Calculating Overhead for a Joint Venture Using a User Defined Method

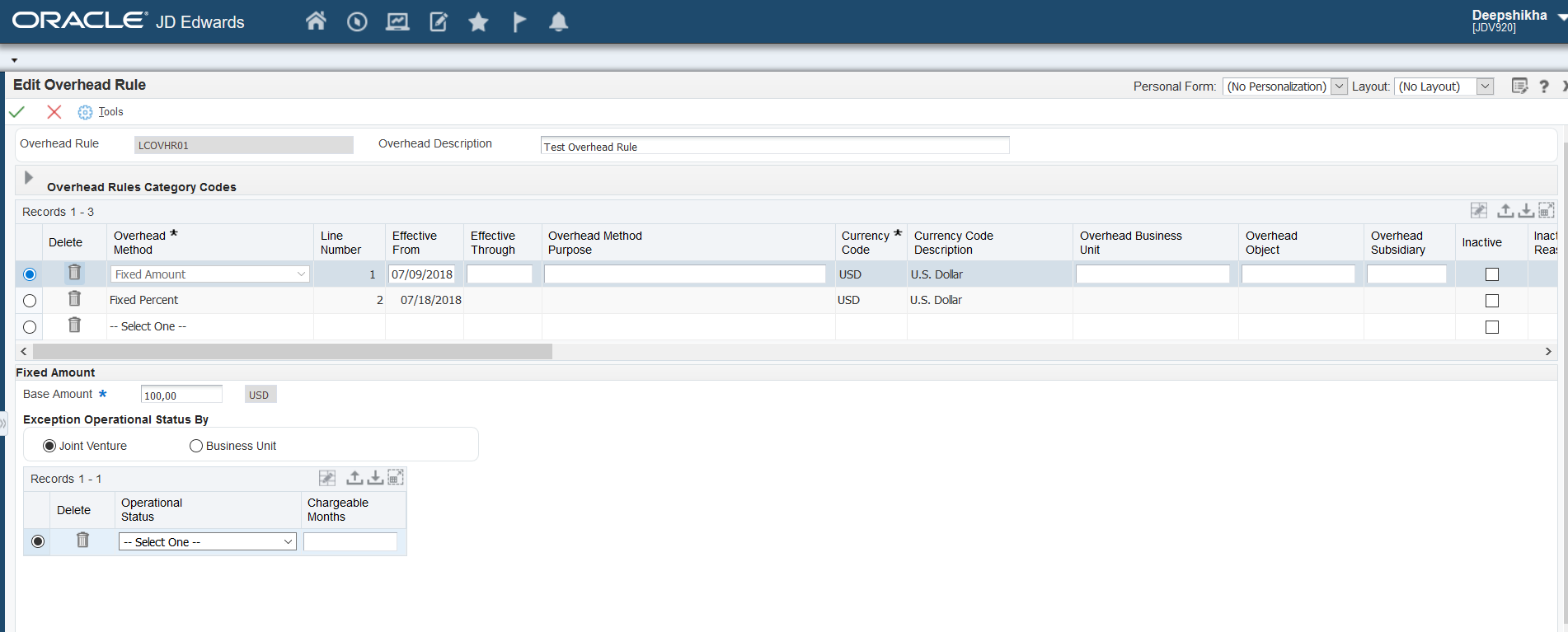

Overhead amounts are calculated based on the calculation methods associated with the overhead rule. An overhead rule (header) has one or more detail lines, with different calculation methods.

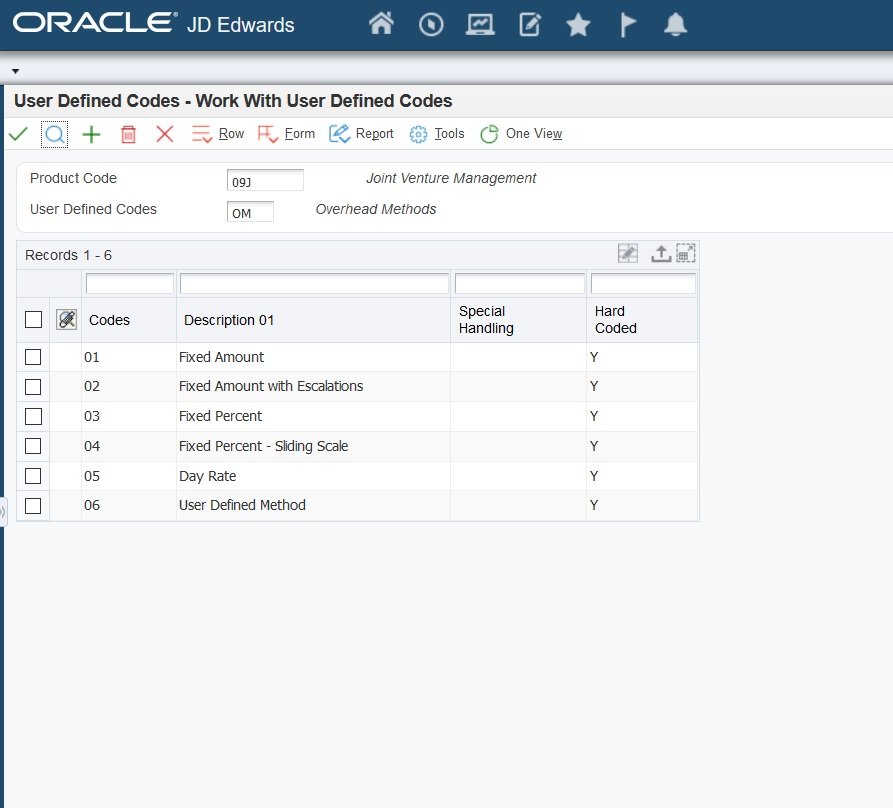

The Overhead Methods UDC (09J/OM) has 6 values: the first 5 values are associated with predefined methods for overhead calculations and UDC value 06 is used to specify a user defined method.

