Understanding the Joint Venture Process for Billing and Paying the Partners

The expenses incurred and revenue generated by a joint venture are shared among the joint venture partners. You record expenses and revenue for actual amounts, and then bill the distributed expenses or pay the distributed revenue to the partners based on ownership percentages maintained in the Division of Interest (DOI) tables (F09J20 and F09J21).

Distribution records are marked as an invoice, voucher, or journal entry depending on the accounts used for the transactions. Transactions in the revenue account ranges will be vouchers and transactions in the capital cost account ranges or expense account ranges will be invoices based on the account type (expense, capital cost, or revenue) used for the transactions. Transactions for insider business units will be journal entries unless the DOI indicates that invoices and vouchers are to be generated.

See Transaction Type.

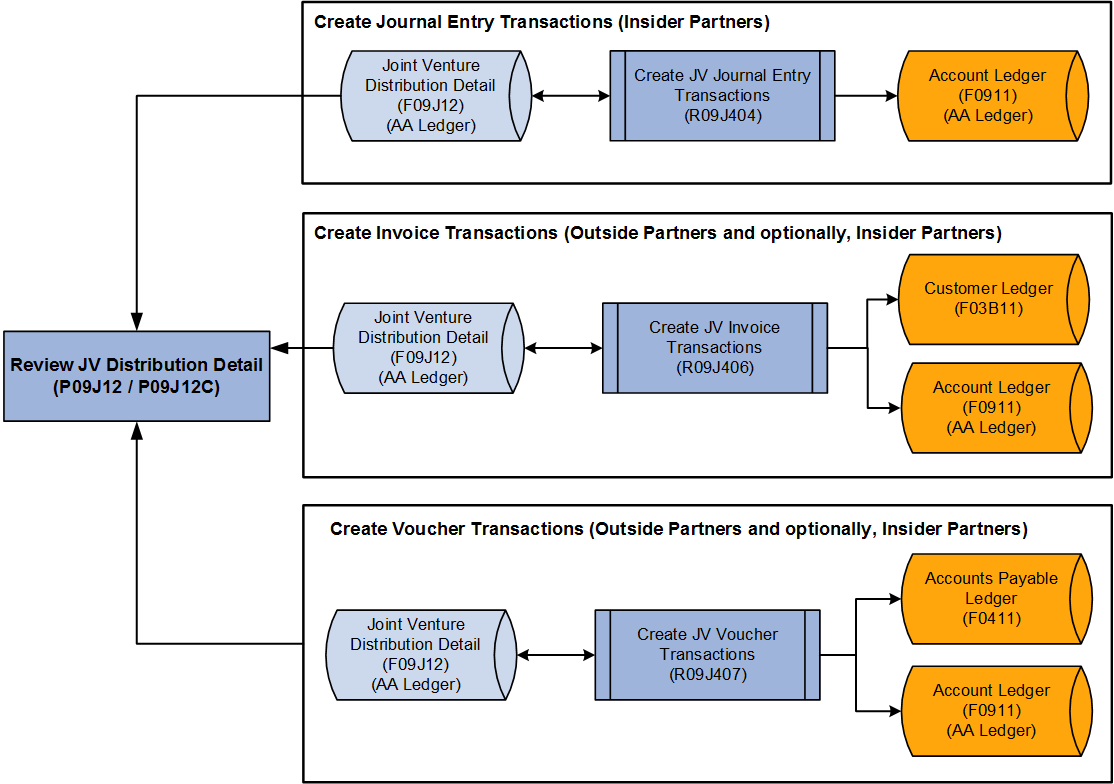

You run separate batch programs to generate journal entries, vouchers, and invoices for joint ventures. The batch programs process selected distribution records in the F09J12 table and create joint venture journal entries, invoices, and vouchers. This results in the creation of general ledger journal entries in the Account Ledger table (F0911), invoices in the Customer Ledger table (F03B11), and vouchers in the Account Payable Ledger table (F0411). The F09J12 table is updated with information about the resulting journal entries, invoices, or vouchers.

Cutback Process

The amount billed and paid to the partners through invoices and vouchers and journal entries must create balanced journal entries. The Cutback AAIs are used to create these balanced journal entries. The business unit used for the Cutback accounts is the business unit of the original transaction. The Cutback AAIs used are JVCBR for Revenue, JVCBC for Capital Cost, and JVCBE for Expenses.

See Joint Venture Cutback AAIs (Release 9.2 Update).

The entries to the cutback accounts are always summarized by the cutback account and the business unit where the transaction originated. Therefore, there may be multiple entries to a cutback account depending on the number of business units associated with the originating transactions.

Journal Entry, Voucher, and Invoice Batches for Joint Ventures

The batch processes create invoice, voucher, and journal entry document batches for each managing company that is associated with the selected distribution records. The document batches are created with joint venture specific batch types:

JI (Joint Venture Invoices)

JV (Joint Venture Vouchers)

JG (Joint Venture Journal Entries)

These joint venture specific batch types enable you to distinguish transactions that originate from the JD Edwards EnterpriseOne Joint Venture Management system. You cannot make any changes (for example: edit, delete or void) to the transactions belonging to these joint venture batch types from outside the Joint Venture Management system.

Approving and Posting Joint Venture Document Batches

The system allows you to automatically approve and post the batches after they are created. When you set the system to automatically approve the batches, the approval process set up in the general accounting constants for journal entries, accounts payable constants for vouchers, and accounts receivable constants for invoices are overridden. The General Ledger Post program (R09801) posts the batches using post versions specific to the joint venture batch types.

The post versions are:

ZJDE0048 for JI batch type

ZJDE0049 for JV batch type

ZJDE0047 for JG batch type

Records Processed Successfully and Records with Errors and Warnings

When you run the batch programs to create journal entries, vouchers, and invoices, the system prints a report listing the number of documents for which journal entries, vouchers, or invoices were created and the batch numbers that were generated in the process. The report also includes a message if there are records in error. Each document that is successfully created has a unique document number that the system populates in the Distribution Document field in the F09J12 table. The system also updates additional fields for the records on the F09J12 table that links to the resulting journal entry created in the Account Ledger table (F0911), invoice in the Customer Ledger (F03B11), and voucher in the Account Payable Ledger (F0411). The fields for the journal entries are: Distribution Document Number, Distribution Document Company, Distribution Document Type, Distribution G/L Date, Distribution Line Number, Distribution Line Extension, and Distribution Ledger Type. In the case of invoices and vouchers, only these fields will be populated: Distribution Document Number, Distribution Document Company, Distribution Document Type, Distribution Pay Item, and Distribution G/L Date.

The document that resulted in error does not have a distribution document, but has a unique distribution ID that the system populates in the Distribution ID field. You use this distribution ID to identify the specific error in the work center. After you review and resolve the errors, you can rerun the program to generate the journal entries, vouchers, or invoices. The system also populates the distribution ID for the document that is successfully created but has warnings. You can reference the specific warning message in the work center using the distribution ID. Error or warning messages for cutback entries are written to the work center in line number 0 (zero).