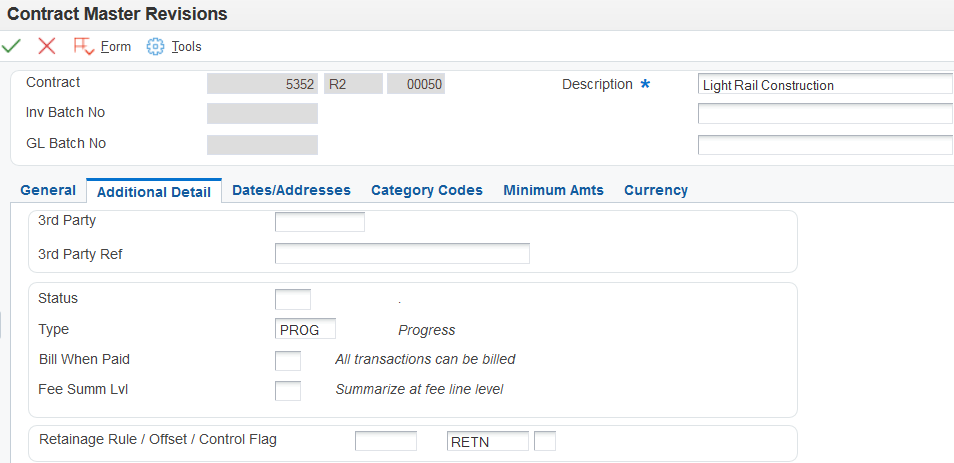

Assigning a Retainage Rule to a Contract Master

Access the Contract Master Revisions form. Select the Additional Detail tab.

- Retainage Rule

Enter the code that identifies the retainage rule to associate with this contract.

- Offset

Enter a code that designates the offset accounts for retainage, for example RETN or 1225. You set up the code as an automatic accounting instruction.

Note: Do not use code 9999. This is reserved for the post program and indicates that offsets should not be created.- Control Flag

Leave this field blank to store retainage in the JD Edwards EnterpriseOne Accounts Receivable system and compute tax from the total taxable amount.

Enter 1 to store retainage in the JD Edwards EnterpriseOne Accounts Receivable system and calculate tax on the retainage amount and then subtract that amount from the total tax amount. This tax on retainage is deferred until the retainage is released.

Enter 2 to store retainage in the JD Edwards EnterpriseOne General Accounting system and calculate tax from the total taxable amount.

Enter 3 to store retainage in the JD Edwards EnterpriseOne General Accounting system and calculate tax on the retainage amount and then subtract that amount from the total tax amount. This tax on retainage is deferred until the retainage is released.