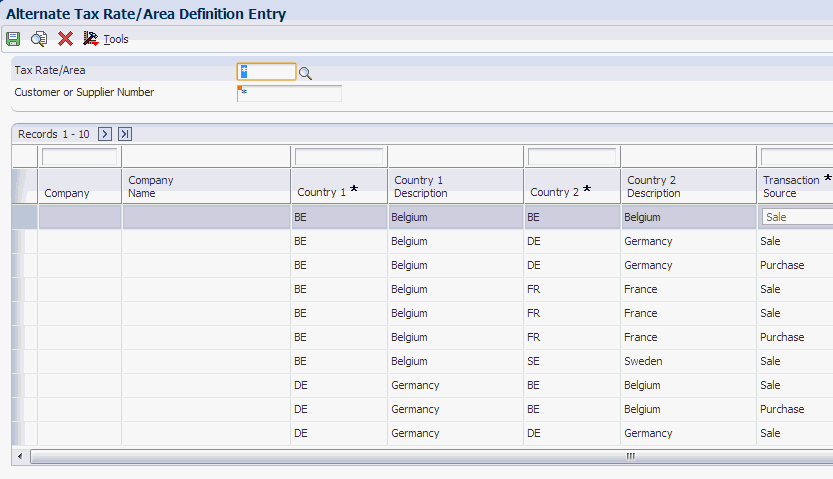

Setting Up Alternate Tax Rate/Area Definitions

Access the Alternate Tax Rate/Area Definition Entry form.

- Company

Specify the company number for which you set up the alternate tax rate/area definitions. The system automatically retrieves the company name from the Company Master (F0010) table. This field is optional. If you leave this field blank, the system creates the definition for all companies.

- Country 1

Specify the first country code from the Countries Alternate Tax Area (00/EC) UDC table. When you enter a transaction, the system retrieves this country code from the business unit or branch plant setup.

- Country 2

Specify the second country code from the Countries Alternate Tax Area (00/EC) UDC table. When you enter a transaction, the system retrieves this country code from the customer (in the case of sales) or supplier (in the case of purchases) address book setup.

- Transaction Source

Specify the transaction type from the Transaction Source (00/ES) UDC table. Values are:

1: Sales transactions.

2: Purchase transactions

- Customer/Supplier Number

Specify the customer (in the case of sales) or supplier (in the case of purchases) address book number for which you set up the alternate tax rate/area definition. This field is optional. If you leave this field blank, the system uses this tax area definition for all customers or suppliers.

- Tax Rate/Area

Specify the tax rate/area to use for the combination. You must select a valid value from the Tax Rate/Area (F4008) table.