Adding Invoice Response Details for GST Invoices

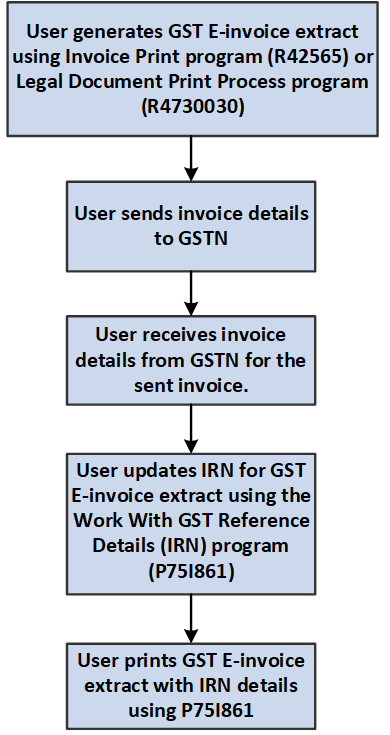

After you receive the Invoice Reference Number (IRN) from the tax authorities for your GST invoices, you can add an electronic invoice response and view an existing electronic invoice response using the Work With GST Invoice Reference Details (IRN) program (P75I861). The program also enables you to reprint the GST invoices with the IRN details.

IRN is a unique legal number generated by the tax authorities for an electronic tax invoice. IRN must be referenced in all relevant documents for a taxable supply including tax invoices, commercial or AR invoices, receipts, and documents issued for post-supply adjustments (for example, debit notes, supplementary invoices, credit notes, and so on).

You can review the invoice details by accessing the GST Tax File Information program (P75I807) from the Row menu of the P75I861 program.