Business Case for Transaction Matching

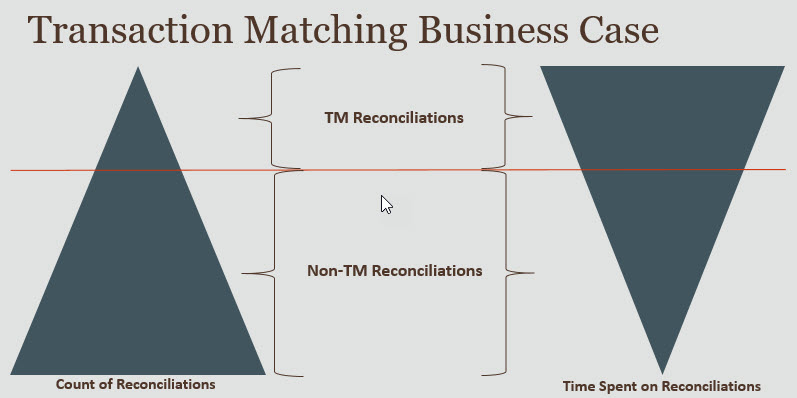

When you consider your total number of reconciliations, you will notice that a small number of reconciliations cause the most work. This is reason Transaction Matching features are a perfect complement to Reconciliation Compliance. They provide the tools to make those complex reconciliations simpler and then integrate the period-end results into the Reconciliation Compliance period-end process.

Scenarios for Which Transaction Matching is Beneficial

- Balance sheet-related reconciliations

- Suspense and Clearing Accounts

- Intercompany

- Cash

- Credit card receivables

- Detailed Subledger reconciliation

- Operational, off-balance sheet, reconciliations

- System to System reconciliations (which typically involve two third-parties whose accounts must be in sync with each other)

- Stock or share settlements

- Expense reimbursements