Specifying a GUI/VAT Number Segment Used by a Document Type / Format Code Combination

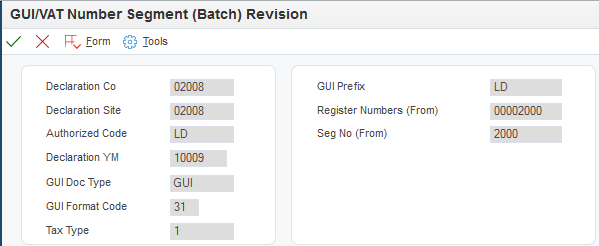

Access the GUI/VAT Number Segment (Batch) Revision form.

To select a new batch for a declaration company and site for which a number segment batch has already been set up, select an existing record on the Work With GUI/VAT Number Segment (Batch) form and click Select.

The system completes the Declaration Co and Declaration Site fields based on the information that is specified in the processing options of the GUI/VAT Number Segment (Batch) Setup program. You can change them on the GUI/VAT Number Segment (Batch) Revision form, if necessary.

- Authorized Code

Enter a value that exists in the Authorized Code (75T/AC) UDC table to limit the use of the assigned number to users who have the same authorization code assigned for the declaration site.

- Declaration YM (year and month of VAT declaration)

Enter the Taiwanese calendar year and month of the segment that you want to assign to the batch programs. You must complete this field. The value that you enter must be set up as a declaration period in the GUI/VAT Declaration Site program.

- GUI Doc Type (GUI document type)

Enter a value that exists in the GUI/VAT Document Type (75T/DT) UDC table to specify the GUI document type to assign to the segment.

You must complete this field.

- GUI Format Code

Enter a code that specifies the GUI format code for the transaction. The code that you enter must exist in the GUI/VAT Format Code (75T/F3) UDC table. You must complete this field.

Values are:

31: Triplicate / Computer GUI

32: Duplicate / Duplicate Cash Register GUI

33: Triplicate Sales Return / Allowance

34: Duplicate Sales Return / Allowance

35: Triplicate Cash Register GUI

36: GUI-Exempt

37: Special Tax: Sales

38: Special Tax: Return, Allowance

99: Sales Receipt

- Tax Type

Enter a value that exists in the GUI/VAT Tax Type (75T/TX) UDC table to specify the tax type of the transaction.