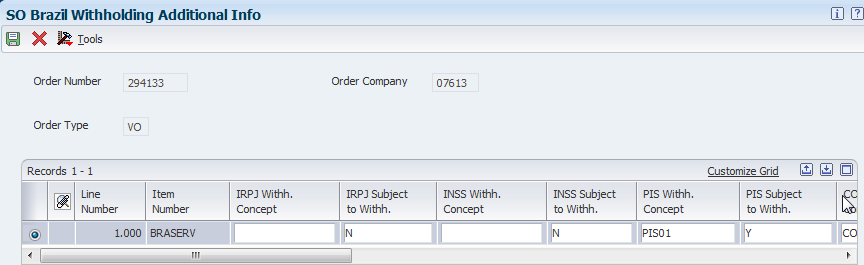

Entering Withholding Information for Sales Orders for Services

Access the SO Brazil Withholding Additional Information form.

The system populates the values on the form based on the values for the item number and legal company address book number. You can modify the withholding concepts and whether to apply the withholding to each line for a service on a sales order.

The forms that appear when you use the Regional Info menu options to modify withholding information are slightly different from the form that appears when you add a sales order.

- IRPJ Withh. Concept ([Imposto de Renda de Pessoa Jurídicais] withholding concept)

Enter a tax type code for IRPJ from the F76B0401 table. You set up tax code types in the Review A/P Tax Code program. You must select the IRPJ Withholding Flag option before you can enter a value in this field.

- IRPJ Subject to Withh.

Select to cause the system to calculate withholding for this tax type when you run the Generate Nota Fiscal program. You must select this option before you can enter a value in the IRPJ Withholding Concept field.

- INSS Withh. Concept

Enter a tax type code for INSS that exists in the F76B0401 table. You set up tax code types in the Review A/P Tax Code program. You must select the INSS Withholding Flag option before you can enter a value in this field.

- INSS Subject to Withh.

Select to cause the system to calculate withholding for this tax type when you run the Generate Nota Fiscal program. You must select this option before you can enter a value in the INSS Withholding Concept field.

- PIS Withh. Concept

Enter a tax type code for PIS that exists in the F76B0401 table. You set up tax code types in the Review A/P Tax Code program. You must select the PIS Withholding Flag option before you can enter a value in this field.

- PIS Subject to Withh.

Select to cause the system to calculate withholding for this tax type when you run the Generate Nota Fiscal program. You must select this option before you can enter a value in the PIS Withholding Concept field.

- COFINS Withh. Concept ([Contribuição para Financiamento da Seguridade Social] withholding concept)

Enter a tax type code for COFINS from the F76B0401 table. You set up tax code types in the Review A/P Tax Code program. You must select the COFINS Withholding Flag option before you can enter a value in this field.

- COFINS Subject to Withh.

Select to cause the system to calculate withholding for this tax type when you run the Generate Nota Fiscal program. You must select this option before you can enter a value in the COFINS Withholding Concept field.

- CSLL Withh. Concept ([Contribuição Social sobre o Lucro Líquido] withholding concept)

Enter a tax type code for CSLL from the F76B0401 table. You set up tax code types in the Review A/P Tax Code program. You must select the CSLL Withholding Flag. option before you can enter a value in this field.

- CSLL Subject to Withh.

Select to cause the system to calculate withholding for this tax type when you run the Generate Nota Fiscal program. You must select this option before you can enter a value in the CSLL Withholding Concept field.

- City Code

Enter a value from the Fiscal City Code (76B/FC) UDC table to specify the city in which the service was sold.

- Service Type Code

Enter a tax type code for ISS from the F76B0401 table. You set up tax code types in the Review A/P Tax Code program. You must select the ISS Withholding Flag option before you can enter a value in this field.

- ISS Subject to Withh.

Select to cause the system to calculate withholding for this tax type when you run the Generate Nota Fiscal program. You must select this option before you can enter a value in the Service Type Code field.

- Sales Service Fiscal Code

The system retrieves the sales service fiscal code from the Service Fiscal Code table (F76B405). You cannot change the default value on this form.

- Service National Code

The system retrieves the service national code from the Service Type Code table (F76B408). You cannot change the default value on this form.