Understanding Withholding for the Sale of Services

When you sell goods and services, you prepare and send to your customers a nota fiscal for the goods or services. The nota fiscal includes information about the transaction, including the taxes applied to the transaction.

When you sell services to a customer, you must include lines on the nota fiscal for the supplier withholding taxes that are applied to the services that you sell. These withholding amounts are withheld from the payment that the customer makes to you. The system calculates withholding amounts for these withholding types:

Imposto de Renda de Pessoa Jurídicais (IRPJ)

Instituto Nacional do Seguro Social (INSS)

Imposto sobre Serviços (ISS)

Programa de Integração Social (PIS)

Contribuição para Financiamento da Seguridade Social (COFINS)

Contribuição Social sobre o Lucro Líquido (CSLL)

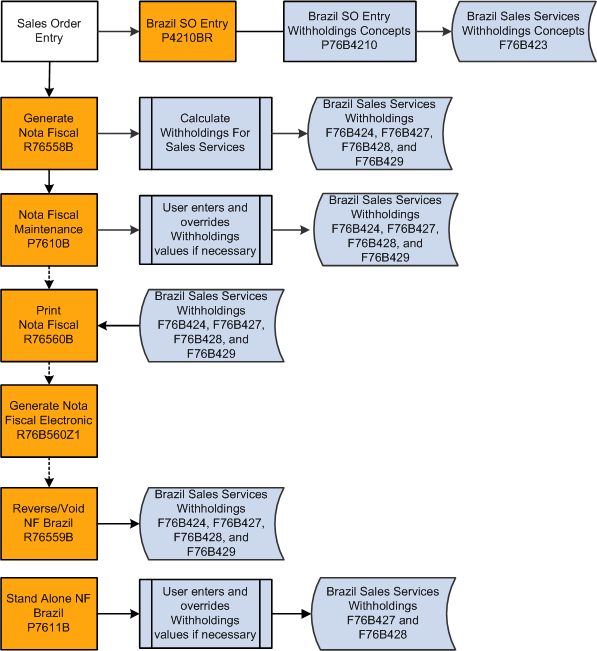

The JD Edwards EnterpriseOne applications that you use to enter sales order and nota fiscal information and to generate notas fiscais enable you to calculate withholding and include the withholding lines on the nota fiscal that you send to your customer. You can provide the withholding amounts on the service notas fiscais that you generate from the sales order process, and when you create a stand-alone nota fiscal.

When you enter a sales order for a service that you sell, the system enables you to enter withholding concepts for the sales order. The system uses the concepts to obtain the information needed to calculate the withholding amounts when you generate the nota fiscal. When you print the nota fiscal, the system retrieves the calculated amounts and includes them on the nota fiscal. If you need to modify the nota fiscal or void it, the system accesses the stored withholding information and updates it to include the changes.

This process flow shows the programs that you use to process notas fiscais and work with withholding for the sale of services: