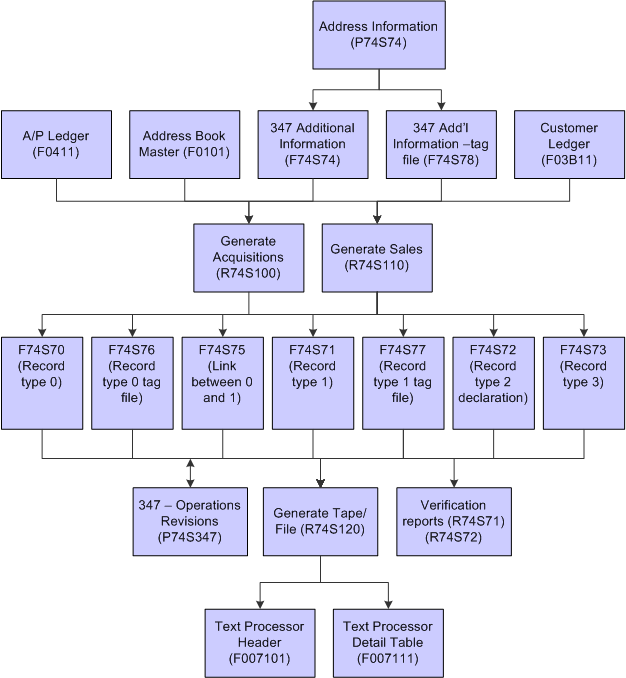

Process Flow

This graphic illustrates the Model 347 process:

The steps to generate the declaration are:

Add commercial site information to your company records.

You use the Address Information program (P74S74) to add leased commercial site information.

See Adding Commercial Site Address Information to Company Records.

Generate the workfiles for the model 347 declaration.

You run the Model 347 - Generate Acquisition Records (R74S100) and Model 347 - Generate Sales Records (R74S110) programs to generate the Model 347 workfiles.

Review and revise data in the workfiles if necessary.

You run the Model 347 - Print Records Type 1 - Spain (R74S71) and the Model 347 - Print Records Types 2 & 3 - Spain (R74S72) program to print reports that you use to view the data.

Generate the tax declaration file and write the file to the Text Processor Header table (F007101) and Text Processor Detail Table (F007111).

You run the 347 - Generate Tape File program (R74S120) to write the file to the F007101 and F007111 tables.

Use the Text File Processor program (P007101) to copy the files in the F007101 and F007111 tables to the media that you submit to the government.