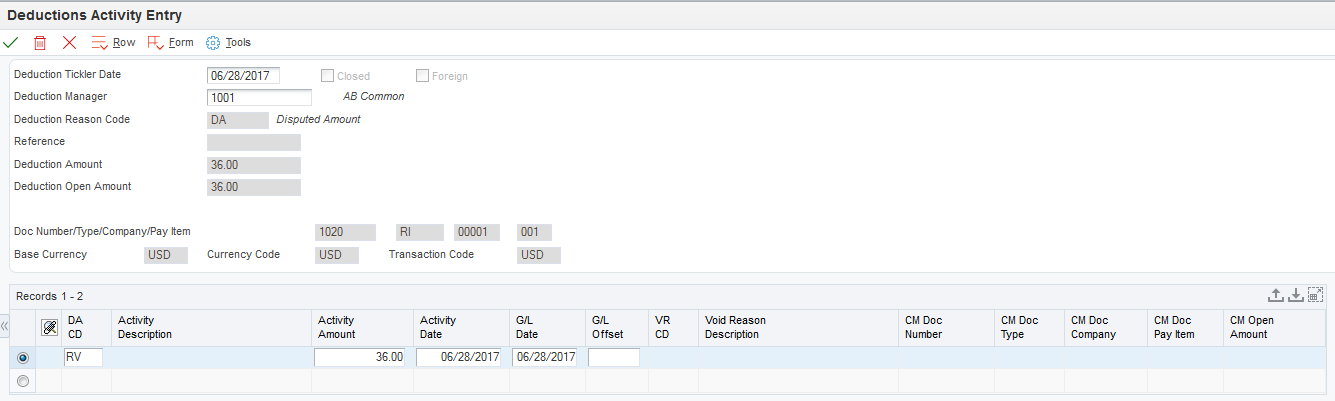

Applying an Activity Code to a Deduction

Access the Deductions Activity Entry form.

When resolving a deduction, you can assign multiple resolution activities. For example, you might decide to create a chargeback for part of the deduction and then write off the remaining amount. To do this, you enter the deduction reason and amount for each portion of the deduction in the detail area of the Deductions Activity Entry form.

- Deduction Tickler Date

Enter the date on which the deduction needs to be researched. This field is optional. If you leave this field blank, the system uses the G/L date of the deduction as the default value.

- Deduction Manager

Enter the address book record of the deduction manager who needs to research the deduction. This field is optional.

- Activity Amount

Enter the domestic amount applied to a deduction. The currency associated with this amount appears in the Base Currency Code field (BCRC).

- Activity Date

Enter the date on which the deduction activity was entered.

- G/L Offset

Enter the code that determines the trade account that the system uses as the offset when you post transactions.