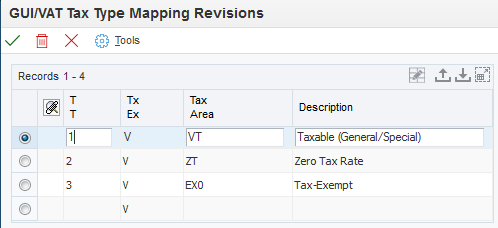

Setting Up a GUI/VAT Tax Type Mapping

Access the GUI/VAT Tax Type Mapping Revisions form.

- T T (VAT tax type)

Enter a value that exists in the GUI/VAT Tax Type (75T/TX) UDC table to specify the tax type of the VAT that you associate with a tax explanation code/tax rate area combination.

Values are:

1: Taxable

2: Zero tax rate

3: Exempt

D: Unused

F: Void

- Tx Ex (tax explanation code)

Enter a value that exists in the Tax Explanation Codes (00/EX) UDC table to specify the tax explanation code that you associate with the tax rate area and tax type. The tax explanation code for VAT must be V.

- Tax Area

Enter a code that identifies a tax or geographic area that has common tax rates and tax authorities. The system validates the code you enter against the Tax Areas table (F4008). The system uses the tax rate area in conjunction with the tax explanation code and tax rules to calculate tax and GL distribution amounts when you create an invoice or voucher.