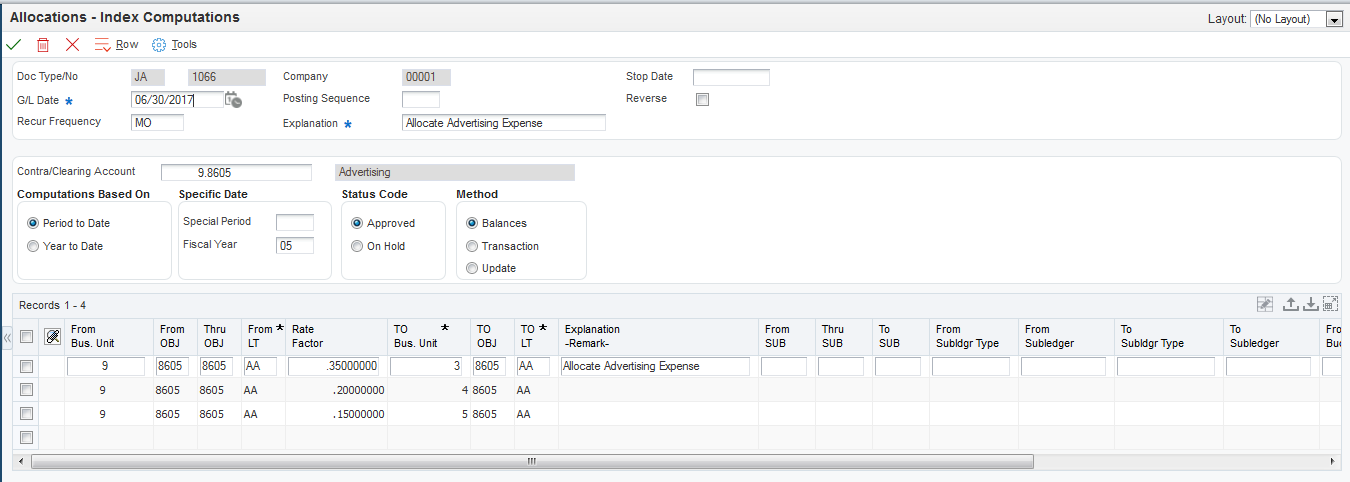

Creating Indexed Allocations

Access the Allocations - Index Computations form.

- Company

Enter the company number. The system uses the current period, fiscal year, and general ledger date of the company for calculations and for identifying errors based on the General Ledger Date field. The number in this field does not affect the journal entries created.

- Explanation

Enter text that describes the allocation. The text appears in the first of two description lines for each journal entry that the computation creates. This field is required.

- Contra/Clearing Account

Enter the account to use for a balancing or offsetting journal entry. This field is required for all ledger types that are required to balance. You must enter the account in the business unit.object.subsidiary format.

Leave this field blank for non-balancing ledger types, such as budgets, and use the annual budget fields in the detail area of the Allocations - Index Computations form.

- Period to Date and Year to Date

Enter a code that controls whether the allocation is based on month-to-date or year-to-date amounts. Values are:

M: Month-to-date.

The basis is period activity for the month (net monthly postings). These do not include prior month corrections in the allocation base.

Y: Year-to-date.

The basis is the period-end balance. For profit and loss accounts, this is the sum of all net postings for the year. For balance sheet accounts, this is the cumulative (inception-to-date) balance. These include prior month corrections in the allocation base. If you have recurring annual allocations, set them up as automatically reversing entries by selecting the Reverse check box.

- Balances, Transaction, and Update

Select one of these options to specify how the system creates allocation journal entries or updates:

Balance Method. Create journal entries based on the balance of an account or the balance of a range of accounts in the F0902 table. For annual budgets, you must use this method; journal entries are not created.

Transaction Method. Create journal entries on a one-for-one basis for each posted transaction in the F0911 table for the account range specified.

Update Method. Update the account balance for non-AA ledger types in the F0902 table and do not create any journal entries.

- From Bus. Unit (from business unit)

Enter a specific business unit or *xxxxx (asterisk and the company number) to specify all business units for the company. If you enter *xxxxx, the system uses all business units for that company and bypasses any business unit security that is set up. For example, if you specify an allocation for *00001, the allocation is for all business units in company 00001. Even if your access is normally restricted to business unit 3, the allocation bypasses business unit security.

You cannot enter *00000 to specify all business units in all companies.

- To Business Unit

Enter a specific business unit or * to post to the business unit entered in the From Business Unit field.

- From Budget Code

Enter a value in this field only for annual budgets. Values are:

1: Requested budget amount.

2: Approved budget amount.

3: Final budget amount.

Note: These three codes are valid only when you specify the Balances method and have the recurring frequency set to AN (annual).Blank is not a value.

- TO OBJ (to object)

Enter a specific account or * to post to the same account indicated in the From Object field.

- To SUB (to subsidiary)

Enter * in this field to carry the subledger in the From OBJ (from object) field to the Thru OBJ (thru object) field. The TO OBJ field must also contain *.

- TO LT

Enter the ledger type. If you leave this field blank for annual budgets, the default is BA. If you leave this field blank for other ledger types, the default is AA.

- Explanation -Remark

Enter text that describes the allocation. The text appears in the second of two description lines for each journal entry that the computation creates.