Process Overview

Much of the data that you need to report is available in the base and China-specific software tables. However, you will need to set up some additional information to include in the XML files that you generate to report your transactions.

You can generate the XML files in any order you choose. However, because some setup is used by multiple programs, Oracle recommends that you:

Set up the primary functionality that is used across all modules.

This functionality includes the document titles that you want to print in the XML file, alternative UDC descriptions, currency code information, and so on.

See Setting Up Your System to Generate CNAO Version 2 Audit Files

Set up and generate the Shared Information XML file.

The CNAO Shared Information XML file includes data about the reporting organization as well as metadata about records in the other CNAO XML files. Some of the data exists in the tables provided for the electronic accounting books for China. Other data includes customer and supplier master records; address book records for employees, customers and suppliers; and data that you enter in new programs for CNAO version 2 audit files.

Because some of the data that you enter in the new setup programs for the shared information XML file is used by the programs for other XML files, you must complete some of the setup described in the Setting Up and Generating the CNAO Shared Information XML File chapter before generating the XML files for other XML files

See Setting Up and Generating the CNAO Shared Information XML File

Process your payroll, and then set up and generate the Payroll XML file.

Because China-specific payroll processing is not available in the JD Edwards EnterpriseOne system, you must add data about your employees, payroll periods, payroll categories, and the payroll amounts that you paid to employees in new programs provided in this ESU. You must process your payroll before setting up and generating the payroll XML file because you must enter up-to-date information about payroll transactions before you generate the XML file.

Setting Up and Generating Payroll Information for CNAO Audit Files for China

Process and post your general ledger records, and then set up and generate the general ledger XML file. The process for generating the general ledger XML file includes two sub-processes. After you set up subsidiary information, you must run several programs to update the subsidiary information for general ledger; accounts receivable and accounts payable; purchase orders; and, sales orders. You must also run several programs to update financial statement data such as cash flow, income statements, and balance sheets. The subprocesses each populate a table that is used by the XML generation program to produce the final output file.

See Setting Up and Generating GL Information for CNAO Audit Files

Process and post your accounts payable and accounts receivable records, and then generate the AP/AR XML file.

See Setting Up and Generating AP and AR Information for CNAO Audit Files

Set up and generate the fixed asset XML file.

See Setting Up and Generating Fixed Assets Information for CNAO Audit Files

Detailed process flows for each XML file are available in the chapters that describe how to generate each XML file.

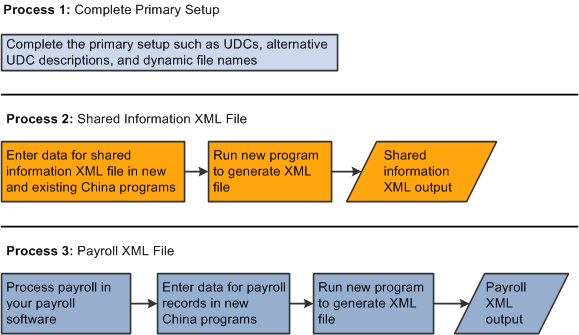

This illustration shows the high-level process flow for the primary setup, the shared information XML file, and the payroll XML file.

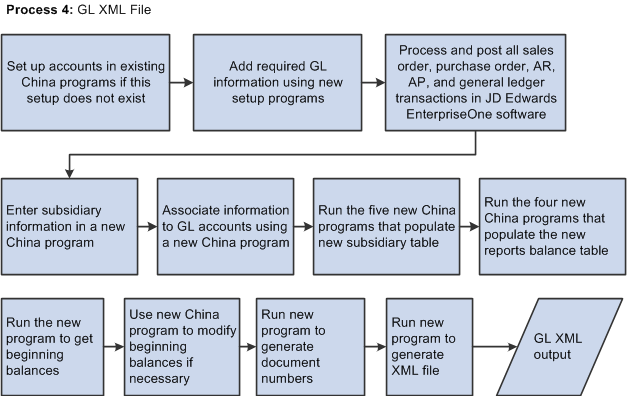

This illustration shows the high-level process flow for the general ledger XML file.

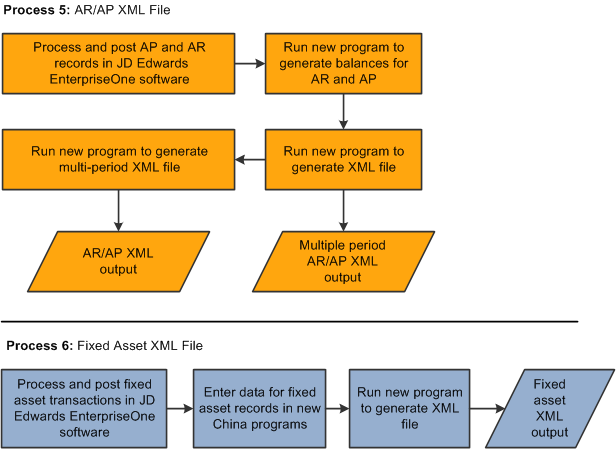

This illustration shows the high-level process flow for the accounts receivable and accounts payable, and the fixed asset XML files: