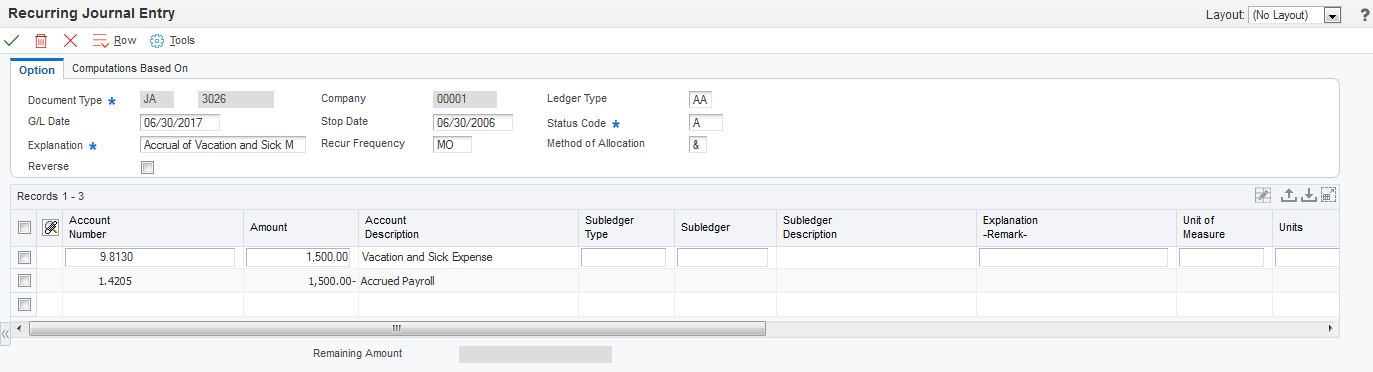

Creating Recurring Journal Entries

Access the Recurring Journal Entry form.

- Explanation

Enter the text that appears in the first of two description lines for each journal entry that the allocation creates. This field is required.

- Method of Allocation

Enter a code that indicates how the system is to calculate the allocation journal entries. The system uses this code in conjunction with the values in the Amount field. Values are:

&: Fixed amount method.

The system allocates the amount that you specify in the Amount field. You can use this method to create recurring journal entries.

%: Percentage method.

The system uses the percentage that you specify in the Amount field to perform the allocation.

U: Unit method.

The system creates a percentage from the units that you specify in the Amount field to perform the allocation. It then allocates the amount in the from and through account range according to the percentages. Examples include square feet and number of employees.

Note: If you specify the percentage or unit allocation method, the Computations Based On tab is activated. In this case, the currency for the ledger type or account from which the amount is distributed must be the same as the currency for the ledger type or business unit company on which the computation is based.- From Obj/Sub and Thru Obj/Sub

Enter the beginning account and ending account in a range of accounts. Only amounts posted to accounts in this range are allocated.

- Using MTD, YTD, or Budget (M/Y/B)

Enter a code that controls whether the allocation is based on month-to-date, year-to-date, or final budget amounts. For the percentage and unit methods, this field is required. Values are:

M: Month-to-date.

The basis is period activity for the month (net monthly posting for the month).

Month-to-date allocations do not include prior month corrections in the allocation base, while year-to-date allocations do.

Y: Year-to-date for recurring allocations.

The basis is the period-end balance. For profit and loss accounts, this is the sum of all net postings for the year. For balance sheet accounts, this is the cumulative (inception-to-date) balance. For accrual recurring allocations, select the Reverse option.

B: Final budget.

This is also known as original budget in the JD Edwards EnterpriseOne General Accounting and JD Edwards EnterpriseOne Job Cost systems. No journal entries are created. Use only with budget ledger types.

- Period

Enter a number that identifies the general ledger period to use for based-on amounts. If you leave this field blank, the system uses the current period of the company for the based-on amounts.

- Amount

Enter a number that identifies the amount that the system adds to the account balance of the associated account number. Enter credits with a minus sign (–) either before or after the amount.

If you use the percentage allocation method, enter the percentage that you want to allocate to a specific account in this field. The percentages do not have to equal 100, but the debits and credits must balance if the option to require ledgers to balance is selected in the Ledger Type Master Setup program (P0025).

If you use the unit allocation method, enter the number of units for the account in this field. The system allocates the amount based on a percentage of the number of units of the account over the total number of units.