Understanding the Mexico VAT Recognition Process

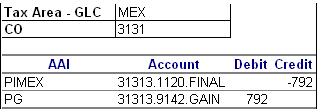

The VAT process for Mexico calculates VAT on the gain or loss amounts based on the tax explanation code and the tax area of the associated document. The JD Edwards system has three reports that calculate the VAT amount for gain or loss amounts on the AP and AR transactions. The system includes in the reports only those tax explanation codes that start with V or A. When you run these reports, the system reclassifies the VAT on gain and loss amounts that is generated on payments or receipts to VAT accounts.

These examples depict the payment and receipts process with the inclusion of the VAT process for Mexico during the accounts payable and accounts receivable transaction processing respectively:

Accounts Payable

You post a voucher for 1100 units when the exchange rate is 10.

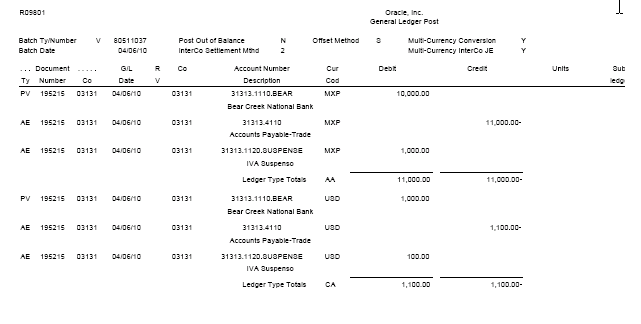

This illustration shows how the system generates the journal entries:

During the time of payment, the exchange rate is 2.8. This diagram illustrates an example of journal entries that the system creates when you make a payment:

In this case, the gain amount is (1100*2.8 - 1100*10 = -7920).

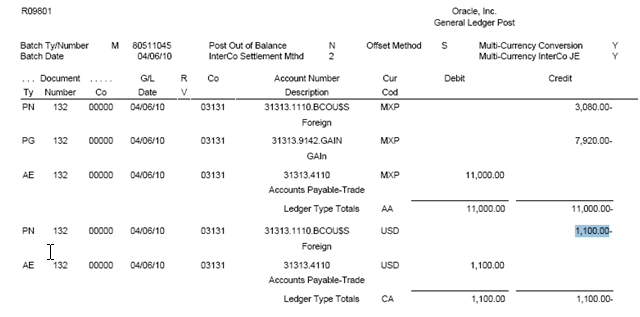

However, the Mexican Localization software generates only certain entries and does not reclassify VAT on the gain or loss amounts. This diagram illustrates an example of journal entries that the system creates without reclassifying VAT:

When you post a payment, the system classifies the VAT amount separately, but does not process gain or loss amounts. If there is any setup error on the Mexican solution, the system posts the payment batch, but reflects error in the journal entry associated with reclassification.

