Understanding the ANX-2 Process

After the supplier uploads the sales information in the ANX-1 report, you, the recipient, will view your inbound information in the GST ANX-2 report provided by the tax authority.

ANX-2 is for claiming the input tax credit (ITC). The supplier's sales information in ANX-2 must be matched with your purchase records before accepting them for claiming ITC.

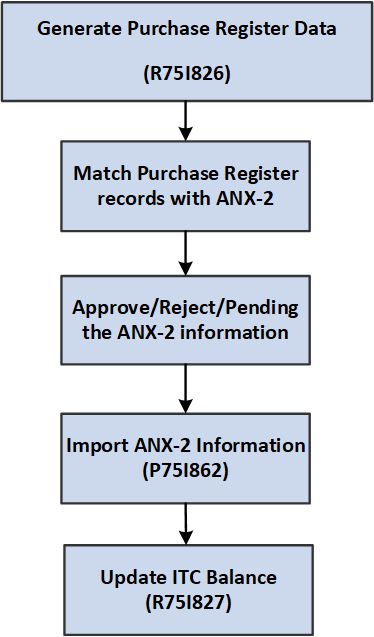

ITC is granted based on the information reported in ANX-2. There are a number of procedural requirements for submission of ANX-2 which include matching the ANX-2 information (pertaining to inward supplies) with your purchase information and taking an appropriate action on the records such as assigning the status Accept, Pending, or Reject to each record and declaring the ITC eligibility for the accepted records. Unmatched records should be either kept pending for further assessment or rejected. You perform the matching process and take action on the records using the tool provided by the tax authority. The tool supports the matching process only when your purchase information is in the Purchase Register format provided by the tax authority.

Therefore, you must first extract your purchase information from the JD Edwards system in this Purchase Register format.

Then, you can upload your Purchase Register report to the tax authority-provided tool and match the records with the supply information that is available in ANX-2. After you accept the matched records, the tax authority prepares the ANX-2 acknowledgement with the ITC amount that you have claimed.

You must import the ANX-2 information in the JD Edwards system to keep a record of your ITC information.