Calculations

After validating whether withholding amounts should be calculated, the system calculates the withholding and saves the calculated amount for ISS to the Service Nota Fiscal Withholding Amount by Service table (F76B428), the calculated amounts for IRRF and INSS to the Service Nota Fiscal Withholding Amounts by Formula table (F76B427), and the calculated amounts for PIS, COFINS, and CSLL to the Service Nota Fiscal Wh by Formula Installment table (F76B429). The system reads the values in the F76B427, F76B428, and F76B429 tables when you modify calculated amounts using the Nota Fiscal Withholdings program (P76B4220) and when you print the nota fiscal.

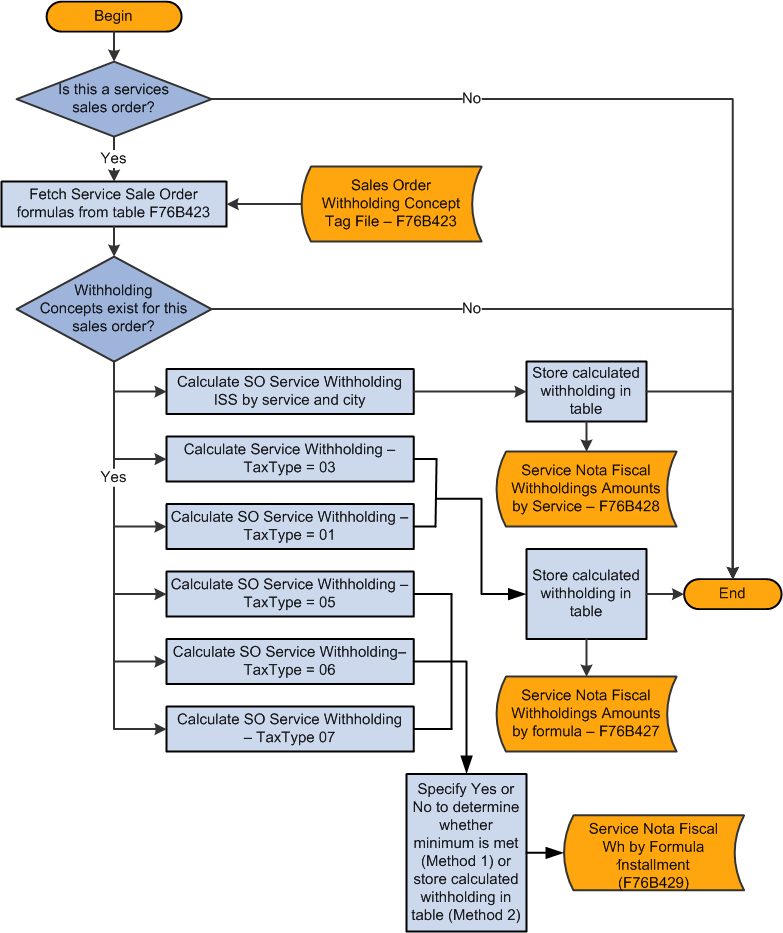

The following process flow shows how the system determines whether to calculate withholding and the tables to which it saves the withholding information. If the company and transaction is set up to use Withholding Method 1, then the system writes a value of Y (yes) or N (no) to the Service Nota Fiscal Wh by Formula Installment table (F76B429). If the company and transaction is set up to use Withholding Method 2, then the system writes the withholding amounts to the F76B429 table.