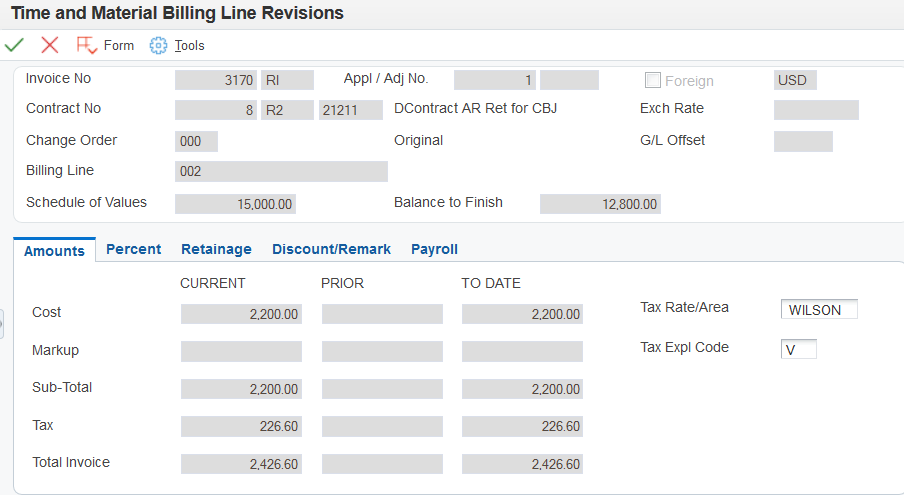

Reviewing Summarized Invoice Information for a Time and Material Contract Billing Line

Access the Time and Material Billing Line Revisions form.

- Tax Rate/Area

Enter a code that identifies a tax or geographic area that has common tax rates and tax distribution. The tax rate/area must be defined to include the tax authorities (for example, state, county, city, rapid transit district, province) and their rates. To be valid, a code must be set up in the Tax Rate/Area table (F4008).

- Tax Expl Code (tax explanation code)

Enter a code from UDC 00/EX to control how tax is assessed and distributed to the G/L revenue and expense accounts.

- Retainage

Displays the retained amount for a contract line.

Note: If you change a T and M billing line

on which other billing lines depend, the system displays a warning stating that you

might need to recalculate fees, draws, and retainage.