Transferring GST Liability on Inter-Branch Transfer of Goods

When you create a stock transfer order of non-personal consumption goods to an interstate branch plant, the system transfers the GST on the order to the interstate branch plant during the voucher match process and updates the GST Tax File table (F75I807).

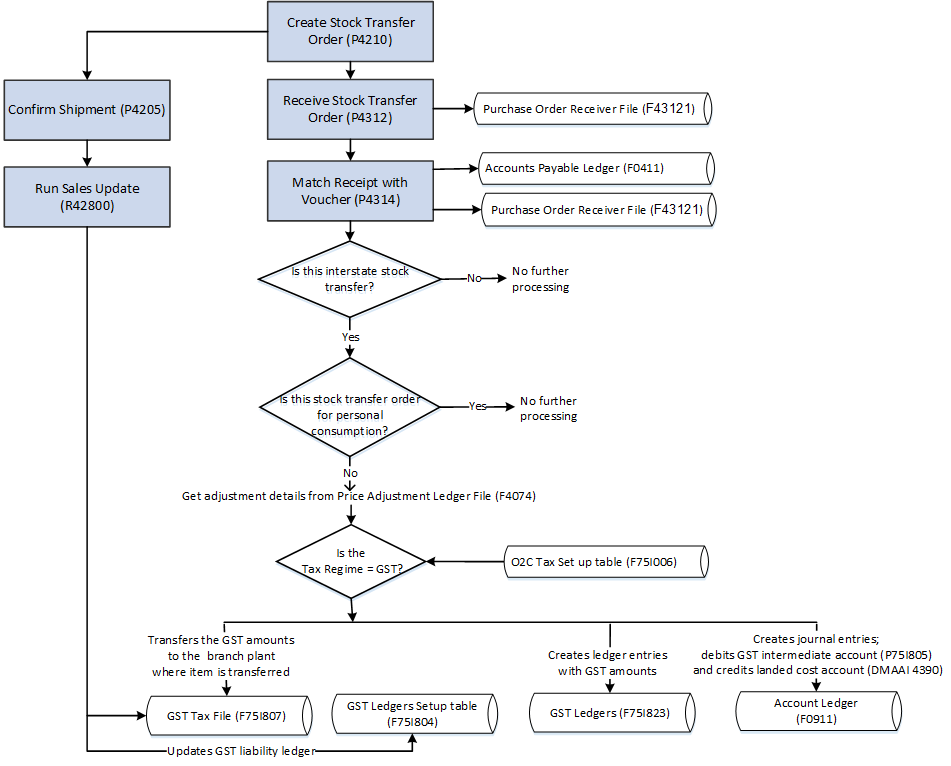

This illustration shows the stock transfer process in the JD Edwards EnterpriseOne system for non-personal consumption goods that are applicable for GST.

To create stock transfer orders for non-personal consumption goods:

Create stock transfer orders in the in the Sales Order Entry program (P4210).

Receive the items on the stock transfer orders using the standard PO Receipts program (P4312).

Create vouchers and match the receipt with the vouchers in the Voucher Match program (P4314).

The system checks for these conditions:

The order is for interstate transfer of items.

The system determines whether an order is an inter-branch order by comparing the GSTIN of the from and to branch plants in the stock transfer order.

The order is not for personal consumption.

Tax regime is for GST.

Note: The system displays the zero amount landed cost lines in the P4314 program if you have enabled the Zero Amount Landed Cost processing option from the Process tab.If these conditions are met, the system retrieves the adjustment details from the F4074 table, creates journal entries, and updates these tables:

GST Tax File table (F75I807)

Account Ledger table (F0911)

GST Ledgers-IND-75I table (F75I823)