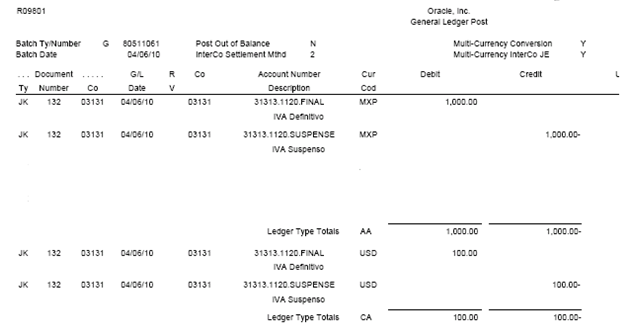

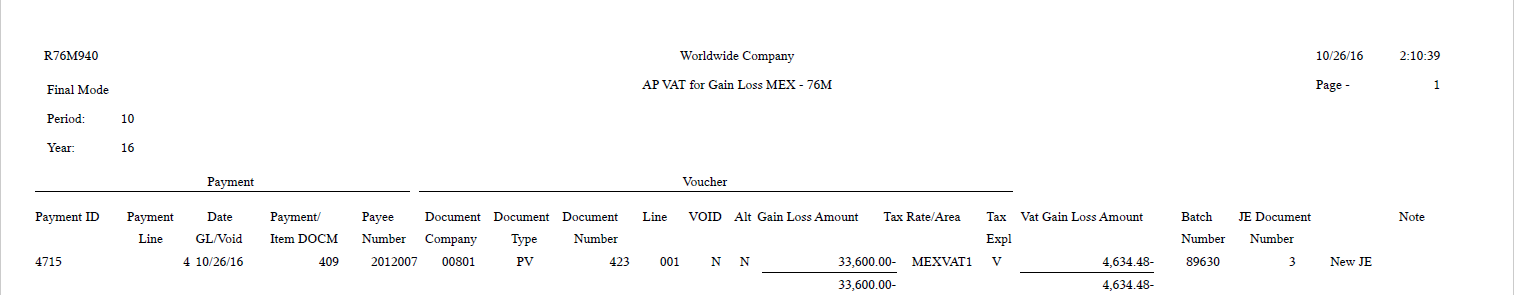

Now, with the new VAT process for Mexico, you run the AP Vat for Gain Loss (R76M940) or the Closed AP Draft Vat on Gain Loss (R76M990) report to reclassify the VAT applicable on the gain or loss amounts. When you run one of these reports, the system generates this new journal entry for the discussed example:

Accounts Receivable

You post an invoice with an exchange rate of 3. The system generates journal entries as shown in this image:

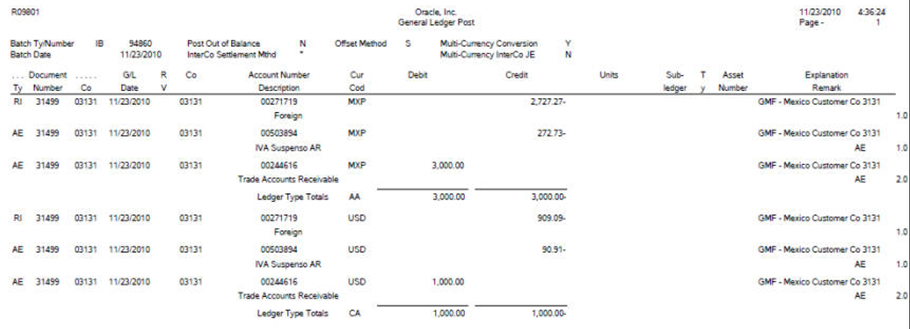

During the time of receiving payment, the exchange rate is 2. Now, the standard posting General Ledger Post report generates these journal entries:

In this case, the loss amount is (1100*2 - 1100*3 = -1000).

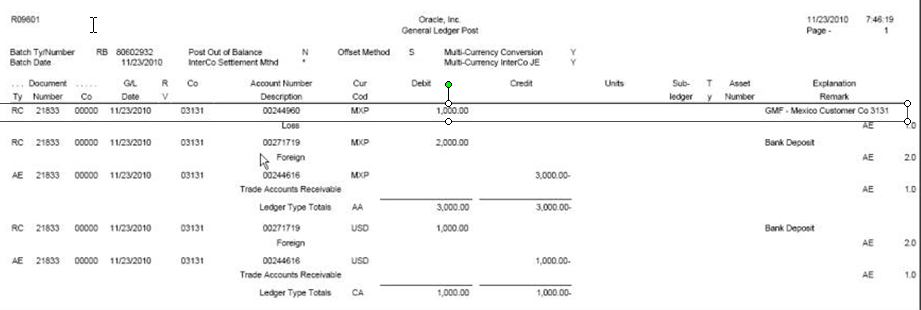

However, the Mexican Localization software generates only these entries without reclassifying VAT on the gain or loss amounts:

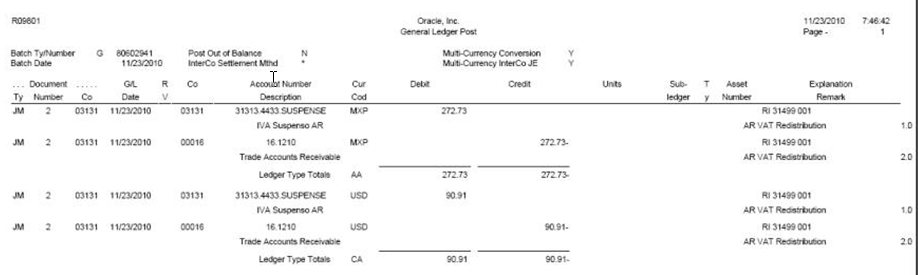

With the VAT process for Mexico, you run the AR Vat on Gain Loss report (R76M930) to reclassify the VAT applicable on the gain or loss amounts.