Understanding Tax Calculations for PIS/PASEP, COFINS, and CSLL (Release 9.2 Update)

The system calculates PIS/PASEP, COFINS, and CSLL contributions automatically when you run the automatic payment process. This section discusses the automatic payment process. You can also enter the contribution amounts when you process manual payments.

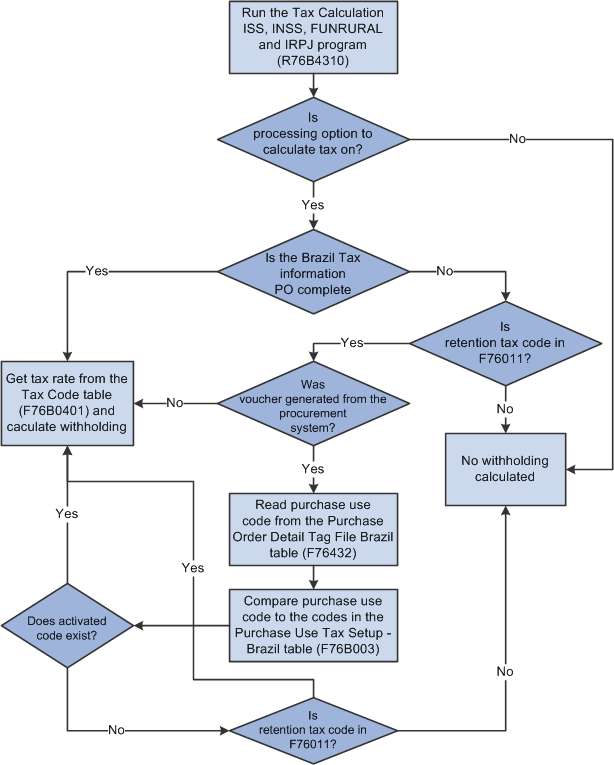

The system uses this process flow to determine whether to calculate PIS/PASEP, COFINS, and CSLL contributions:

If withholdings apply to the payment, the system:

Checks the Voucher Tax Processed table (F76B4012) to verify that ISS and INSS taxes were calculated.

For payments to suppliers, checks that the negative withholding lines for ISS, INSS, and FUNRURAL are included in the payment.

If using Withholding Method 2 for transactions for the sale of services, verifies that the supplier does not have another payment in process because the system uses accumulated amounts that might be affected by another payment.

Calculates the withholding for each line on the voucher.

Each withholding that the system calculates is generated as a new line of the voucher.

Creates a line in the F76B0411 table for PIS/PASEP, COFINS, and CSLL contributions.

When using Withholding Method 2 for the sale of services, vouchers subject to PIS/PASEP, COFINS, and CSLL contributions do not generate contributions if the accumulated gross amount in a month is less than the established minimum. In the first payment in which the accumulated gross amount is greater than the minimum, the system creates a line in the F76B0411 table.

When using Withholding Method 1 for the sale of services, vouchers subject to PIS/PASEP, COFINS, and CSLL contributions do not generate contributions if the total of the PIS/PASEP, COFINS, and CSLL contributions does not exceed the minimum amount established for the company and transaction type in the PIS-COFINS-CSLL Minimum Withholding Setup (P76B410) program.

Writes two lines to the F0411 table; one that is a positive amount that is paid to the fiscal authority and one that is a negative amount that is paid with the voucher.

Updates the F76B4017 table when using Withholding Method 2.

The system accumulates by month, tax ID of the supplier, tax ID of the company, and tax type (PIS/PASEP, COFINS and CSLL) the gross amounts and contribution amounts paid if using Withholding Method 2.

When using Withholding Method 2, if the accumulated gross amount in a month is less than the minimum amount in the Minimum Withholding Amount processing option in the Brazilian Payment Process - PO program, or if the first payment in the accumulated gross amount is greater than the minimum, the system writes the tax amount and the gross amount for the voucher line in the PIS, COFINS and CSLL Below Min. table (F76B411A).