Generating 1099 Forms by Using BI Publisher

Use the BI Publisher to create a Blank-Sheet and Pre-printed format for the 1099-INT, 1099-DIV, 1099-MISC, 1099-G, and 1099-NEC forms. You can modify the BIP templates to generate the PDF outputs for the Blank-Sheet and Pre-printed 1099-INT, 1099-DIV, 1099-MISC, 1099-G, and 1099-NEC forms. You can select the Blank-Sheet format radio button to print different forms through the Write Media Application program (P04515). You use the new processing options to define the new BIP version, which is used to run the report through the UBE Summary Report (R04515), to generate Blank-sheet and Pre-printed format. You use BI Publisher to generate 1099 forms using the Rich Text Format (RTF) template.

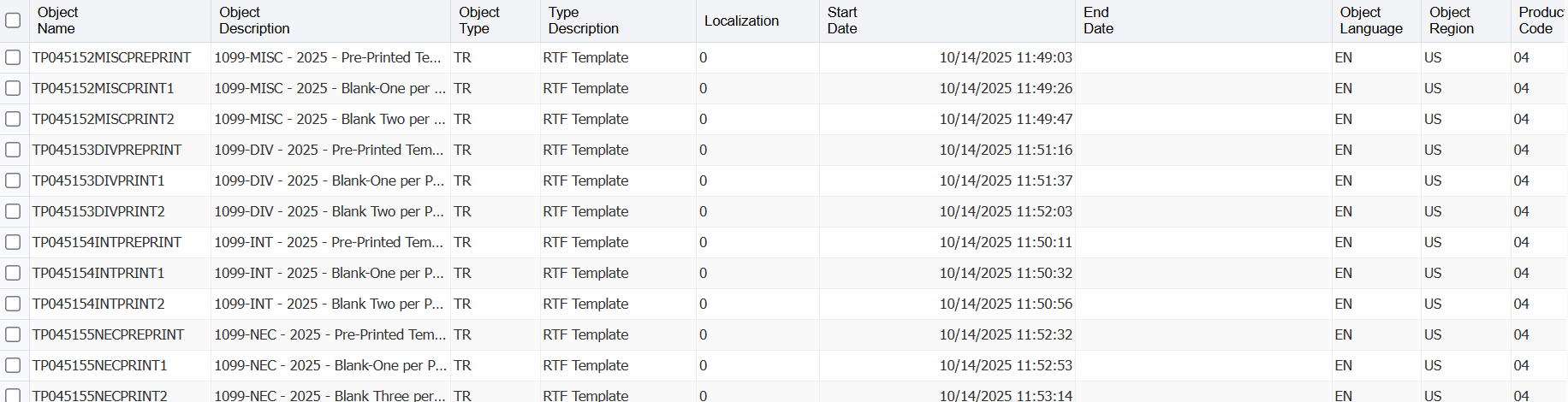

Each format has a template with their design (RTF), and this template is associated with the UBE version through a Report definition. If you create a new batch version or copy an existing version to run Blank-Sheet or Pre-Printed, you should associate it with a template and report definition. If you run a new version that is not associated with a template and report definition or any other versions, then the system will print the old Pre-Printed version. The 1099 templates available are:

