Understanding the São Paulo Electronic Nota Fiscal Process

The electronic nota fiscal (NFe) process enables you to generate an XML file that includes information about the nota fiscal, which is sent to the fiscal authority. The fiscal authority validates the file and returns information to you, including an assigned number for the NFe.

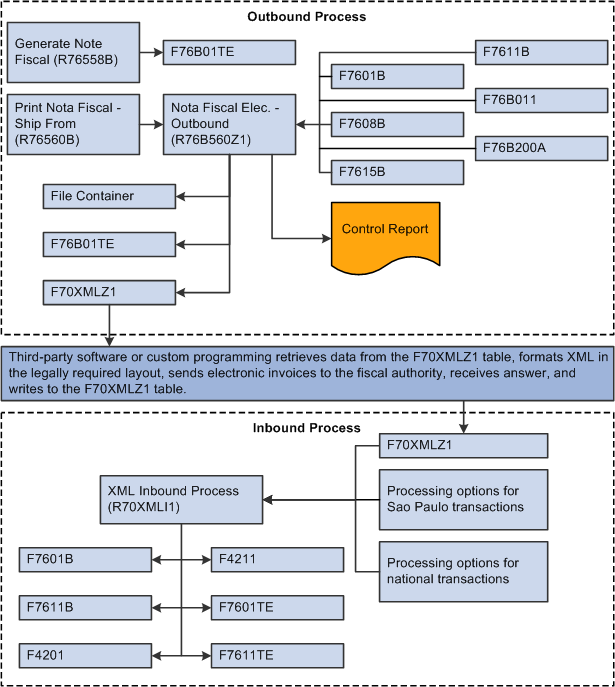

JD Edwards EnterpriseOne software provides the programs that you use to generate the XML file and to review and update the information that is returned to you by the fiscal authority. You must use a third-party software or develop your own custom programming to:

Read the XML data from the JD Edwards EnterpriseOne tables.

Format the XML data in the legally required layout.

Send the data to the fiscal authority.

Write the information returned from the government to JD Edwards EnterpriseOne tables.

JD Edwards EnterpriseOne software provides a process for transactions that occur in the state of São Paulo and one for transactions that are outside of São Paulo (national transactions).

To use the São Paulo NFe process:

Generate the nota fiscal by running the Generate Nota Fiscal program (R76558B).

This program generates the initial record in the NFe Header table (F76B01TE),

Print the final nota fiscal by running the Print Nota Fiscal – Ship From program (R76560B).

As the last process within the Print Nota Fiscal – Ship From program, the system launches the Nota Fiscal Elec. - Outbound program (R76B560Z1) if you set the processing options in the Print Nota Fiscal – Ship From program to do so. You can also run the Nota Fiscal Elec. - Outbound program from a menu option.

Use the XML Transaction Review program (P70XMLZ1) to review the data that you wrote to the tables for the outbound transaction.

Use the custom program that you develop or that you obtain from a third-party to format in the legally required layout the XML data generated by the JD Edwards EnterpriseOne programs.

Use the custom program that you develop or that you obtain from a third-party to send the formatted XML data to the fiscal authority.

Use the custom program that you develop or that you obtain from a third-party to receive the data that the fiscal authority sends back.

Run the XML Inbound Process program (R70XMLI1) to update your system with the information that you receive back from the fiscal authority.

Use the XML Transaction Review program to review the data that you receive.

Use the Nota Fiscal Elect. Revision program (P76B01TE) to review updated nota fiscal information and release the nota fiscal that was put on hold by the Nota Fiscal Elec. - Outbound program.

Update journal entries for Brazil taxes by running the Update Sales – Brazil program (R76B803).

Update the base-software sales tables by running the Sales Update program (R42800) if you did not set the processing option in the Update Sales – Brazil program to update the base-software tables.

The Nota Fiscal Elec. - Outbound program assigns these values to the outbound records as it writes them to the XML Transaction Interface table (F70XMLZ1):

Transaction type of BRNFEO

Transaction group of BRNFE

The records retain this transaction group for the duration of the NFe process.

Status of P

This diagram shows the batch processes and tables that are used by the São Paulo NFe process:

The system changes the status of the records to b when the third-party software or custom program reads the data from the F70XMLZ1 table.

The third-party software or custom program assigns the BRNFI-SP transaction type to the São Paulo transactions records when it writes data to the F70XMLZ1 table after sending the records to and receiving an answer from the fiscal authority.

The status remains b until the JD Edwards EnterpriseOne software processes the returned record. After processing, the status becomes P.