Understanding the Portugal Legal Number Requirement (Release 9.2 Updates)

Taxpayers are required to submit information related to shipping documents issued to the tax authorities in order to obtain an identification code for each transaction reported. The identification code must be obtained before shipping the goods.

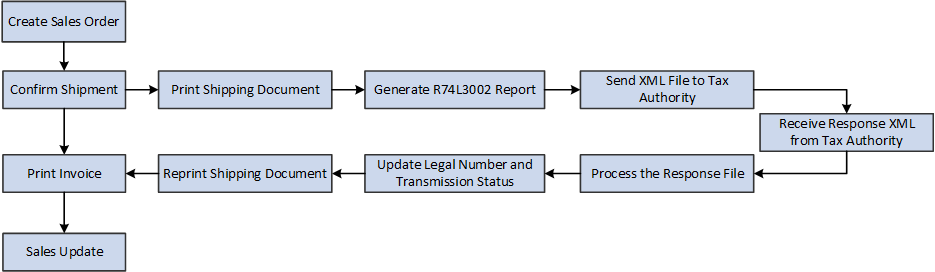

The following illustration describes the sales order process.

To obtain the AT identification code for transportation documents:

Create the sales order in the standard Sales Order Entry program (P4210).

Confirm that the goods are ready for shipping using the Confirm Shipment program (P4205).

Print shipping documents using the Legal Shipping Document Print - Portugal report (R74L3035).

Extract information related to the shipping documents using the Movement of Goods Extract report (R74L3002).

You submit information related to the shipping documents to the tax authority.

You receive the response XML file from the tax authority.

Parse the response XML file to extract the AT identification code for approved transactions using the Parse XML Response report (R74L3003).

Update the legal document number and transmission status in the Exported Transactions File table (F74L3002).

Print the AT identification code in the invoices using the Reprint Legal Document program (P7430031).

Print the invoice for the customer using the Print Legal Documents from Sales Orders program (P7420565).

Run the Sales Update program (R42800) to record and maintain accurate records.