Understanding Suspended VAT

The system enables companies to defer paying VAT until they are able to do so. Since January 1, 2014, Spanish law allows companies with annual turnover less than 2 million Euros, to defer the booking of VAT payable until receipt of complete or partial payment for the invoice. Instead of booking VAT to an active VAT payable account at the time of the sale, the companies must hold the VAT in suspense until they receive the payment. This deferment of VAT payable is called suspended VAT. In Spain, the suspended VAT works on these conditions:

Suspended VAT must be reclassified and posted to the final VAT account on the payment receipt. For deferred payments, they are posted on the bank confirmation date.

Companies must perform the reclassification latest by December 31st of the year following the one the invoice was created. For example, if the invoice was created in January, 2014, the last date for performing VAT reclassification is December 31st, 2015.

In Spain, businesses report and remit VAT to the government on a periodic basis. The amount that a business owes is calculated as the difference between the VAT payable (generated in the JD Edwards EnterpriseOne Accounts Receivable system) and the VAT recoverable (generated in the JD Edwards EnterpriseOne Accounts Payable system) amounts.

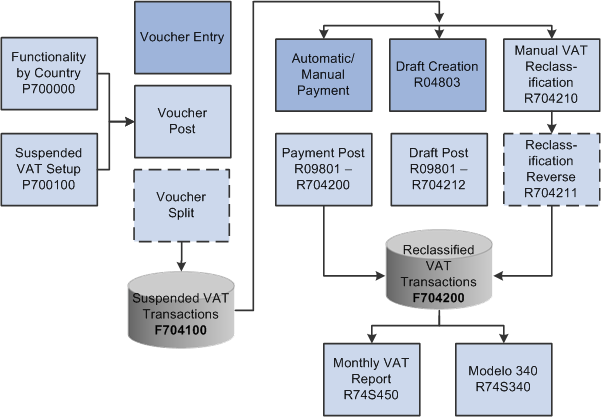

When you post a voucher, the system inserts into F704100.

With the suspended VAT processing, the system updates the F704100 table with AP tax detailed information after successfully completing the voucher posting.

This diagram illustrates the suspended VAT process for Spain: