About Reverse Adjustments

Reverse adjustments provide an automated and efficient way of managing the unmatching of matches containing an adjustment and that are associated with a closed reconciliation.

A reverse adjustment is created automatically when a transaction that satisfies the following conditions is unmatched in the source system:

- Match status is Confirmed Match or Confirmed Adjust

- Extract Status of the adjustment is Closed

When such a transaction is unmatched, a warning message is displayed indicating that this will result in a reverse adjustment being created. Click Yes to proceed with the creation of a reverse adjustment. Note that the original adjustment is retained within Transaction Matching.

The match details, such as Match ID, adjustment amount, and other related information, are added to the audit history. The terms original match and original adjustment are associated with the unmatched adjustment. The Reverse Status column for the original adjustment is set to Reverse Adjustment, indicating that a reverse adjustment was created for this adjustment. The reverse adjustment has the same match ID as that of the original match but its Extract Status is Open. The adjustment amount is also the same as the original adjustment, but with the opposite sign. For example, if the original adjustment amount is 120.45, the reverse adjustment amount is -120.45.

If the Accounting Date of the reverse adjustment is same as that of the original adjustment, then there are no in-transit adjustments. However, when the Accounting Date of the reverse adjustment is later than that of the original adjustment, the original adjustment will be in-transit for periods between the Accounting Date of the original adjustment and the reverse adjustment. For such periods, the original adjustment will be part of the Less Matched-In Transit bucket. When you run the Balance Report Transactions, these adjustments will be included in the zip file.

After the unmatch operation, the unmatched transaction is added to Less Unmatched and the original adjustment is added to Less Matched In-Transit. Any comments and attachments in the original adjustment are also included in the reverse adjustment. Users can subsequently modify or delete these, if required.

Note:

You cannot change the status of the original adjustment to open after a reverse adjustment has been created.Note:

Only Service Administrators can delete a reverse adjustment.Determining the Accounting Date of a Reverse Adjustment

The Accounting Date of the reverse adjustment is determined based on the match process configuration:

- If the reverse adjustment's Accounting Date = Match Date, then Accounting Date of adjustment is set to the current date

- If the reverse adjustment's Accounting Date = latest accounting date in match group, then Accounting Date of adjustment is set to the Accounting Date of the original adjustment.

Reverse Adjustment Example

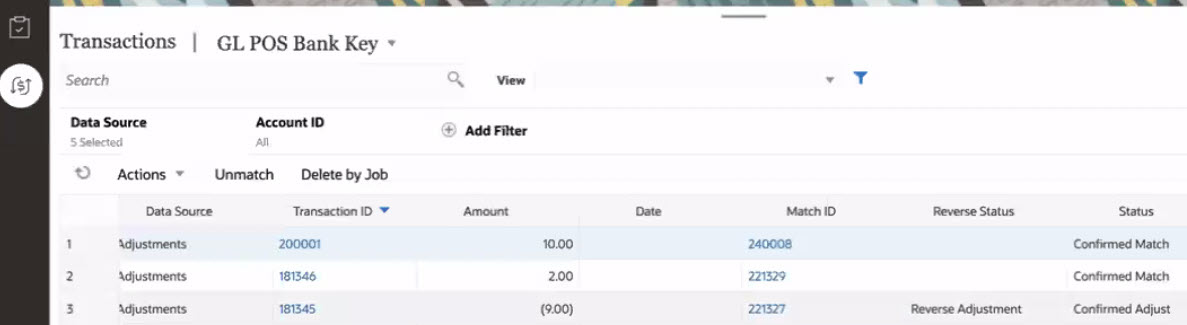

Here's an example of a confirmed match, with Match ID 240008 and Transaction ID 200001, in the Transactions tab:

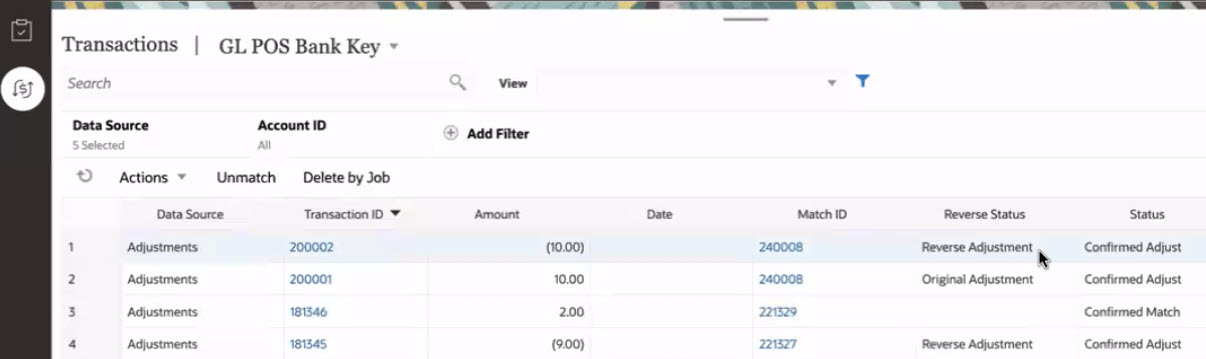

The following image shows the Transactions tab after an unmatch operation created a reverse adjustment for Transaction ID 200001. The Transaction ID of the reverse adjustment is 200002, but it's Match ID is the same as the original adjustment.

Viewing Reverse Adjustment Details

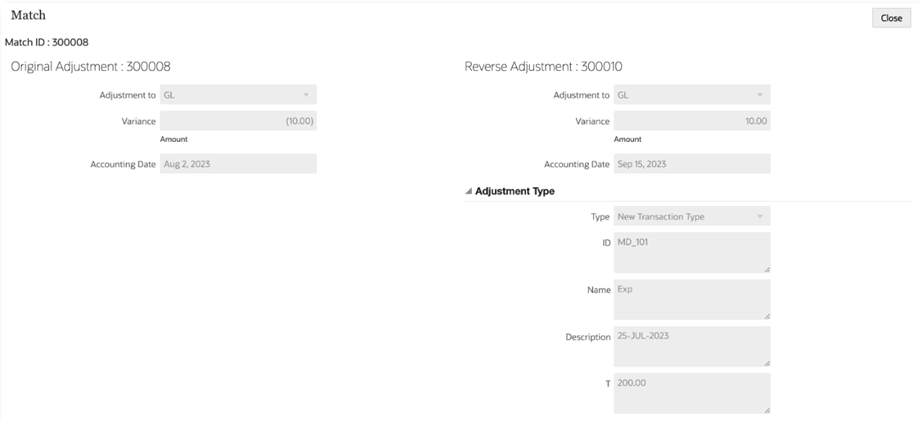

To view details about a reverse adjustment, open its match details from the Matches tab or the Transactions tab in the Matching card. The details displayed, for the original adjustment and reverse adjustment, are shown below.