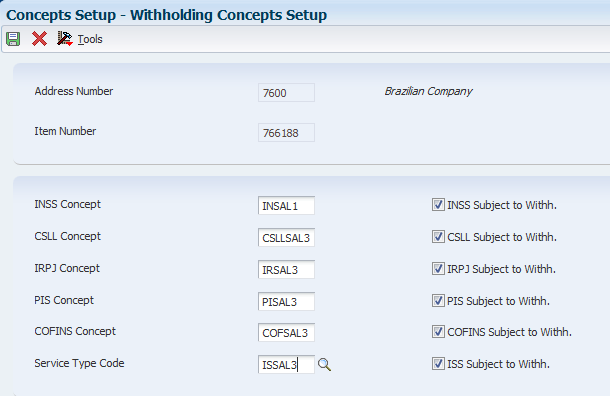

Setting Up Withholding Concepts for the Sale of Services

Access the Withholding Concepts Setup form.

- Address Number

Enter the company address book number to which the tax types apply. Leave this field blank to associate only an item number to the withholding type.

Note:You can set up the withholding concepts by only the company, by only the item number, or by both the company and item number. Enter values in both the Address Number and Item Number fields to associate the withholding to the combination of the address book and item number. Either the Address Number or Item Number field must be completed. At a minimum, you must complete either the Address Number or Item Number field.

- Item Number

Enter the short item number of the service for which the withholding tax applies. Leave this field blank to associate only a company address book record to the withholding type.

Note:You can set up the withholding concepts by only the company, by only the item number, or by both the company and item number. Enter values in both the Address Number and Item Number fields to associate the withholding to the combination of the address book and item number. At a minimum, you must complete either the Address Number or Item Number field.

- INSS Concept

Enter a tax type code that exists in the F76B0401 table for INSS retention. You set up tax code types in the Review A/P Tax Code program. You must select the INSS Subject to Withh. option before you can enter a value in this field. The system uses the value that you set up as a default value when you enter sales orders for services.

- INSS Subject to Withh. (INSS subject to withholding)

Select this option to cause the system to calculate withholding for this tax type when you run the Generate Nota Fiscal program. You must select this option before you can enter a value in the INSS Concept field.

- CSLL Concept

Enter a tax type code that exists in the F76B0401 for CSLL retention. You set up tax code types in the Review A/P Tax Code program. You must select the CSLL Subject to Withh. option before you can enter a value in this field. The system uses the value that you set up as a default value when you enter sales orders for services.

- CSLL Subject to Withh. (CSLL subject to withholding)

Select to cause the system to calculate withholding for this tax type when you run the Generate Nota Fiscal program. You must select this option before you can enter a value in the CSLL Concept field.

- IRPJ Concept

Enter a tax type code that exists in the F76B0401 for IRPJ retention. You set up tax code types in the Review A/P Tax Code program. You must select the IRPJ Subject to Withh. option before you can enter a value in this field. The system uses the value that you set up as a default value when you enter sales orders for services.

- IRPJ Subject to Withh. (IRPJ subject to withholding)

Select to cause the system to calculate withholding for this tax type when you run the Generate Nota Fiscal program. You must select this option before you can enter a value in the IRPJ Concept field.

- PIS Concept

Enter a tax type code that exists in the F76B0401 for PIS retention. You set up tax code types in the Review A/P Tax Code program. You must select the PIS Subject to Withh. option before you can enter a value in this field. The system uses the value that you set up as a default value when you enter sales orders for services.

- PIS Subject to Withh. (PIS subject to withholding)

Select to cause the system to calculate withholding for this tax type when you run the Generate Nota Fiscal program. You must select this option before you can enter a value in the PIS Concept field.

- COFINS Concept

Enter a tax type code that exists in the F76B0401 for COFINS retention that exists in the F76B0401 table. You set up tax code types in the Review A/P Tax Code program. You must select the COFINS Subject to Withh. option before you can enter a value in this field. The system uses the value that you set up as a default value when you enter sales orders for services.

- COFINS Subject to Withh. (COFINS subject to withholding)

Select to cause the system to calculate withholding for this tax type when you run the Generate Nota Fiscal program. You must select this option before you can enter a value in the COFINS Concept field.

- Service Type Code

Enter a tax type code for ISS that exists in the Taxes Setup by City and Service table (F76B409). You set up service type codes in the Taxes Setup by City & Service program (P76B409). You must select the ISS Subject to Withh. option before you can enter a value in this field.

- ISS Subject to Withh. (ISS subject to withholding)

Select to cause the system to calculate withholding for this tax type when you run the Generate Nota Fiscal program. You must select this option before you can enter a value in the Service Type Code field.