Understanding the P2P Process for Services Applicable for GST

Under the GST regime, customers are charged on the services provided to them. Service providers are responsible for issuing invoices and charging taxes to their customers. The tax components that the customer pay to the service provider are CGST, SGST, and GST Cess when the service provider is from the same state, and IGST and GST Cess when the service provider is from a different state. The service provider is required to deposit the tax amount to the tax authority after collecting the tax amount from the customer. The customer can claim a credit for the tax paid on the service received after the service provider remits the tax to the government following the statutory requirements. Customers can claim a credit only when the service is used to run their businesses.

When certain categories of registered persons pay the suppliers for services received and the amount paid includes GST duty, the transactions are subject to tax deducted at source (TDS) when the total value of the supply exceeds a specific statutory limit in a financial year.

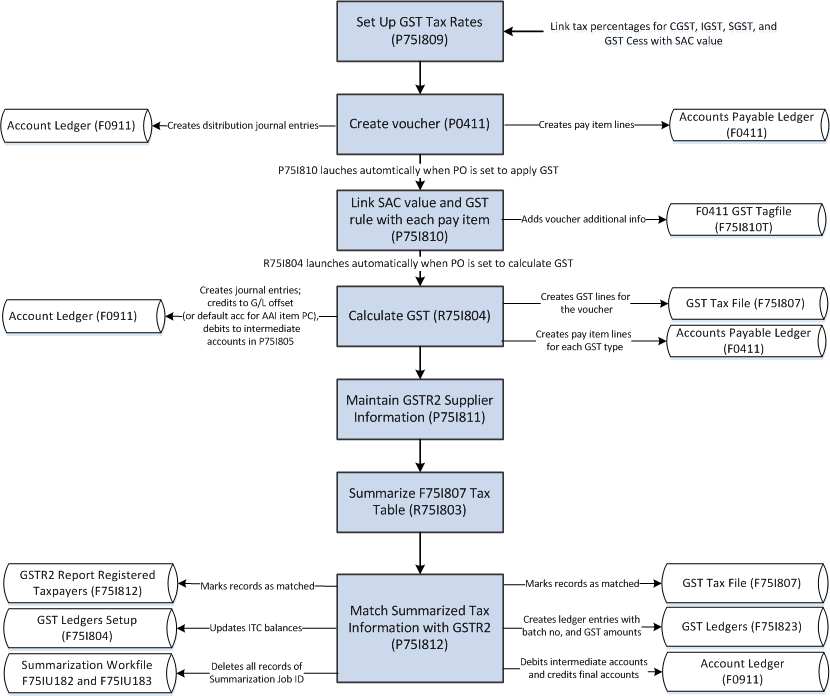

This illustration describes the procure to pay (P2P) process for GST applicable services in the JD Edwards EnterpriseOne system.

To obtain services in the GST regime:

Create vouchers in the A/P Standard Voucher Entry program (P0411).

After you create the vouchers, the system enables you to associate the GST SAC value and GST rule with the vouchers that you entered. The GST SAC value determines the rate of tax that applies to services. Additionally, you also enter the TDS type if TDS applies to the transaction.

Calculate GST using the A/P Vouchers program (R75I804).

If the transaction is subject to TDS, calculate the TDS using the Calculate TDS program (R75I515).

Maintain the GSTR2 Information provided by the government using the GSTR2 Report program (P75I811).

Summarize the tax information in the GST Tax File table (F75I807) in a specific format using the GST Tax File Summarization program (R75I803).

Match the summarized tax information with GSTR2 information to claim input tax credit (ITC) on your purchases.

See Matching the Summarized Tax Data with GSTR2A to Claim ITC