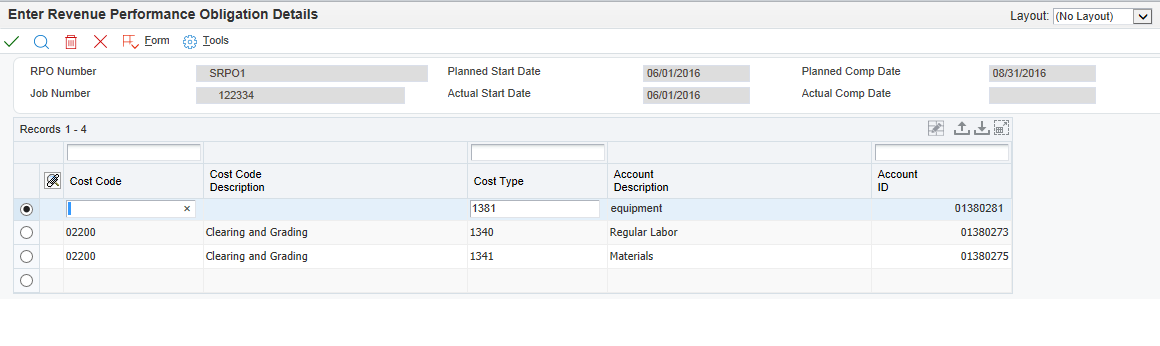

Associating Accounts with a Revenue Performance Obligation

Access the Enter Revenue Performance Obligation Details form.

- Cost Code

Enter a value that is the part of the account number that identifies a step, phase, or type of activity within a job, such as site work, earthwork, paving, or landscaping.

Note: The cost code is the subsidiary in a G/L account. While a subsidiary is optional for a G/L account, a cost code is required for each job cost account. Blank can be set up as a valid cost code value in the chart type setup.- Cost Type

Enter a value that is the part of the account number that identifies a cost category within a cost code, such as labor, materials, equipment, and subcontracts. It can further divide a cost category into subcategories, such as regular time, premium time, and burden for labor.

Note: The cost type is the object account in a G/L account. An object account is required for cost type accounts, but you do not use a cost type value for cost code headers.

If you do not know the values for the Cost Code or Cost Type fields, select RPO Accounts on the Form menu to access the Select Revenue Performance Obligation Accounts form. Use this form to search for and select one or more accounts to associate with an RPO.