Understanding Application Approval and the SPC Cascade

After you post the application, you can approve it using the SPC Application Approval program if you set the Approval Active processing option in the SPC - Application Maintenance program (P74U0420) to activate the approval routing. The system uses the value in the Approval Route Code processing option of the SPC - Application Maintenance program to determine the routing for the approvals.

When you access the Application Approval form, you can select to view all applications, or only those at a specific status. You can view details about the application, invoice, and the question and answers associated with the purchase order. The system shows that the final approver has approved the application by changing the value in the Approved field to Y. The Approved field includes a value of N (no) if no approvers have approved the application, and a numeric value that changes as each successive approver approves the application. For example, the value in the Approved field is 1 after the first approver approves the application, 2 after the second approver approves it, and so on.

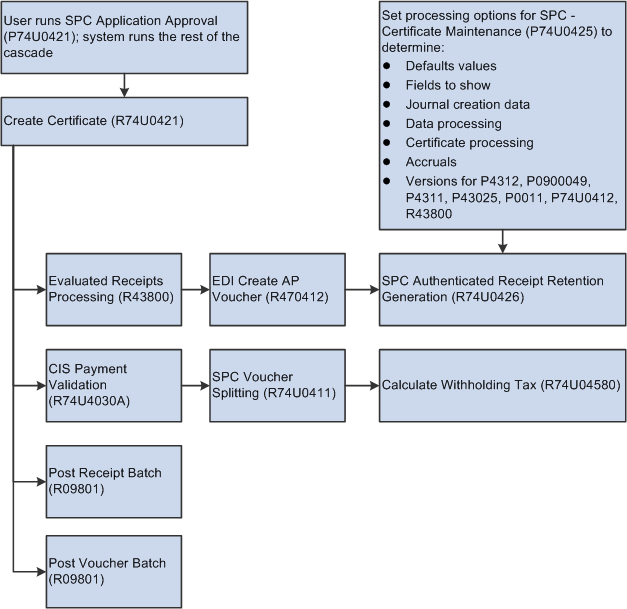

The SPC cascade of programs:

Creates the certificate.

Processes the receipt and creates the voucher.

Creates journal entries for retention.

Validates the voucher lines for withholding and splitting.

Splits the voucher if that functionality is enabled.

Calculates withholding taxes.

Posts the receipt batch.

Posts the voucher batch.

This process flow shows the programs run by the SPC cascade:

This table describes the functions performed by the programs in the SPC cascade:

Programs |

Comments |

|---|---|

Create Certificate (R74U0421) |

The system launches the version of the Create Certificate program that you specified in the processing option of the SPC Application Approval program. The Create Certificate program:

|

Evaluated Receipts Processing (R43800) EDI Inbound Invoice/Match (R470412) |

You specify the version of the EDI Inbound Invoice/Match program to run in the processing options of the Evaluated Receipts Processing program. These programs:

|

SPC Authenticated Receipt Retention Generation (R74U0426) |

You must set up the processing options in the SPC - Certificate Maintenance program (P74U0425) before you run the SPC cascade because the SPC Authenticated Receipt Retention Generation program uses values from those processing options. The SPC Authenticated Receipt Retention Generation program inserts lines for retention into the voucher records. It also generates a report that shows the voucher batch number. |

CIS Pre-Withholding Validation (R74U4030A) |

You specify the version of the CIS Voucher Splitting program (R74U0411) to run to split CIS vouchers in the processing options of the CIS Pre-Withholding Validation program. The CIS Pre-Withholding Validation program assesses whether a voucher requires that withholding be applied, and updates the CIS status of the voucher to S (splitting enabled). |

CIS Voucher Splitting (R74U0411) |

The CIS Voucher Splitting program changes the pay status to A (approved) for pay items that will have no tax withheld, such as lines for materials, and changes the pay status to% (withholding applies) for pay items that will have tax withheld, such as lines for labor. The CIS status for both material and labor lines is changed to B (voucher split). |

Calculate Withholding Tax (R74U04580) |

The Calculate Withholding Tax program creates the withholding lines for the labor lines, changes the pay status for the labor lines to A (approved), and changes the CIS status to W (withholding). |

General Ledger Post (R09801) |

You can specify the versions of the General Ledger Post program to run to post receipts and to post vouchers in the processing options of the Create Certificate program. If you do not want to post the receipts and vouchers as part of the SPC cascade, leave the processing options for the version blank. |