Offsetting and Distributing ITC

You select the GST unit, period, and year for which you want to offset the ITC against the liability amounts in the GST Credit Distribution program (P75I831).

The system uses the payment date specified in the Payment Date processing option for the P75I831 program and:

Retrieves the effective offset rule that has an expiration date equal to or nearest to the payment date

For example, if the payment date is March 15, 2017, and two offset rules exist with expiration dates in that period: March 20, 2017, and March 31, 2017. The system uses the offset rule with the expiration date of March 20, 2017.

Offsets the available ITC against the liability amounts based on the order of priority set up in the retrieved offset rule

Consider an example of three transactions (an interstate purchase, an interstate sale, and an intrastate sale) that originated from a business unit in Karnataka state. The ITC and the liability amounts are illustrated according to the transaction types in the table below. All the amounts are in INR.

Transaction Originated From

Destination State

Transaction Type

ITC on IGST

Liability on CGST

Liability on SGST

Liability on IGST

Karnataka

Tamil Nadu

Purchase

13,000

Karnataka

Maharashtra

Sale

10,000

Karnataka

Karnataka

Sale

4,000

5,000

The system offsets the ITC on IGST against the liability amounts in this order according to the offset rule:

IGST ITC of 13,000 is utilized to offset the IGST liability of 10,000

Balance IGST ITC = 3,000

Balance IGST liability = 0

Balance IGST payment to be made to the government= 0

Balance IGST ITC of 3,000 is utilized to offset the CGST liability of 4,000

Balance IGST ITC = 0

Balance CGST liability = 1,000

Balance CGST payment to be made to the government= 1,000

When CGST liability of 1,000 is paid to the government, balance CGST liability = 0

Because there is no balance IGST ITC to offset the SGST liability of 5,000,

SGST liability = 5,000

Balance SGST payment to be made to the government= 5,000

When SGST liability of 5,000 is paid to the government, balance SGST liability = 0

This example illustrates how the ITC for IGST is used to offset the liability according to the recommended offset rule for IGST. This example does not include ITC for CGST and SGST. But if they exist, then the rules for CGST and SGST will also be applied, and the system will utilize the ITC on each GST type in this order:

ITC on IGST

ITC on CGST

ITC on SGST

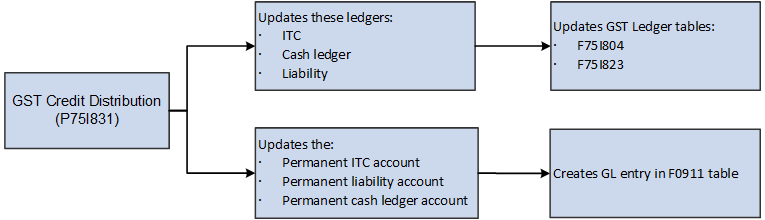

The GST Credit Distribution Setup program passes amount and account details to create a pair of credit and debit entries in the Account Ledger table (F0911) for the amounts being distributed. The system decreases the ITC closing balances and increases the TL and CL closing balances in the F75I804 table, and also updates the ITC, TL, and CL ledgers in the F75I823 table using a single batch number for the credit and debit entries.

The system creates GL distribution journal entries in the F0911 table, crediting the permanent ITC account, crediting the permanent cash ledger account, and debiting the permanent liability account.