How can you extend Joint Venture Management to allow the addition of new methods for overhead calculation without making changes to the Overhead Calculation UBE (R09J408)?

Perform the following steps:

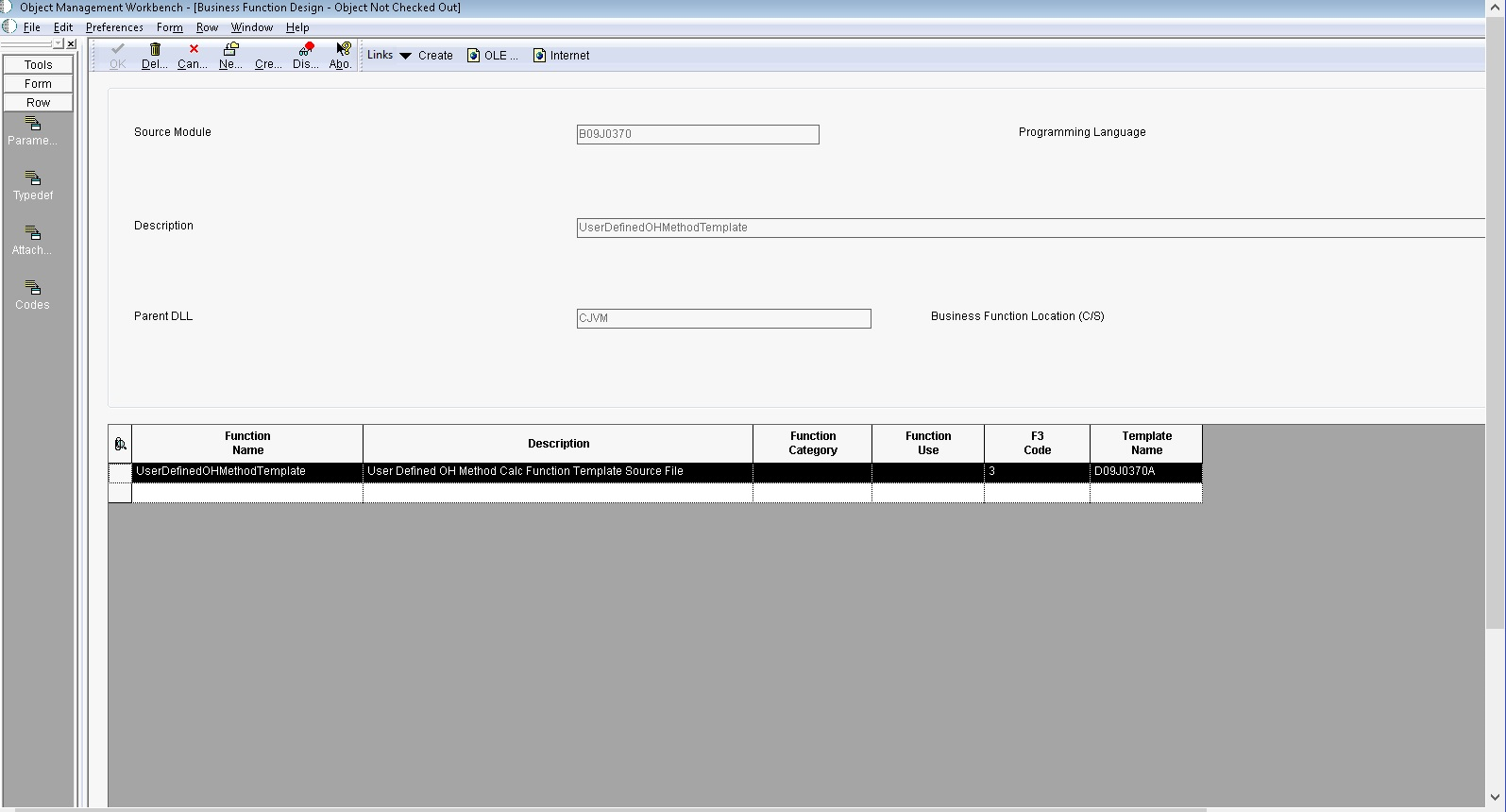

Create a custom business function (BSFN) that will be responsible for performing the overhead calculation's logic using the data structure template D09J0370.

This data structure will allow parameters to pass from the overhead calculation to the custom BSFN.

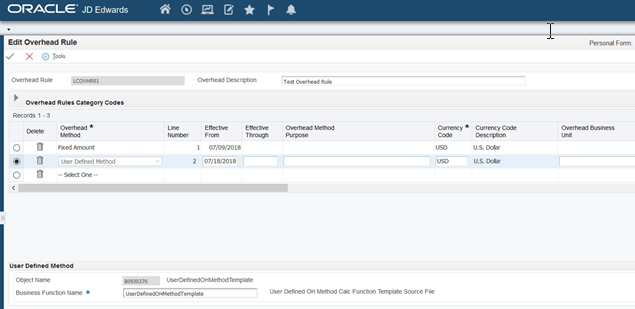

Use the custom business function in an overhead rule.

Access the Overhead Rules application, and select the 'User Defined Method' option from the Overhead Method drop-down list (UDC 09J/OM code '06') under an overhead rule.

On the Method Details subform, provide the name of the custom business function for the overhead calculation.

Note: Steps 1 and 2 can be repeated to include any number of user defined methods.

Note: Steps 1 and 2 can be repeated to include any number of user defined methods.Assign this overhead rule to any company, joint ventures, joint venture parent business units, or business units.

Execute the overhead calculation UBE to calculate overhead amounts for a joint venture or business unit.