Financial Enterprise Structure Components

Oracle Fusion Applications are an integrated suite of business applications that connects and automates the entire flow of the business process across both front and back-office operations and addresses the needs of a global enterprise.

The process of designing the enterprise structure, including the accounting configuration, is the starting point for an implementation. This process often includes determining financial, legal, and management reporting requirements and examining consolidation considerations.

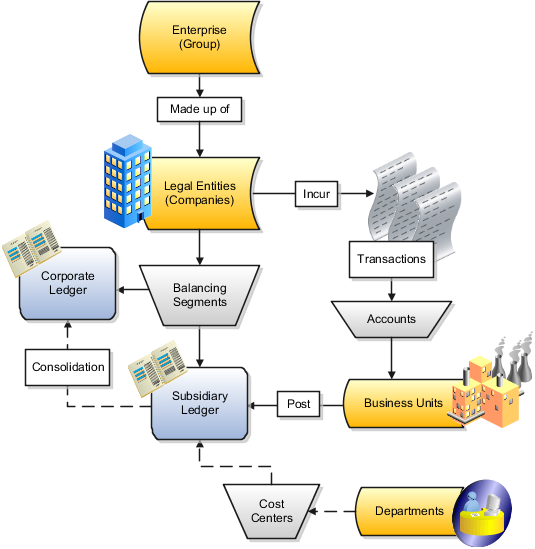

This figure illustrates the enterprise structure components, including legal entities, ledgers, balancing segments, accounts, cost centers, business units and departments, and their relationships to each other.

Accounting Configuration Components

The accounting configuration components are:

-

Ledgers: The main record-keeping structure. A ledger records the transactional balances by defining a chart of accounts with a calendar and currency, and accounting rules, implemented in an accounting method. The ledger is associated with the subledger transactions for the business units that are assigned to it, and provides context and accounting for them.

-

Balancing Segments: Use these chart of accounts element to represent and track both legal and management entities. The primary balancing segment is used to represents your legal entities. The Second and Third balancing segments are used to implement management reporting and analysis. Balancing segments provide automatic balancing functionality by legal entity for journal entries, including intercompany and intracompany entries, suspense posting, and rounding imbalances.

-

Cost Centers: The component that aggregates elements of natural expenses to identify functional costs. A cost center can be the smallest segment of an organization for which costs are collected and reported. Not all cost centers represent organizations. A manager is assigned responsibility for cost control and is assigned both a department and a cost center; in which case the cost center and department might be identified with each other. However, a finance department manager might have separate cost centers for finance cost and audit costs and a Research and Development department manager might have separate cost centers for research and development.

Cost centers are represented by segment values in the chart of accounts that indicate the functional areas of your business, such as accounting, facilities, shipping, or human resources. You might keep track of functional areas at a detailed level, but produce summary reports that group cost centers into one or more departments. Cost center values are also used by Oracle Fusion Assets to assist the managers in tracking locations and accounting for assets assigned to their departments.

-

Accounts: The code in the chart of accounts that uniquely identifies each type of transactions recorded in the ledger and subledgers. The account segment is mapped to a dimension in the GL Balances Cube to enable reporting and inquiry. This functionality uses Oracle Fusion Business Intelligence to analyze and drill into expense and revenue transactions.

Representing Legal Entities, Business Units, Departments in Chart of Accounts

The following list provides information about how to represent legal entities, business units, and departments in chart of accounts.

-

Representing Legal Entities in the Chart of Accounts: Legal entity is the term used in Oracle Fusion Applications for registered companies and other organizations recognized in law as having a legal existence and as parties with given rights and responsibilities.

Legal entities are created in the applications and then assigned balancing segment values, sometimes called company codes in your ledgers during accounting configuration.

-

Representing Business Units in the Chart of Accounts: A business unit (BU) is part of an enterprise managed by a manager with profit and loss responsibility. The business unit is generally tracked in the chart of accounts. A business unit can be represented by a single ledger. For example, in countries where you need document sequencing for unique transaction sequencing within a legal entity, you can have a single ledger with a single business unit and legal entity.

A business unit can also be identified in the chart of accounts as a:

-

Balancing segment value

-

Roll up of cost center segments using hierarchies

For example, a business unit manager is responsible for working capital utilization or overall asset utilization. You identify the business unit as a balancing segment value, to enable calculation of ratios for various utilization measurements.

A business unit is assigned to a primary ledger, as well as a default legal entity when the business unit is configured. A BU identifies the primary ledger that subledger transactions are posted to, facilitating the use of more than one BU per general ledger. Each business unit posts transactions to a single primary ledger. For example, a shared service center handles all the procurement functions for the entire company. The procurement transactions are posted to the business unit's ledger with intercompany entries to other ledgers as needed.

-

-

Representing Departments in the Chart of Accounts: A department is an organizational structure with one or more operational objectives or responsibilities that exist independently of its manager and that has one or more employees assigned to it. The manager of a department is typically responsible for business deliverables, personnel resource management, competency management, and occasionally, for cost control and asset tracking.

In Oracle Fusion Applications, departments can be set up in Oracle Fusion Human Capital Management (HCM). If wanted, they can also be represented by a unique segment in the chart of accounts or a group of cost center values.