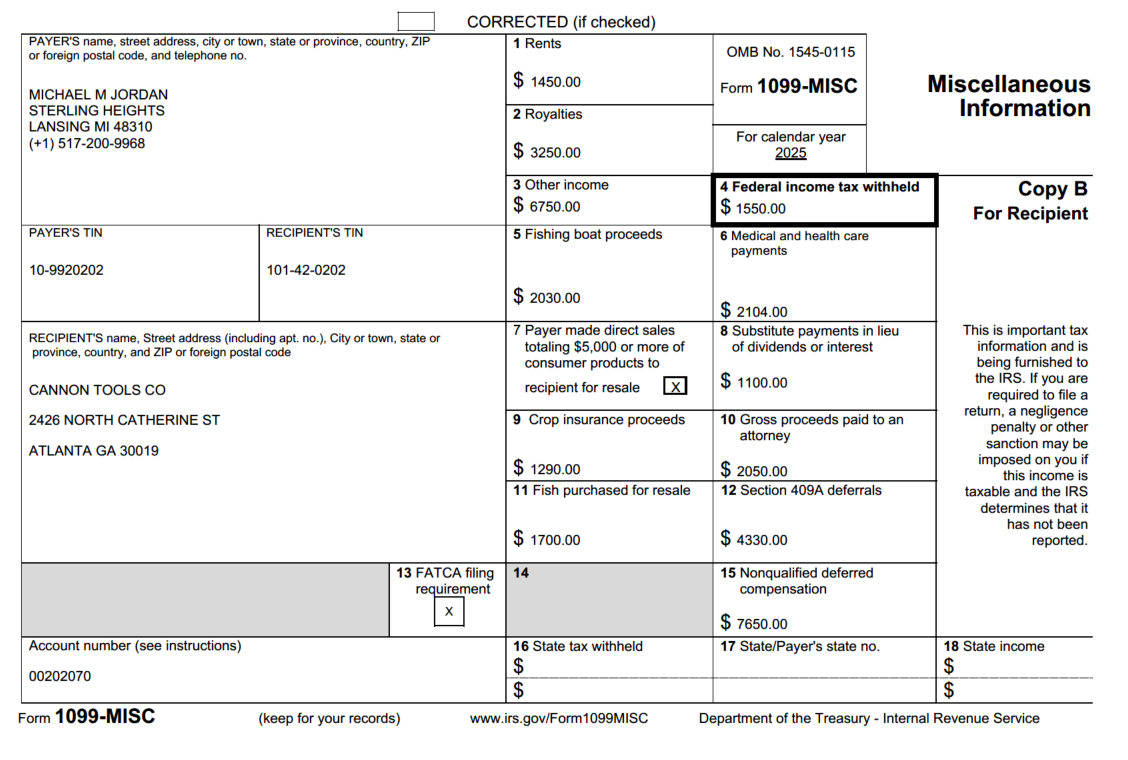

The Blank Sheet format for 1099-Misc, 1099-Div, 1099-Int, 1099-G, and 1099-NEC: This template prints two per page on a blank paper for 1099-Misc, 1099-Div, and 1099-Int, and three per page for 1099-G and 1099-NEC. This is a copy of the Copy B that the IRS provides. This template will print the boxes as well as the data that they contain.

Note:

Note:You can also use this template as an example to customize a template to generate Blank-Sheet format for the other 1099 forms.

Blank-Sheet-Burst template: This template prints one per page on a blank paper. This is a copy of the Copy B that the IRS provides. This template will print the boxes as well as the data that they contain.

The steps to print 1099-INT, 1099-DIV , 1099-MISC, 1099-G, and 1099-NEC form one per page are:

Open the Write 1099 Media application (P04515), select the type of return, the Blank-Sheet Forms option, and then run the application.

Click View Job Status to open the Submitted Job Search application. Select the generated output, and from the Row exit, click the View RD Source option. This will download the source xml.

Open the BI Publisher Object Repository (P95600) and in the Object Name QBE field, enter TP045* to view all the templates available for 1099.

Select the RTF Burst template for the type of return you have selected, and download the template from the Row exit.

On the BI Publisher tab, click the Sample XML button to load the source xml that you have downloaded, and then click the PDF icon under the BI Publisher tab to print the final Burst mode (One per page) PDF output.

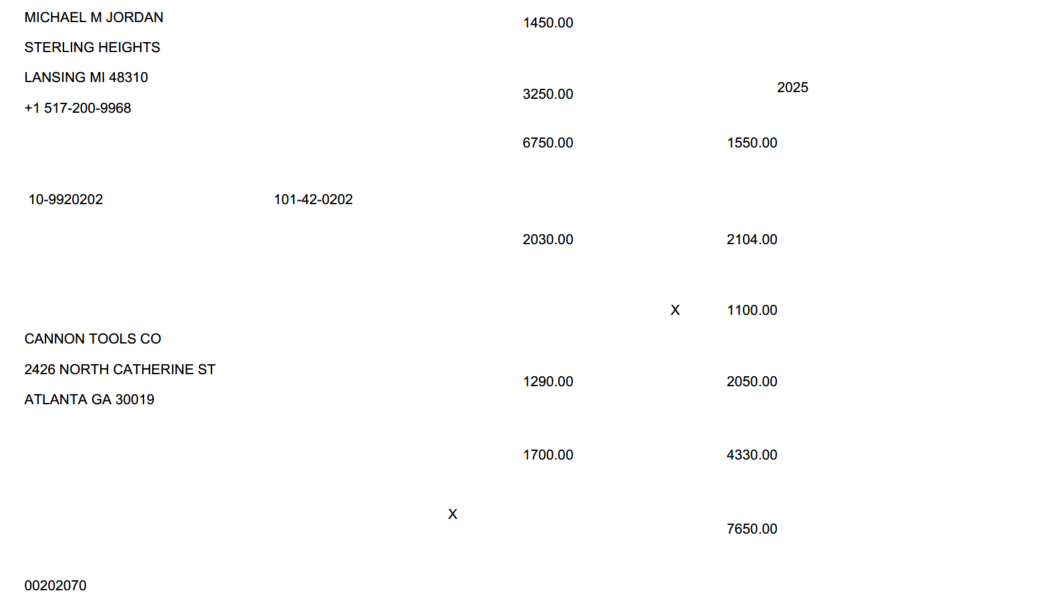

1099-MISC Pre-Printed format - This template prints two forms on each page (2-UP), without Recipient instructions. This is a copy of the "Copy B" provided by IRS, with just the data printed, without any boxes.

Note: You can also use this template as an example to customize a template to generate Pre-Printed format for the other 1099 forms.

Note: You can also use this template as an example to customize a template to generate Pre-Printed format for the other 1099 forms.1099-DIV Pre-Printed format - This template prints two forms on each page (2-UP), without Recipient instructions. This is a copy of the "Copy B" that the IRS provides. This template prints with just data printed without any boxes.

1099-INT Pre-Printed format - This template prints three forms on each page (2-UP), without Recipient instructions. This is a copy of the "Copy B" that the IRS provides, with just the data printed, without any boxes.

1099-G Pre-Printed format - This template prints three forms on each page (3-UP), without Recipient instructions. This is a copy of the "Copy B" that the IRS provides, with just the data printed, without any boxes.

1099-NEC Pre-Printed format - This template prints three forms on each page (3-UP), without Recipient instructions. This is a copy of the "Copy B" that the IRS provides, with just the data printed, without any boxes.